The Goldman Sachs Group upgraded shares of Nutrien (TSE:NTR - Free Report) to a strong sell rating in a report issued on Thursday morning,Zacks.com reports.

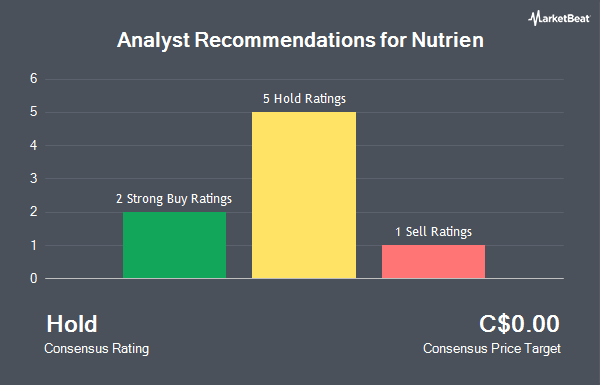

A number of other equities research analysts also recently weighed in on the company. Raymond James upgraded Nutrien from a "hold" rating to a "moderate buy" rating in a report on Tuesday, December 3rd. Barclays downgraded Nutrien from a "strong-buy" rating to a "hold" rating in a report on Tuesday, January 21st. Finally, Piper Sandler upgraded Nutrien from a "strong sell" rating to a "strong-buy" rating in a research note on Monday, January 13th. One investment analyst has rated the stock with a sell rating, four have given a hold rating and one has assigned a strong buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Hold" and an average price target of C$59.00.

Get Our Latest Stock Report on Nutrien

Nutrien Stock Performance

Shares of TSE NTR traded up C$0.53 during trading on Thursday, reaching C$75.01. The stock had a trading volume of 960,670 shares, compared to its average volume of 1,730,036. Nutrien has a one year low of C$60.74 and a one year high of C$83.14. The company has a debt-to-equity ratio of 59.10, a quick ratio of 0.65 and a current ratio of 1.27. The stock has a market cap of C$25.82 billion, a PE ratio of 35.32, a P/E/G ratio of 1.15 and a beta of 0.95. The firm's 50 day moving average price is C$73.80 and its two-hundred day moving average price is C$68.48.

Nutrien Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, April 10th. Investors of record on Monday, March 31st will be paid a dividend of $0.545 per share. This is an increase from Nutrien's previous quarterly dividend of $0.54. This represents a $2.18 dividend on an annualized basis and a yield of 2.91%. Nutrien's dividend payout ratio is presently 137.48%.

Insider Buying and Selling

In other Nutrien news, Director Michael Jeremiah Hennigan purchased 5,000 shares of Nutrien stock in a transaction on Monday, February 24th. The stock was bought at an average price of C$73.98 per share, for a total transaction of C$369,910.00. Also, Director Julie Lagacy purchased 2,000 shares of Nutrien stock in a transaction on Tuesday, March 11th. The shares were acquired at an average price of C$73.28 per share, with a total value of C$146,563.20. Insiders purchased a total of 18,840 shares of company stock worth $1,285,304 in the last three months. 0.03% of the stock is owned by insiders.

Nutrien Company Profile

(

Get Free Report)

Nutrien Ltd. provides crop inputs and services. The company operates through four segments: Retail, Potash, Nitrogen, and Phosphate. The Retail segment distributes crop nutrients, crop protection products, seeds, and merchandise products. The Potash segment provides granular and standard potash products.

Recommended Stories

Before you consider Nutrien, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nutrien wasn't on the list.

While Nutrien currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.