Nutrien (NYSE:NTR - Get Free Report) had its price target increased by analysts at Barclays from $56.00 to $59.00 in a note issued to investors on Wednesday,Benzinga reports. The brokerage presently has an "equal weight" rating on the stock. Barclays's price objective would indicate a potential upside of 17.94% from the stock's previous close.

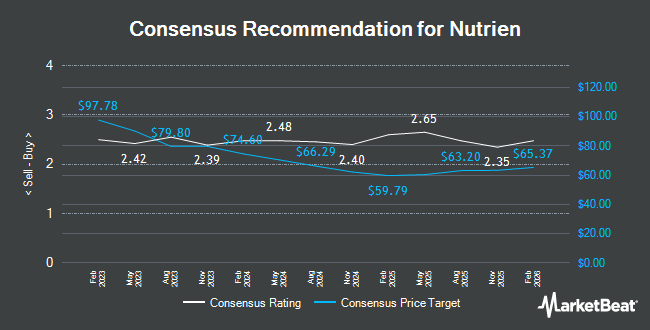

A number of other research analysts also recently issued reports on the stock. Piper Sandler lifted their price target on shares of Nutrien from $58.00 to $63.00 and gave the stock an "overweight" rating in a research note on Monday, January 27th. Wells Fargo & Company lifted their price objective on shares of Nutrien from $53.00 to $56.00 and gave the stock an "equal weight" rating in a research report on Friday, February 21st. Mizuho increased their target price on Nutrien from $52.00 to $55.00 and gave the company a "neutral" rating in a report on Thursday, February 20th. CIBC increased their price objective on Nutrien from $64.00 to $66.00 and gave the company an "outperformer" rating in a report on Tuesday, February 25th. Finally, Scotiabank boosted their price objective on Nutrien from $60.00 to $62.00 and gave the company a "sector outperform" rating in a research note on Monday, February 24th. One investment analyst has rated the stock with a sell rating, six have assigned a hold rating and nine have assigned a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average price target of $59.94.

Get Our Latest Stock Report on Nutrien

Nutrien Trading Up 3.2 %

Shares of Nutrien stock opened at $50.02 on Wednesday. The stock has a 50 day moving average of $50.33 and a 200 day moving average of $48.52. The company has a debt-to-equity ratio of 0.38, a quick ratio of 0.82 and a current ratio of 1.27. The firm has a market capitalization of $24.47 billion, a price-to-earnings ratio of 36.51, a PEG ratio of 1.19 and a beta of 0.81. Nutrien has a fifty-two week low of $43.70 and a fifty-two week high of $60.87.

Nutrien (NYSE:NTR - Get Free Report) last released its quarterly earnings results on Wednesday, February 19th. The company reported $0.28 earnings per share for the quarter, missing analysts' consensus estimates of $0.37 by ($0.09). Nutrien had a return on equity of 6.81% and a net margin of 2.62%. The business had revenue of $5.08 billion for the quarter, compared to analysts' expectations of $5.09 billion. As a group, research analysts predict that Nutrien will post 3.72 earnings per share for the current year.

Institutional Trading of Nutrien

Several large investors have recently made changes to their positions in NTR. Wealth Enhancement Advisory Services LLC increased its stake in Nutrien by 6.5% in the third quarter. Wealth Enhancement Advisory Services LLC now owns 4,309 shares of the company's stock valued at $207,000 after purchasing an additional 263 shares in the last quarter. US Bancorp DE lifted its position in shares of Nutrien by 15.5% in the third quarter. US Bancorp DE now owns 23,574 shares of the company's stock valued at $1,133,000 after buying an additional 3,157 shares during the last quarter. Farther Finance Advisors LLC grew its stake in Nutrien by 217.0% in the 3rd quarter. Farther Finance Advisors LLC now owns 3,500 shares of the company's stock valued at $168,000 after buying an additional 2,396 shares during the last quarter. Janney Montgomery Scott LLC raised its holdings in Nutrien by 25.7% in the 3rd quarter. Janney Montgomery Scott LLC now owns 97,635 shares of the company's stock valued at $4,692,000 after acquiring an additional 19,984 shares during the period. Finally, Harvest Portfolios Group Inc. lifted its position in Nutrien by 20.3% during the third quarter. Harvest Portfolios Group Inc. now owns 56,012 shares of the company's stock worth $2,692,000 after acquiring an additional 9,444 shares during the last quarter. Institutional investors own 63.10% of the company's stock.

Nutrien Company Profile

(

Get Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.