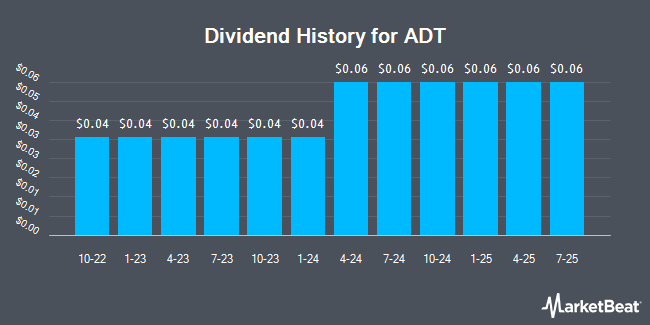

ADT Inc. (NYSE:ADT - Get Free Report) announced a quarterly dividend on Thursday, October 24th, Zacks reports. Stockholders of record on Thursday, December 12th will be paid a dividend of 0.055 per share by the security and automation business on Thursday, January 9th. This represents a $0.22 dividend on an annualized basis and a dividend yield of 2.79%. The ex-dividend date is Thursday, December 12th.

ADT has a dividend payout ratio of 26.2% indicating that its dividend is sufficiently covered by earnings. Analysts expect ADT to earn $0.77 per share next year, which means the company should continue to be able to cover its $0.22 annual dividend with an expected future payout ratio of 28.6%.

ADT Stock Down 3.2 %

NYSE ADT traded down $0.26 during trading on Friday, hitting $7.88. The stock had a trading volume of 14,795,969 shares, compared to its average volume of 5,099,404. The company has a market capitalization of $7.27 billion, a PE ratio of 11.27 and a beta of 1.53. ADT has a 12 month low of $5.53 and a 12 month high of $8.25. The company's 50-day moving average price is $7.18 and its two-hundred day moving average price is $7.15. The company has a debt-to-equity ratio of 1.98, a quick ratio of 0.59 and a current ratio of 0.75.

ADT (NYSE:ADT - Get Free Report) last announced its earnings results on Thursday, October 24th. The security and automation business reported $0.20 EPS for the quarter, topping the consensus estimate of $0.17 by $0.03. ADT had a net margin of 13.83% and a return on equity of 15.45%. The business had revenue of $1.24 billion during the quarter, compared to analysts' expectations of $1.22 billion. During the same quarter in the prior year, the company posted $0.07 earnings per share. The firm's revenue was up 5.4% on a year-over-year basis. As a group, sell-side analysts forecast that ADT will post 0.62 EPS for the current year.

Wall Street Analyst Weigh In

ADT has been the subject of several analyst reports. Royal Bank of Canada raised their target price on shares of ADT from $8.00 to $9.00 and gave the company a "sector perform" rating in a research note on Friday. The Goldman Sachs Group raised their price objective on ADT from $8.20 to $9.20 and gave the company a "buy" rating in a research report on Friday.

Check Out Our Latest Analysis on ADT

ADT Company Profile

(

Get Free Report)

ADT Inc provides security, interactive, and smart home solutions to residential and small business customers in the United States. It operates through two segments, Consumer and Small Business, and Solar. The company provides burglar and life safety alarms, smart security cameras, smart home automation systems, and video surveillance systems.

Read More

Before you consider ADT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ADT wasn't on the list.

While ADT currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.