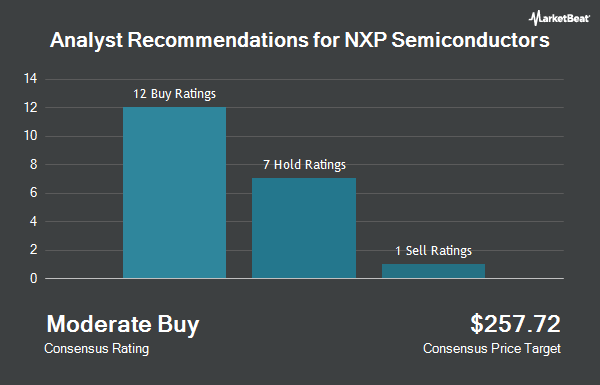

NXP Semiconductors (NASDAQ:NXPI - Get Free Report) has received a consensus rating of "Moderate Buy" from the nineteen research firms that are covering the stock, Marketbeat Ratings reports. Three analysts have rated the stock with a hold recommendation and sixteen have assigned a buy recommendation to the company. The average 1 year target price among brokers that have covered the stock in the last year is $267.00.

A number of equities analysts have recently issued reports on the stock. JPMorgan Chase & Co. dropped their price objective on shares of NXP Semiconductors from $260.00 to $240.00 and set a "neutral" rating on the stock in a research note on Wednesday, February 5th. Oppenheimer cut their price target on shares of NXP Semiconductors from $330.00 to $300.00 and set an "outperform" rating on the stock in a report on Wednesday, November 6th. Morgan Stanley raised NXP Semiconductors from an "equal weight" rating to an "overweight" rating and raised their price objective for the stock from $231.00 to $257.00 in a research report on Wednesday, February 12th. Needham & Company LLC reduced their target price on NXP Semiconductors from $250.00 to $230.00 and set a "buy" rating on the stock in a research report on Wednesday, February 5th. Finally, Loop Capital started coverage on NXP Semiconductors in a report on Monday, November 11th. They issued a "buy" rating and a $300.00 price target for the company.

Get Our Latest Stock Report on NXPI

NXP Semiconductors Trading Up 2.7 %

NXPI stock traded up $5.61 during mid-day trading on Friday, reaching $216.77. The company had a trading volume of 2,618,721 shares, compared to its average volume of 2,300,197. NXP Semiconductors has a 12 month low of $198.21 and a 12 month high of $296.08. The company has a market capitalization of $54.98 billion, a PE ratio of 22.28, a price-to-earnings-growth ratio of 3.01 and a beta of 1.46. The firm has a 50 day moving average of $215.99 and a 200 day moving average of $226.68. The company has a debt-to-equity ratio of 1.09, a current ratio of 2.36 and a quick ratio of 1.60.

Institutional Investors Weigh In On NXP Semiconductors

Hedge funds have recently added to or reduced their stakes in the business. GDS Wealth Management grew its position in NXP Semiconductors by 7.7% during the third quarter. GDS Wealth Management now owns 55,740 shares of the semiconductor provider's stock valued at $13,378,000 after buying an additional 3,985 shares during the period. HITE Hedge Asset Management LLC acquired a new position in NXP Semiconductors in the 3rd quarter valued at $13,445,000. Merit Financial Group LLC purchased a new position in shares of NXP Semiconductors in the fourth quarter worth about $360,000. Strategic Financial Concepts LLC purchased a new position in NXP Semiconductors in the 4th quarter worth approximately $46,000. Finally, Banque Cantonale Vaudoise boosted its holdings in shares of NXP Semiconductors by 60.2% during the 3rd quarter. Banque Cantonale Vaudoise now owns 25,850 shares of the semiconductor provider's stock worth $6,204,000 after purchasing an additional 9,710 shares during the last quarter. 90.54% of the stock is owned by hedge funds and other institutional investors.

NXP Semiconductors Company Profile

(

Get Free ReportNXP Semiconductors N.V. offers various semiconductor products. The company's product portfolio includes microcontrollers; application processors, including i.MX application processors, and i.MX 8 and 9 family of applications processors; communication processors; wireless connectivity solutions, such as near field communications, ultra-wideband, Bluetooth low-energy, Zigbee, and Wi-Fi and Wi-Fi/Bluetooth integrated SoCs; analog and interface devices; radio frequency power amplifiers; and security controllers, as well as semiconductor-based environmental and inertial sensors, including pressure, inertial, magnetic, and gyroscopic sensors.

Featured Stories

Before you consider NXP Semiconductors, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NXP Semiconductors wasn't on the list.

While NXP Semiconductors currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.