Nuance Investments LLC grew its position in shares of Marten Transport, Ltd. (NASDAQ:MRTN - Free Report) by 13.0% in the third quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 2,627,111 shares of the transportation company's stock after acquiring an additional 303,132 shares during the quarter. Marten Transport accounts for 1.6% of Nuance Investments LLC's holdings, making the stock its 21st biggest position. Nuance Investments LLC owned approximately 3.23% of Marten Transport worth $46,500,000 at the end of the most recent quarter.

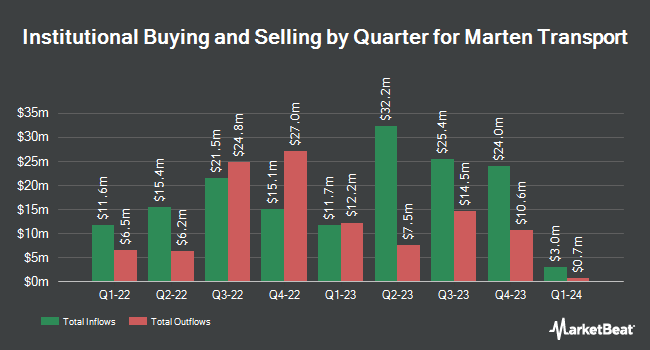

Several other hedge funds and other institutional investors have also recently added to or reduced their stakes in the business. Dimensional Fund Advisors LP boosted its position in shares of Marten Transport by 0.3% in the second quarter. Dimensional Fund Advisors LP now owns 5,831,191 shares of the transportation company's stock valued at $107,585,000 after acquiring an additional 14,660 shares during the period. Geneva Capital Management LLC grew its holdings in Marten Transport by 0.5% during the 3rd quarter. Geneva Capital Management LLC now owns 3,231,604 shares of the transportation company's stock worth $57,199,000 after acquiring an additional 15,388 shares during the last quarter. American Century Companies Inc. increased its holdings in Marten Transport by 13.1% in the second quarter. American Century Companies Inc. now owns 1,402,776 shares of the transportation company's stock valued at $25,881,000 after purchasing an additional 162,924 shares during the period. Bank of New York Mellon Corp increased its position in Marten Transport by 6.4% during the 2nd quarter. Bank of New York Mellon Corp now owns 692,385 shares of the transportation company's stock valued at $12,775,000 after purchasing an additional 41,505 shares during the period. Finally, Clearbridge Investments LLC grew its holdings in Marten Transport by 2.3% during the 1st quarter. Clearbridge Investments LLC now owns 690,329 shares of the transportation company's stock worth $12,757,000 after acquiring an additional 15,736 shares during the period. 69.12% of the stock is currently owned by institutional investors and hedge funds.

Marten Transport Stock Down 1.9 %

Shares of NASDAQ MRTN traded down $0.32 during trading on Wednesday, reaching $16.59. The company had a trading volume of 430,612 shares, compared to its average volume of 400,943. The stock has a market cap of $1.35 billion, a PE ratio of 39.50 and a beta of 0.79. The business's 50-day moving average is $16.86 and its 200 day moving average is $17.39. Marten Transport, Ltd. has a 12-month low of $15.33 and a 12-month high of $21.38.

Marten Transport (NASDAQ:MRTN - Get Free Report) last posted its quarterly earnings data on Thursday, October 17th. The transportation company reported $0.05 EPS for the quarter, missing the consensus estimate of $0.07 by ($0.02). Marten Transport had a return on equity of 4.41% and a net margin of 3.36%. The company had revenue of $237.37 million during the quarter, compared to the consensus estimate of $244.00 million. On average, analysts anticipate that Marten Transport, Ltd. will post 0.32 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of analysts recently commented on the company. StockNews.com lowered Marten Transport from a "hold" rating to a "sell" rating in a research report on Wednesday, October 2nd. Raymond James downgraded shares of Marten Transport from an "outperform" rating to a "market perform" rating in a report on Monday, October 14th.

View Our Latest Stock Report on MRTN

Insider Buying and Selling

In other Marten Transport news, Director Jerry M. Bauer acquired 10,000 shares of the company's stock in a transaction dated Wednesday, October 30th. The shares were purchased at an average cost of $15.81 per share, for a total transaction of $158,100.00. Following the completion of the purchase, the director now owns 156,444 shares in the company, valued at approximately $2,473,379.64. This trade represents a 6.83 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this link. 22.90% of the stock is owned by corporate insiders.

Marten Transport Profile

(

Free Report)

Marten Transport, Ltd. operates as a temperature-sensitive truckload carrier for shippers in the United State, Mexico, and Canada. The company operates through four segments: Truckload, Dedicated, Intermodal, and Brokerage. The Truckload segment transports food and other consumer packaged goods that require a temperature-controlled or insulated environment, as well as dry freight; and regional short-haul and medium-to-long-haul full-load transportation services.

Recommended Stories

Before you consider Marten Transport, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marten Transport wasn't on the list.

While Marten Transport currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.