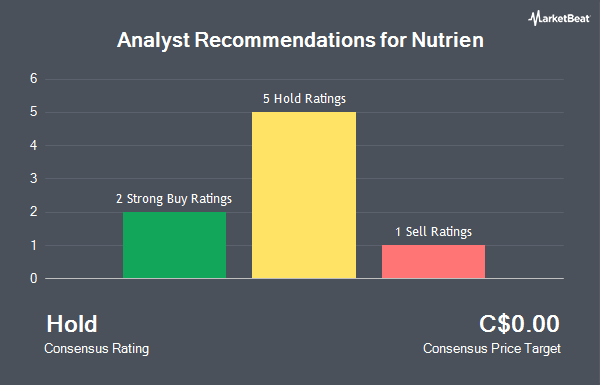

Shares of Nutrien Ltd. (TSE:NTR - Get Free Report) have been given a consensus rating of "Hold" by the five brokerages that are covering the company, MarketBeat reports. Four equities research analysts have rated the stock with a hold recommendation and one has given a buy recommendation to the company. The average 12 month price objective among brokerages that have updated their coverage on the stock in the last year is C$64.50.

A number of analysts have recently weighed in on NTR shares. Hsbc Global Res upgraded Nutrien to a "moderate sell" rating in a research report on Friday, August 2nd. UBS Group downgraded shares of Nutrien from a "strong-buy" rating to a "hold" rating in a research note on Thursday, October 10th. Wells Fargo & Company lowered shares of Nutrien from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 24th. Finally, The Goldman Sachs Group downgraded shares of Nutrien from a "strong-buy" rating to a "hold" rating in a report on Tuesday, September 10th.

View Our Latest Research Report on NTR

Insider Buying and Selling at Nutrien

In other news, Senior Officer Mark Thompson purchased 3,500 shares of Nutrien stock in a transaction dated Tuesday, August 20th. The shares were bought at an average cost of C$64.00 per share, for a total transaction of C$224,000.00. Also, Director Keith Martell bought 1,250 shares of Nutrien stock in a transaction on Thursday, September 19th. The shares were acquired at an average cost of C$65.23 per share, for a total transaction of C$81,537.50. Insiders have purchased 11,975 shares of company stock worth $768,820 over the last quarter. Corporate insiders own 0.03% of the company's stock.

Nutrien Price Performance

Shares of TSE NTR traded down C$0.36 during midday trading on Thursday, reaching C$65.20. The company's stock had a trading volume of 893,949 shares, compared to its average volume of 1,527,768. The company has a debt-to-equity ratio of 53.14, a quick ratio of 0.65 and a current ratio of 1.26. The company has a market cap of C$32.26 billion, a P/E ratio of 29.50, a P/E/G ratio of 1.15 and a beta of 0.95. The business's 50 day moving average price is C$65.54 and its two-hundred day moving average price is C$69.28. Nutrien has a fifty-two week low of C$60.74 and a fifty-two week high of C$83.14.

Nutrien Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 17th. Investors of record on Tuesday, December 31st will be paid a $0.54 dividend. This represents a $2.16 annualized dividend and a yield of 3.31%. The ex-dividend date is Tuesday, December 31st. Nutrien's payout ratio is 132.13%.

Nutrien Company Profile

(

Get Free ReportNutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Further Reading

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.