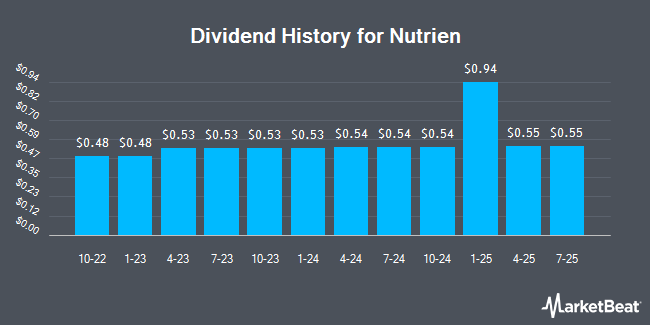

Nutrien Ltd. (NYSE:NTR - Get Free Report) declared a quarterly dividend on Wednesday, November 6th,Zacks Dividends reports. Shareholders of record on Tuesday, December 31st will be paid a dividend of 0.939 per share on Friday, January 17th. This represents a $3.76 annualized dividend and a yield of 7.77%. The ex-dividend date of this dividend is Tuesday, December 31st. This is a positive change from Nutrien's previous quarterly dividend of $0.54.

Nutrien has increased its dividend by an average of 5.6% annually over the last three years. Nutrien has a dividend payout ratio of 58.5% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Nutrien to earn $3.78 per share next year, which means the company should continue to be able to cover its $2.16 annual dividend with an expected future payout ratio of 57.1%.

Nutrien Stock Down 1.3 %

NYSE NTR traded down $0.62 during mid-day trading on Friday, reaching $48.32. The stock had a trading volume of 2,325,746 shares, compared to its average volume of 1,951,724. The stock has a market cap of $23.86 billion, a PE ratio of 32.21, a price-to-earnings-growth ratio of 1.62 and a beta of 0.82. Nutrien has a 1 year low of $44.65 and a 1 year high of $60.87. The company has a debt-to-equity ratio of 0.37, a current ratio of 1.26 and a quick ratio of 0.82. The company has a fifty day moving average price of $47.97 and a 200 day moving average price of $50.65.

Nutrien (NYSE:NTR - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.39 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.43 by ($0.04). Nutrien had a net margin of 2.79% and a return on equity of 6.99%. The business had revenue of $5.35 billion for the quarter, compared to the consensus estimate of $5.26 billion. During the same period in the previous year, the company earned $0.35 earnings per share. The company's revenue for the quarter was down 5.0% compared to the same quarter last year. On average, research analysts expect that Nutrien will post 3.82 earnings per share for the current year.

Analyst Ratings Changes

NTR has been the topic of a number of research analyst reports. Royal Bank of Canada restated an "outperform" rating and set a $60.00 price objective on shares of Nutrien in a research report on Friday, September 20th. BMO Capital Markets dropped their price target on Nutrien from $80.00 to $75.00 and set an "outperform" rating on the stock in a research note on Friday, August 9th. Hsbc Global Res cut Nutrien from a "hold" rating to a "moderate sell" rating in a research report on Friday, August 2nd. Wells Fargo & Company cut Nutrien from an "overweight" rating to an "equal weight" rating and dropped their target price for the stock from $62.00 to $50.00 in a research report on Tuesday, September 24th. Finally, Barclays reduced their price target on shares of Nutrien from $68.00 to $55.00 and set an "overweight" rating for the company in a research report on Friday, August 16th. Three equities research analysts have rated the stock with a sell rating, six have given a hold rating and ten have assigned a buy rating to the stock. According to data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $60.44.

View Our Latest Report on Nutrien

About Nutrien

(

Get Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Read More

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.