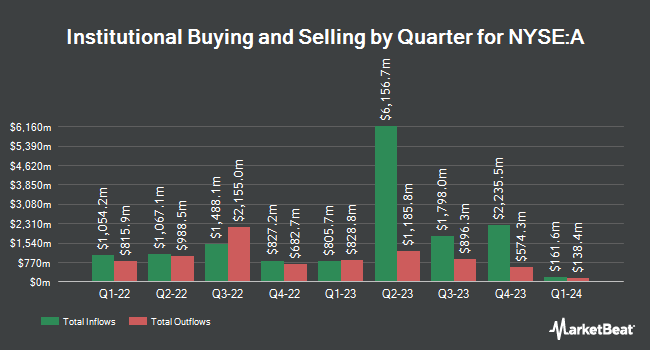

Van ECK Associates Corp grew its position in shares of Agilent Technologies, Inc. (NYSE:A - Free Report) by 6.6% in the third quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 2,976,905 shares of the medical research company's stock after purchasing an additional 183,716 shares during the period. Van ECK Associates Corp owned approximately 1.04% of Agilent Technologies worth $442,011,000 at the end of the most recent reporting period.

A number of other institutional investors have also recently made changes to their positions in the company. Livelsberger Financial Advisory bought a new position in shares of Agilent Technologies in the 3rd quarter valued at about $28,000. Crewe Advisors LLC lifted its holdings in shares of Agilent Technologies by 114.8% in the 2nd quarter. Crewe Advisors LLC now owns 189 shares of the medical research company's stock valued at $25,000 after acquiring an additional 101 shares during the last quarter. Ridgewood Investments LLC bought a new position in shares of Agilent Technologies in the 2nd quarter valued at about $29,000. Fortitude Family Office LLC lifted its holdings in shares of Agilent Technologies by 68.3% in the 3rd quarter. Fortitude Family Office LLC now owns 234 shares of the medical research company's stock valued at $35,000 after acquiring an additional 95 shares during the last quarter. Finally, Larson Financial Group LLC lifted its holdings in shares of Agilent Technologies by 29,300.0% in the 1st quarter. Larson Financial Group LLC now owns 294 shares of the medical research company's stock valued at $43,000 after acquiring an additional 293 shares during the last quarter.

Agilent Technologies Stock Up 5.0 %

Shares of A stock traded up $6.56 during trading hours on Friday, reaching $136.87. 2,077,724 shares of the company's stock were exchanged, compared to its average volume of 1,348,171. The stock's 50 day moving average is $139.73 and its 200-day moving average is $138.08. The company has a market cap of $39.33 billion, a price-to-earnings ratio of 28.40, a P/E/G ratio of 6.26 and a beta of 1.07. The company has a current ratio of 1.78, a quick ratio of 1.37 and a debt-to-equity ratio of 0.36. Agilent Technologies, Inc. has a fifty-two week low of $102.70 and a fifty-two week high of $155.35.

Agilent Technologies (NYSE:A - Get Free Report) last issued its quarterly earnings results on Wednesday, August 21st. The medical research company reported $1.32 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.26 by $0.06. Agilent Technologies had a return on equity of 25.26% and a net margin of 21.75%. The business had revenue of $1.58 billion for the quarter, compared to the consensus estimate of $1.56 billion. During the same period in the prior year, the firm posted $1.43 earnings per share. The business's quarterly revenue was down 5.6% on a year-over-year basis. Analysts predict that Agilent Technologies, Inc. will post 5.24 earnings per share for the current fiscal year.

Agilent Technologies Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Wednesday, October 23rd. Investors of record on Tuesday, October 1st were given a $0.236 dividend. This represents a $0.94 annualized dividend and a dividend yield of 0.69%. The ex-dividend date was Tuesday, October 1st. Agilent Technologies's payout ratio is 19.50%.

Insider Activity at Agilent Technologies

In other Agilent Technologies news, SVP Dominique Grau sold 9,990 shares of the company's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $145.00, for a total value of $1,448,550.00. Following the sale, the senior vice president now directly owns 40,011 shares of the company's stock, valued at approximately $5,801,595. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In other Agilent Technologies news, SVP Dominique Grau sold 9,990 shares of the company's stock in a transaction on Thursday, September 26th. The shares were sold at an average price of $145.00, for a total value of $1,448,550.00. Following the sale, the senior vice president now directly owns 40,011 shares of the company's stock, valued at approximately $5,801,595. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Padraig Mcdonnell sold 1,958 shares of the company's stock in a transaction on Thursday, August 22nd. The shares were sold at an average price of $145.00, for a total transaction of $283,910.00. Following the completion of the sale, the chief executive officer now directly owns 24,118 shares in the company, valued at approximately $3,497,110. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 11,995 shares of company stock valued at $1,739,510 in the last ninety days.

Wall Street Analysts Forecast Growth

A has been the subject of several analyst reports. Wells Fargo & Company initiated coverage on shares of Agilent Technologies in a research note on Tuesday, August 27th. They issued an "overweight" rating and a $157.00 price objective for the company. UBS Group raised their price objective on shares of Agilent Technologies from $141.00 to $150.00 and gave the stock a "neutral" rating in a research note on Thursday, August 22nd. Evercore ISI raised their price objective on shares of Agilent Technologies from $135.00 to $145.00 and gave the stock an "in-line" rating in a research note on Tuesday, October 1st. Citigroup raised their price objective on shares of Agilent Technologies from $150.00 to $165.00 and gave the stock a "buy" rating in a research note on Thursday, August 22nd. Finally, Bank of America raised their price objective on shares of Agilent Technologies from $140.00 to $147.00 and gave the stock a "neutral" rating in a research note on Thursday, August 22nd. One analyst has rated the stock with a sell rating, five have assigned a hold rating and nine have issued a buy rating to the stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $144.36.

Check Out Our Latest Analysis on A

Agilent Technologies Profile

(

Free Report)

Agilent Technologies, Inc provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide. The company operates in three segments: Life Sciences and Applied Markets, Diagnostics and Genomics, and Agilent CrossLab. The Life Sciences and Applied Markets segment offers liquid chromatography systems and components; liquid chromatography mass spectrometry systems; gas chromatography systems and components; gas chromatography mass spectrometry systems; inductively coupled plasma mass spectrometry instruments; atomic absorption instruments; microwave plasma-atomic emission spectrometry instruments; inductively coupled plasma optical emission spectrometry instruments; raman spectroscopy; cell analysis plate based assays; flow cytometer; real-time cell analyzer; cell imaging systems; microplate reader; laboratory software; information management and analytics; laboratory automation and robotic systems; dissolution testing; and vacuum pumps, and measurement technologies.

Recommended Stories

Before you consider Agilent Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agilent Technologies wasn't on the list.

While Agilent Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.