Captrust Financial Advisors decreased its holdings in Nutrien Ltd. (NYSE:NTR - Free Report) by 2.9% during the 3rd quarter, according to the company in its most recent filing with the SEC. The institutional investor owned 721,323 shares of the company's stock after selling 21,618 shares during the quarter. Captrust Financial Advisors owned 0.15% of Nutrien worth $34,668,000 at the end of the most recent quarter.

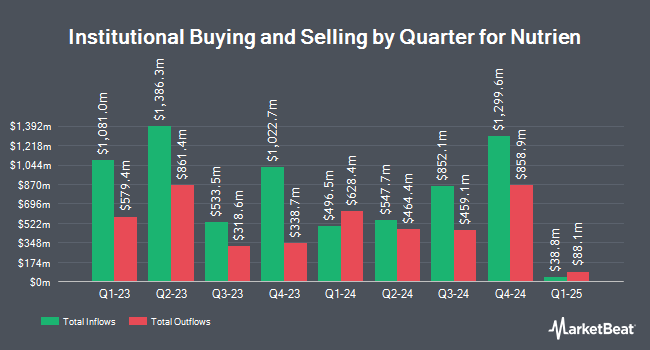

Other hedge funds have also recently modified their holdings of the company. Bank of Montreal Can raised its holdings in shares of Nutrien by 15.5% in the 2nd quarter. Bank of Montreal Can now owns 13,354,385 shares of the company's stock worth $719,668,000 after purchasing an additional 1,794,333 shares during the period. Silchester International Investors LLP raised its holdings in shares of Nutrien by 164.4% in the 3rd quarter. Silchester International Investors LLP now owns 10,683,242 shares of the company's stock worth $513,437,000 after purchasing an additional 6,642,075 shares during the period. 1832 Asset Management L.P. raised its holdings in shares of Nutrien by 1.9% in the 2nd quarter. 1832 Asset Management L.P. now owns 9,006,528 shares of the company's stock worth $458,522,000 after purchasing an additional 167,312 shares during the period. Altshuler Shaham Ltd raised its holdings in shares of Nutrien by 8.1% in the 2nd quarter. Altshuler Shaham Ltd now owns 5,990,374 shares of the company's stock worth $304,970,000 after purchasing an additional 446,340 shares during the period. Finally, Dimensional Fund Advisors LP raised its holdings in shares of Nutrien by 8.4% in the 2nd quarter. Dimensional Fund Advisors LP now owns 5,145,375 shares of the company's stock worth $261,985,000 after purchasing an additional 399,348 shares during the period. Institutional investors own 63.10% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have recently commented on NTR shares. UBS Group lowered shares of Nutrien from a "buy" rating to a "neutral" rating and reduced their price target for the company from $66.00 to $51.00 in a research report on Thursday, October 10th. Scotiabank lowered their price objective on shares of Nutrien from $66.00 to $59.00 and set a "sector outperform" rating for the company in a research note on Monday, August 12th. Wells Fargo & Company cut shares of Nutrien from an "overweight" rating to an "equal weight" rating and reduced their price target for the company from $62.00 to $50.00 in a research report on Tuesday, September 24th. HSBC cut shares of Nutrien from a "hold" rating to a "reduce" rating in a report on Friday, August 2nd. Finally, Mizuho lowered their price objective on shares of Nutrien from $55.00 to $52.00 and set a "neutral" rating on the stock in a research report on Thursday, August 8th. Three equities research analysts have rated the stock with a sell rating, six have assigned a hold rating and ten have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $60.33.

Get Our Latest Stock Report on Nutrien

Nutrien Stock Performance

NYSE NTR traded up $0.57 during trading on Friday, hitting $46.66. The company's stock had a trading volume of 933,850 shares, compared to its average volume of 1,963,942. The company has a quick ratio of 0.82, a current ratio of 1.27 and a debt-to-equity ratio of 0.38. The firm has a 50 day moving average price of $47.93 and a 200 day moving average price of $49.76. The firm has a market cap of $23.05 billion, a P/E ratio of 31.32, a price-to-earnings-growth ratio of 1.62 and a beta of 0.82. Nutrien Ltd. has a 52 week low of $44.65 and a 52 week high of $60.87.

Nutrien (NYSE:NTR - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $0.39 EPS for the quarter, missing the consensus estimate of $0.43 by ($0.04). The company had revenue of $5.35 billion during the quarter, compared to analyst estimates of $5.26 billion. Nutrien had a net margin of 2.79% and a return on equity of 6.99%. Nutrien's quarterly revenue was down 5.0% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.35 EPS. Equities research analysts forecast that Nutrien Ltd. will post 3.56 earnings per share for the current fiscal year.

Nutrien Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Investors of record on Tuesday, December 31st will be issued a $0.939 dividend. This represents a $3.76 dividend on an annualized basis and a yield of 8.05%. The ex-dividend date of this dividend is Tuesday, December 31st. This is an increase from Nutrien's previous quarterly dividend of $0.54. Nutrien's dividend payout ratio is currently 144.97%.

Nutrien Profile

(

Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Recommended Stories

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.