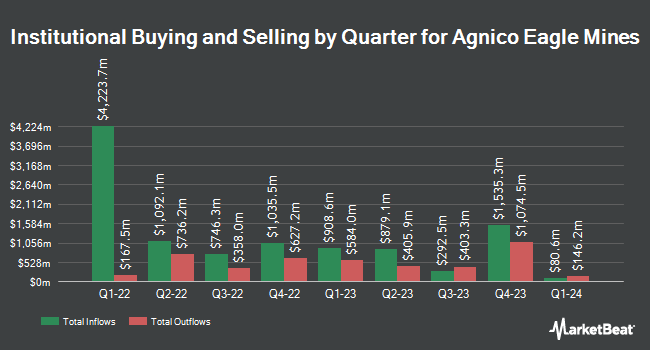

International Assets Investment Management LLC purchased a new position in Agnico Eagle Mines Limited (NYSE:AEM - Free Report) TSE: AEM during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund purchased 151,220 shares of the mining company's stock, valued at approximately $121,820,000.

Other institutional investors also recently added to or reduced their stakes in the company. Financial Sense Advisors Inc. grew its position in Agnico Eagle Mines by 372.3% during the first quarter. Financial Sense Advisors Inc. now owns 62,330 shares of the mining company's stock valued at $3,718,000 after buying an additional 49,132 shares during the period. Manning & Napier Advisors LLC bought a new position in Agnico Eagle Mines during the second quarter worth about $2,595,000. Capital Wealth Planning LLC boosted its position in Agnico Eagle Mines by 62.3% during the first quarter. Capital Wealth Planning LLC now owns 2,620,345 shares of the mining company's stock worth $156,304,000 after purchasing an additional 1,006,001 shares during the period. Principal Financial Group Inc. bought a new position in Agnico Eagle Mines during the first quarter worth about $1,388,000. Finally, GSA Capital Partners LLP bought a new position in Agnico Eagle Mines during the first quarter worth about $878,000. Institutional investors own 68.34% of the company's stock.

Agnico Eagle Mines Price Performance

AEM traded down $1.05 on Friday, reaching $86.88. The company had a trading volume of 2,328,687 shares, compared to its average volume of 2,672,038. The business has a 50 day simple moving average of $81.78 and a 200 day simple moving average of $73.32. The company has a market cap of $43.46 billion, a price-to-earnings ratio of 91.45, a P/E/G ratio of 0.71 and a beta of 1.10. The company has a debt-to-equity ratio of 0.06, a quick ratio of 0.76 and a current ratio of 1.51. Agnico Eagle Mines Limited has a 52-week low of $44.37 and a 52-week high of $89.00.

Agnico Eagle Mines (NYSE:AEM - Get Free Report) TSE: AEM last issued its quarterly earnings results on Wednesday, July 31st. The mining company reported $1.07 EPS for the quarter, beating analysts' consensus estimates of $0.93 by $0.14. Agnico Eagle Mines had a net margin of 8.44% and a return on equity of 7.16%. The business had revenue of $2.08 billion for the quarter, compared to analysts' expectations of $2.03 billion. During the same period last year, the business earned $0.65 earnings per share. The business's quarterly revenue was up 20.9% on a year-over-year basis. As a group, sell-side analysts anticipate that Agnico Eagle Mines Limited will post 3.88 EPS for the current year.

Analysts Set New Price Targets

AEM has been the subject of a number of research reports. Jefferies Financial Group increased their target price on shares of Agnico Eagle Mines from $68.00 to $85.00 and gave the stock a "hold" rating in a research report on Friday, October 4th. Royal Bank of Canada increased their target price on shares of Agnico Eagle Mines from $80.00 to $87.00 and gave the stock an "outperform" rating in a research report on Tuesday, September 10th. UBS Group initiated coverage on shares of Agnico Eagle Mines in a research report on Tuesday, September 17th. They set a "buy" rating and a $95.00 target price for the company. Scotiabank increased their target price on shares of Agnico Eagle Mines from $81.00 to $94.00 and gave the stock a "sector outperform" rating in a research report on Monday, August 19th. Finally, CIBC increased their price target on shares of Agnico Eagle Mines from $81.00 to $101.00 and gave the stock an "outperformer" rating in a report on Wednesday, July 10th. One analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $86.78.

View Our Latest Report on Agnico Eagle Mines

Agnico Eagle Mines Profile

(

Free Report)

Agnico Eagle Mines Limited, a gold mining company, exploration, development, and production of precious metals. It explores for gold. The company's mines are located in Canada, Australia, Finland and Mexico, with exploration and development activities in Canada, Australia, Europe, Latin America, and the United States.

See Also

Before you consider Agnico Eagle Mines, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Agnico Eagle Mines wasn't on the list.

While Agnico Eagle Mines currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.