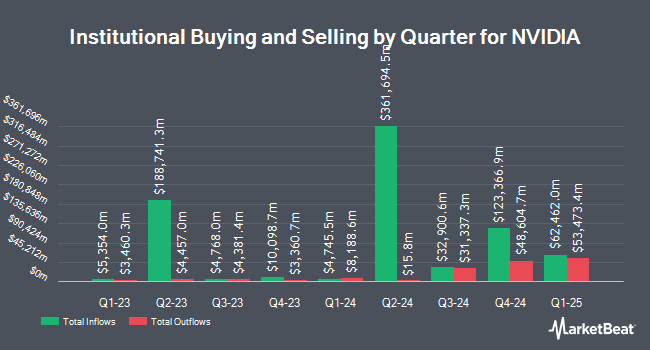

OLD National Bancorp IN lifted its stake in NVIDIA Co. (NASDAQ:NVDA - Free Report) by 124.9% during the 3rd quarter, according to its most recent disclosure with the SEC. The institutional investor owned 334,513 shares of the computer hardware maker's stock after buying an additional 185,807 shares during the quarter. NVIDIA makes up about 0.9% of OLD National Bancorp IN's investment portfolio, making the stock its 18th largest position. OLD National Bancorp IN's holdings in NVIDIA were worth $40,623,000 as of its most recent filing with the SEC.

Several other hedge funds have also recently modified their holdings of the stock. Hamilton Wealth LLC grew its holdings in NVIDIA by 0.3% in the 1st quarter. Hamilton Wealth LLC now owns 3,142 shares of the computer hardware maker's stock valued at $2,839,000 after buying an additional 9 shares in the last quarter. Poehling Capital Management INC. grew its holdings in NVIDIA by 0.9% in the 1st quarter. Poehling Capital Management INC. now owns 1,596 shares of the computer hardware maker's stock valued at $1,442,000 after buying an additional 14 shares in the last quarter. FSA Wealth Management LLC grew its holdings in NVIDIA by 3.0% in the 1st quarter. FSA Wealth Management LLC now owns 486 shares of the computer hardware maker's stock valued at $439,000 after buying an additional 14 shares in the last quarter. Clean Yield Group grew its holdings in NVIDIA by 0.8% in the 1st quarter. Clean Yield Group now owns 1,795 shares of the computer hardware maker's stock valued at $1,622,000 after buying an additional 15 shares in the last quarter. Finally, Earnest Partners LLC grew its holdings in NVIDIA by 1.5% in the 1st quarter. Earnest Partners LLC now owns 1,133 shares of the computer hardware maker's stock valued at $1,024,000 after buying an additional 17 shares in the last quarter. Hedge funds and other institutional investors own 65.27% of the company's stock.

Analyst Ratings Changes

NVDA has been the subject of several analyst reports. DA Davidson upped their target price on NVIDIA from $90.00 to $135.00 and gave the company a "neutral" rating in a report on Friday, November 22nd. Raymond James upped their target price on NVIDIA from $140.00 to $170.00 and gave the company a "strong-buy" rating in a report on Thursday, November 14th. Stifel Nicolaus upped their price target on NVIDIA from $165.00 to $180.00 and gave the company a "buy" rating in a research note on Tuesday, November 19th. HSBC upped their price target on NVIDIA from $145.00 to $200.00 and gave the company a "buy" rating in a research note on Thursday, November 14th. Finally, Benchmark upped their price target on NVIDIA from $170.00 to $190.00 and gave the company a "buy" rating in a research note on Thursday, November 21st. Four investment analysts have rated the stock with a hold rating, thirty-nine have given a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Moderate Buy" and a consensus price target of $164.15.

Get Our Latest Stock Analysis on NVIDIA

Insider Transactions at NVIDIA

In other NVIDIA news, CEO Jen Hsun Huang sold 120,000 shares of the stock in a transaction that occurred on Friday, August 30th. The stock was sold at an average price of $119.03, for a total transaction of $14,283,600.00. Following the completion of the sale, the chief executive officer now directly owns 76,494,995 shares of the company's stock, valued at approximately $9,105,199,254.85. This trade represents a 0.16 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director John Dabiri sold 716 shares of the business's stock in a transaction that occurred on Monday, November 25th. The shares were sold at an average price of $142.00, for a total value of $101,672.00. Following the completion of the transaction, the director now directly owns 19,942 shares in the company, valued at approximately $2,831,764. The trade was a 3.47 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 2,156,986 shares of company stock worth $254,885,999. Company insiders own 4.23% of the company's stock.

NVIDIA Stock Performance

NASDAQ:NVDA traded down $1.58 during mid-day trading on Wednesday, reaching $135.34. 225,240,656 shares of the stock were exchanged, compared to its average volume of 395,069,875. The company has a quick ratio of 3.64, a current ratio of 4.10 and a debt-to-equity ratio of 0.13. NVIDIA Co. has a 1 year low of $45.01 and a 1 year high of $152.89. The company has a 50 day simple moving average of $135.26 and a 200-day simple moving average of $123.26. The stock has a market capitalization of $3.31 trillion, a P/E ratio of 53.26, a P/E/G ratio of 2.46 and a beta of 1.66.

NVIDIA (NASDAQ:NVDA - Get Free Report) last announced its earnings results on Wednesday, November 20th. The computer hardware maker reported $0.81 EPS for the quarter, beating analysts' consensus estimates of $0.69 by $0.12. The business had revenue of $35.08 billion for the quarter, compared to analysts' expectations of $33.15 billion. NVIDIA had a net margin of 55.69% and a return on equity of 114.83%. The company's quarterly revenue was up 93.6% on a year-over-year basis. During the same period in the previous year, the company posted $0.38 EPS. Analysts anticipate that NVIDIA Co. will post 2.76 earnings per share for the current fiscal year.

NVIDIA Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Thursday, December 5th will be paid a dividend of $0.01 per share. The ex-dividend date is Thursday, December 5th. This represents a $0.04 annualized dividend and a dividend yield of 0.03%. NVIDIA's dividend payout ratio (DPR) is 1.57%.

NVIDIA declared that its Board of Directors has initiated a share repurchase program on Wednesday, August 28th that permits the company to buyback $50.00 billion in outstanding shares. This buyback authorization permits the computer hardware maker to purchase up to 1.6% of its stock through open market purchases. Stock buyback programs are usually an indication that the company's leadership believes its stock is undervalued.

NVIDIA Company Profile

(

Free Report)

NVIDIA Corporation provides graphics and compute and networking solutions in the United States, Taiwan, China, Hong Kong, and internationally. The Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; virtual GPU or vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building and operating metaverse and 3D internet applications.

Recommended Stories

Before you consider NVIDIA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVIDIA wasn't on the list.

While NVIDIA currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.