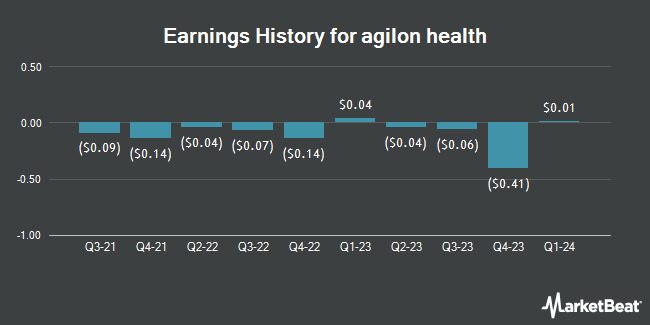

agilon health (NYSE:AGL - Get Free Report) will post its quarterly earnings results after the market closes on Thursday, November 7th. Analysts expect agilon health to post earnings of ($0.10) per share for the quarter. agilon health has set its Q3 2024 guidance at EPS and its FY 2024 guidance at EPS.Persons interested in listening to the company's earnings conference call can do so using this link.

agilon health (NYSE:AGL - Get Free Report) last released its quarterly earnings data on Tuesday, August 6th. The company reported ($0.07) earnings per share for the quarter, meeting the consensus estimate of ($0.07). agilon health had a negative net margin of 5.57% and a negative return on equity of 29.91%. The firm had revenue of $1.48 billion during the quarter, compared to analysts' expectations of $1.56 billion. During the same period in the previous year, the company earned ($0.04) earnings per share. The firm's quarterly revenue was up 38.7% on a year-over-year basis. On average, analysts expect agilon health to post $0 EPS for the current fiscal year and $0 EPS for the next fiscal year.

agilon health Stock Performance

AGL stock traded up $0.10 on Thursday, hitting $2.56. The company had a trading volume of 4,616,142 shares, compared to its average volume of 4,904,203. The stock has a market cap of $1.05 billion, a price-to-earnings ratio of -3.50 and a beta of 0.54. The company has a current ratio of 1.36, a quick ratio of 1.36 and a debt-to-equity ratio of 0.04. The stock's 50-day simple moving average is $3.46 and its 200 day simple moving average is $5.07. agilon health has a 12-month low of $2.36 and a 12-month high of $18.37.

Insider Activity at agilon health

In other agilon health news, CEO Steven Sell bought 20,000 shares of the firm's stock in a transaction dated Thursday, September 12th. The shares were purchased at an average cost of $3.36 per share, for a total transaction of $67,200.00. Following the transaction, the chief executive officer now owns 67,590 shares of the company's stock, valued at $227,102.40. This represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. 3.20% of the stock is currently owned by insiders.

Wall Street Analysts Forecast Growth

AGL has been the subject of several research analyst reports. Citigroup reaffirmed a "sell" rating and issued a $2.50 price objective (down previously from $7.00) on shares of agilon health in a report on Tuesday. Royal Bank of Canada reiterated an "outperform" rating and set a $8.00 target price on shares of agilon health in a research report on Wednesday, August 7th. Deutsche Bank Aktiengesellschaft reduced their price target on agilon health from $5.00 to $4.00 and set a "hold" rating for the company in a research report on Friday, August 9th. Bank of America cut agilon health from a "buy" rating to an "underperform" rating and set a $3.00 price objective on the stock. in a research report on Wednesday, October 2nd. Finally, Evercore ISI reduced their target price on shares of agilon health from $7.00 to $4.00 and set an "in-line" rating for the company in a report on Tuesday, October 8th. Three investment analysts have rated the stock with a sell rating, thirteen have assigned a hold rating and four have assigned a buy rating to the company. Based on data from MarketBeat.com, agilon health currently has an average rating of "Hold" and a consensus price target of $7.81.

Get Our Latest Report on AGL

About agilon health

(

Get Free Report)

agilon health, inc. provides healthcare services for seniors through primary care physicians in the communities of the United States. It offers a platform that manages the total healthcare needs of the patients by subscription-like per-member per-month. The company was formerly known as Agilon Health Topco, Inc and changed its name to agilon health, inc.

Featured Articles

Before you consider agilon health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and agilon health wasn't on the list.

While agilon health currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.