Giverny Capital Inc. lifted its holdings in shares of NVR, Inc. (NYSE:NVR - Free Report) by 1.9% during the 4th quarter, according to its most recent disclosure with the SEC. The institutional investor owned 13,558 shares of the construction company's stock after purchasing an additional 251 shares during the quarter. NVR comprises about 4.1% of Giverny Capital Inc.'s holdings, making the stock its 10th biggest holding. Giverny Capital Inc. owned about 0.44% of NVR worth $110,890,000 at the end of the most recent quarter.

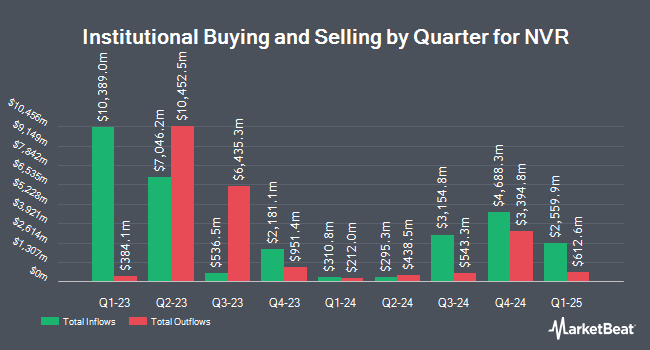

Other hedge funds and other institutional investors have also made changes to their positions in the company. Distillate Capital Partners LLC lifted its holdings in NVR by 17.0% during the 4th quarter. Distillate Capital Partners LLC now owns 2,100 shares of the construction company's stock worth $17,176,000 after buying an additional 305 shares in the last quarter. Sterling Capital Management LLC raised its stake in shares of NVR by 55.0% in the fourth quarter. Sterling Capital Management LLC now owns 172 shares of the construction company's stock valued at $1,407,000 after acquiring an additional 61 shares in the last quarter. Family Office Research LLC acquired a new stake in shares of NVR in the fourth quarter valued at $450,000. Paralel Advisors LLC boosted its holdings in NVR by 11.4% in the fourth quarter. Paralel Advisors LLC now owns 313 shares of the construction company's stock valued at $2,560,000 after purchasing an additional 32 shares during the period. Finally, Treasurer of the State of North Carolina grew its stake in NVR by 1.0% during the 4th quarter. Treasurer of the State of North Carolina now owns 1,266 shares of the construction company's stock worth $10,354,000 after purchasing an additional 12 shares in the last quarter. Hedge funds and other institutional investors own 83.67% of the company's stock.

NVR Stock Down 0.3 %

NVR stock traded down $18.68 during midday trading on Tuesday, reaching $7,222.31. The company's stock had a trading volume of 22,598 shares, compared to its average volume of 22,201. The company has a market cap of $21.44 billion, a P/E ratio of 14.23, a P/E/G ratio of 2.39 and a beta of 1.07. The company has a quick ratio of 3.69, a current ratio of 6.18 and a debt-to-equity ratio of 0.22. The business has a 50-day simple moving average of $7,241.87 and a 200-day simple moving average of $8,267.66. NVR, Inc. has a fifty-two week low of $6,562.85 and a fifty-two week high of $9,964.77.

NVR (NYSE:NVR - Get Free Report) last issued its earnings results on Tuesday, February 4th. The construction company reported $139.93 earnings per share for the quarter, topping the consensus estimate of $132.63 by $7.30. NVR had a return on equity of 39.67% and a net margin of 16.34%. On average, research analysts expect that NVR, Inc. will post 505.2 earnings per share for the current fiscal year.

Insiders Place Their Bets

In other news, Director Thomas D. Eckert sold 143 shares of the company's stock in a transaction on Monday, February 10th. The shares were sold at an average price of $7,515.60, for a total value of $1,074,730.80. Following the completion of the transaction, the director now owns 1,050 shares in the company, valued at approximately $7,891,380. This represents a 11.99 % decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through this link. 7.00% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of equities research analysts have issued reports on the company. JPMorgan Chase & Co. reduced their price target on NVR from $9,245.00 to $8,570.00 and set a "neutral" rating on the stock in a research report on Wednesday, January 29th. UBS Group raised their target price on shares of NVR from $8,750.00 to $8,900.00 and gave the company a "neutral" rating in a report on Wednesday, January 29th. Four equities research analysts have rated the stock with a hold rating and one has issued a buy rating to the company. According to data from MarketBeat, NVR has an average rating of "Hold" and a consensus target price of $9,356.67.

Read Our Latest Research Report on NVR

NVR Company Profile

(

Free Report)

NVR, Inc operates as a homebuilder in the United States. The company operates through, Homebuilding and Mortgage Banking segments. It engages in the construction and sale of single-family detached homes, townhomes, and condominium buildings under the Ryan Homes, NVHomes, and Heartland Homes names. The company markets its Ryan Homes products to first-time and first-time move-up buyers; and NVHomes and Heartland Homes products to move-up and luxury buyers.

See Also

Before you consider NVR, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NVR wasn't on the list.

While NVR currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.