Geode Capital Management LLC raised its position in NV5 Global, Inc. (NASDAQ:NVEE - Free Report) by 298.3% in the fourth quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 1,302,719 shares of the business services provider's stock after buying an additional 975,677 shares during the period. Geode Capital Management LLC owned about 2.00% of NV5 Global worth $24,549,000 at the end of the most recent quarter.

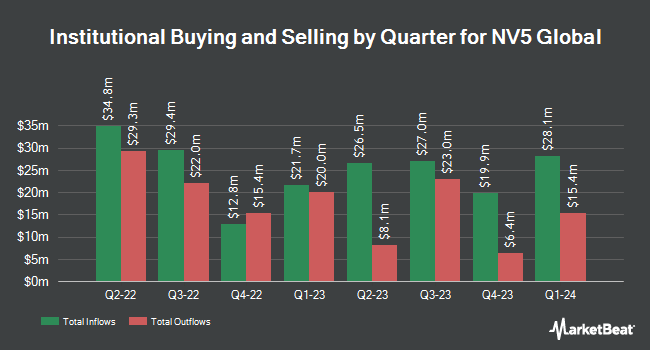

A number of other large investors have also modified their holdings of NVEE. Vanguard Group Inc. lifted its position in shares of NV5 Global by 288.4% in the fourth quarter. Vanguard Group Inc. now owns 3,761,947 shares of the business services provider's stock valued at $70,875,000 after acquiring an additional 2,793,280 shares in the last quarter. American Century Companies Inc. raised its stake in NV5 Global by 322.4% in the 4th quarter. American Century Companies Inc. now owns 2,147,358 shares of the business services provider's stock valued at $40,456,000 after purchasing an additional 1,639,014 shares during the last quarter. Swedbank AB lifted its holdings in NV5 Global by 366.4% in the 4th quarter. Swedbank AB now owns 1,632,296 shares of the business services provider's stock valued at $30,752,000 after purchasing an additional 1,282,296 shares in the last quarter. Geneva Capital Management LLC boosted its stake in NV5 Global by 274.0% during the 4th quarter. Geneva Capital Management LLC now owns 1,618,475 shares of the business services provider's stock worth $30,492,000 after purchasing an additional 1,185,754 shares during the last quarter. Finally, Bank of New York Mellon Corp grew its holdings in shares of NV5 Global by 1,572.9% during the fourth quarter. Bank of New York Mellon Corp now owns 1,510,725 shares of the business services provider's stock worth $28,462,000 after buying an additional 1,420,417 shares in the last quarter. Institutional investors and hedge funds own 75.54% of the company's stock.

NV5 Global Price Performance

Shares of NVEE stock opened at $15.82 on Friday. The company has a debt-to-equity ratio of 0.30, a current ratio of 2.05 and a quick ratio of 2.05. The company has a market capitalization of $1.03 billion, a PE ratio of 32.12, a price-to-earnings-growth ratio of 2.63 and a beta of 1.07. The firm's 50-day moving average is $17.76 and its two-hundred day moving average is $19.76. NV5 Global, Inc. has a 12 month low of $15.14 and a 12 month high of $26.14.

NV5 Global (NASDAQ:NVEE - Get Free Report) last released its quarterly earnings results on Thursday, February 20th. The business services provider reported $0.28 EPS for the quarter, missing the consensus estimate of $0.30 by ($0.02). The firm had revenue of $246.52 million for the quarter, compared to analysts' expectations of $243.46 million. NV5 Global had a net margin of 3.25% and a return on equity of 9.34%. Analysts predict that NV5 Global, Inc. will post 1.26 earnings per share for the current year.

NV5 Global declared that its board has approved a share buyback plan on Monday, January 6th that authorizes the company to repurchase $20.00 million in outstanding shares. This repurchase authorization authorizes the business services provider to reacquire up to 1.6% of its shares through open market purchases. Shares repurchase plans are typically a sign that the company's board of directors believes its stock is undervalued.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the stock. StockNews.com downgraded shares of NV5 Global from a "buy" rating to a "hold" rating in a research note on Wednesday, February 19th. Roth Mkm boosted their target price on NV5 Global from $27.00 to $28.00 and gave the stock a "buy" rating in a report on Friday, February 21st. Finally, Maxim Group cut their price target on NV5 Global from $29.00 to $24.00 and set a "buy" rating for the company in a report on Friday, February 21st.

Check Out Our Latest Stock Report on NV5 Global

About NV5 Global

(

Free Report)

NV5 Global, Inc provides technology, conformity assessment, consulting solutions, and software applications to public and private sector clients in the infrastructure, utility services, construction, real estate, environmental, and geospatial markets in the United States and internationally. It operates through three segments: Infrastructure; Building, Technology & Sciences; and Geospatial Solutions.

Further Reading

Want to see what other hedge funds are holding NVEE? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for NV5 Global, Inc. (NASDAQ:NVEE - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NV5 Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NV5 Global wasn't on the list.

While NV5 Global currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.