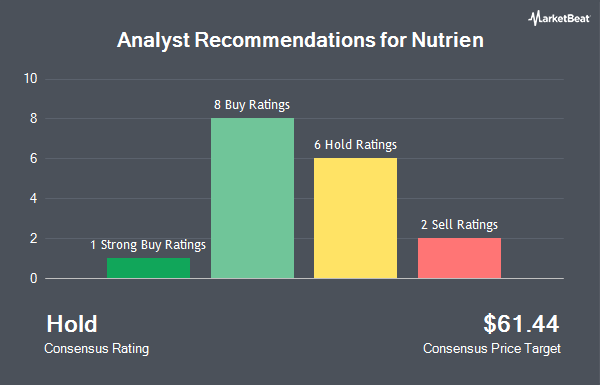

Nutrien Ltd. (NYSE:NTR - Get Free Report) has received a consensus rating of "Hold" from the nineteen analysts that are presently covering the company, Marketbeat reports. Three equities research analysts have rated the stock with a sell recommendation, six have given a hold recommendation and ten have assigned a buy recommendation to the company. The average 1 year price target among brokers that have issued ratings on the stock in the last year is $60.44.

A number of research analysts have weighed in on the stock. Royal Bank of Canada reaffirmed an "outperform" rating and issued a $60.00 price objective on shares of Nutrien in a research note on Friday, September 20th. Scotiabank cut their price target on Nutrien from $66.00 to $59.00 and set a "sector outperform" rating for the company in a research note on Monday, August 12th. BMO Capital Markets lowered their price objective on Nutrien from $80.00 to $75.00 and set an "outperform" rating for the company in a research note on Friday, August 9th. Wells Fargo & Company cut Nutrien from an "overweight" rating to an "equal weight" rating and cut their target price for the company from $62.00 to $50.00 in a research report on Tuesday, September 24th. Finally, HSBC lowered Nutrien from a "hold" rating to a "reduce" rating in a research report on Friday, August 2nd.

Read Our Latest Research Report on NTR

Institutional Investors Weigh In On Nutrien

Several institutional investors have recently made changes to their positions in NTR. Central Pacific Bank Trust Division bought a new position in Nutrien in the 3rd quarter worth about $28,000. Family Firm Inc. purchased a new position in Nutrien during the second quarter valued at $32,000. Trust Co. of Vermont boosted its stake in Nutrien by 50.0% during the second quarter. Trust Co. of Vermont now owns 900 shares of the company's stock worth $46,000 after acquiring an additional 300 shares in the last quarter. Covestor Ltd grew its holdings in Nutrien by 33.3% in the first quarter. Covestor Ltd now owns 932 shares of the company's stock worth $50,000 after purchasing an additional 233 shares during the period. Finally, Andra AP fonden bought a new position in shares of Nutrien during the second quarter valued at approximately $51,000. Hedge funds and other institutional investors own 63.10% of the company's stock.

Nutrien Stock Down 1.3 %

Shares of Nutrien stock traded down $0.62 during trading on Friday, reaching $48.32. 2,325,769 shares of the company traded hands, compared to its average volume of 1,951,724. The firm has a market capitalization of $23.86 billion, a PE ratio of 32.43, a P/E/G ratio of 1.62 and a beta of 0.82. The company has a 50 day moving average price of $47.98 and a 200-day moving average price of $50.61. The company has a debt-to-equity ratio of 0.37, a current ratio of 1.26 and a quick ratio of 0.82. Nutrien has a 1-year low of $44.65 and a 1-year high of $60.87.

Nutrien (NYSE:NTR - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.39 EPS for the quarter, missing the consensus estimate of $0.43 by ($0.04). Nutrien had a net margin of 2.79% and a return on equity of 6.99%. The firm had revenue of $5.35 billion for the quarter, compared to the consensus estimate of $5.26 billion. During the same quarter in the prior year, the firm earned $0.35 EPS. The company's revenue was down 5.0% compared to the same quarter last year. As a group, equities research analysts expect that Nutrien will post 3.82 earnings per share for the current fiscal year.

Nutrien Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Investors of record on Tuesday, December 31st will be issued a $0.939 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This is an increase from Nutrien's previous quarterly dividend of $0.54. This represents a $3.76 annualized dividend and a yield of 7.77%. Nutrien's dividend payout ratio (DPR) is 144.97%.

Nutrien Company Profile

(

Get Free ReportNutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

See Also

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.