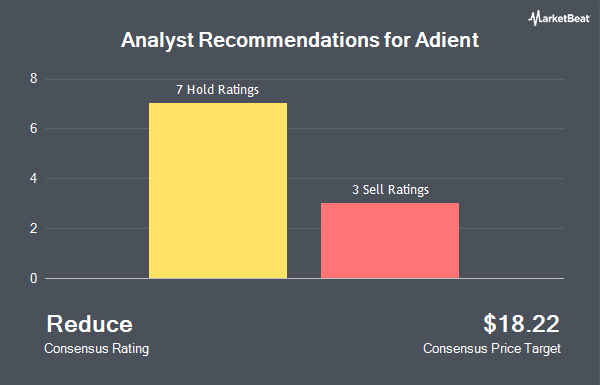

Shares of Adient plc (NYSE:ADNT - Get Free Report) have been given a consensus rating of "Hold" by the nine brokerages that are covering the company, MarketBeat Ratings reports. One equities research analyst has rated the stock with a sell rating, six have issued a hold rating and two have given a buy rating to the company. The average twelve-month price target among brokerages that have updated their coverage on the stock in the last year is $25.38.

A number of research firms recently commented on ADNT. Bank of America decreased their price target on Adient from $35.00 to $30.00 and set a "buy" rating for the company in a research note on Monday, October 14th. Wells Fargo & Company decreased their price objective on shares of Adient from $29.00 to $27.00 and set an "overweight" rating for the company in a report on Friday, September 20th. Barclays dropped their target price on shares of Adient from $29.00 to $24.00 and set an "equal weight" rating on the stock in a report on Thursday, August 8th. Morgan Stanley decreased their price target on shares of Adient from $32.00 to $21.00 and set an "underweight" rating for the company in a report on Wednesday, August 14th. Finally, JPMorgan Chase & Co. cut their target price on shares of Adient from $31.00 to $27.00 and set a "neutral" rating on the stock in a report on Thursday, August 8th.

Check Out Our Latest Report on Adient

Adient Stock Down 0.3 %

Shares of ADNT traded down $0.06 during trading on Friday, reaching $20.87. The company's stock had a trading volume of 635,879 shares, compared to its average volume of 1,223,188. Adient has a twelve month low of $19.40 and a twelve month high of $37.19. The company has a quick ratio of 0.87, a current ratio of 1.08 and a debt-to-equity ratio of 1.08. The company has a market cap of $1.87 billion, a price-to-earnings ratio of 12.90, a P/E/G ratio of 0.35 and a beta of 2.16. The company has a fifty day moving average of $21.85 and a two-hundred day moving average of $24.91.

Adient (NYSE:ADNT - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported $0.32 EPS for the quarter, missing analysts' consensus estimates of $0.62 by ($0.30). The company had revenue of $3.72 billion for the quarter, compared to the consensus estimate of $3.82 billion. Adient had a net margin of 0.50% and a return on equity of 6.34%. The company's revenue was down 8.4% compared to the same quarter last year. During the same quarter last year, the company earned $0.98 earnings per share. On average, sell-side analysts predict that Adient will post 1.76 EPS for the current fiscal year.

Hedge Funds Weigh In On Adient

Several large investors have recently bought and sold shares of ADNT. State of Alaska Department of Revenue raised its holdings in shares of Adient by 402.4% in the 3rd quarter. State of Alaska Department of Revenue now owns 49,755 shares of the company's stock worth $1,122,000 after purchasing an additional 39,851 shares in the last quarter. Louisiana State Employees Retirement System grew its holdings in shares of Adient by 66.1% during the third quarter. Louisiana State Employees Retirement System now owns 42,200 shares of the company's stock valued at $952,000 after buying an additional 16,800 shares in the last quarter. Signaturefd LLC increased its holdings in shares of Adient by 493.8% in the 3rd quarter. Signaturefd LLC now owns 2,191 shares of the company's stock valued at $49,000 after purchasing an additional 1,822 shares during the period. Everence Capital Management Inc. purchased a new stake in Adient in the 3rd quarter worth approximately $240,000. Finally, Creative Planning raised its holdings in shares of Adient by 138.1% during the third quarter. Creative Planning now owns 36,708 shares of the company's stock worth $828,000 after acquiring an additional 21,291 shares in the last quarter. Institutional investors and hedge funds own 92.44% of the company's stock.

Adient Company Profile

(

Get Free ReportAdient plc engages in the design, development, manufacture, and market of seating systems and components for passenger cars, commercial vehicles, and light trucks. The company's automotive seating solutions include complete seating systems, frames, mechanisms, foams, head restraints, armrests, and trim covers.

Featured Articles

Before you consider Adient, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adient wasn't on the list.

While Adient currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.