Assured Guaranty (NYSE:AGO - Get Free Report) is scheduled to post its quarterly earnings results after the market closes on Monday, November 11th. Analysts expect Assured Guaranty to post earnings of $1.42 per share for the quarter. Individual that wish to register for the company's earnings conference call can do so using this link.

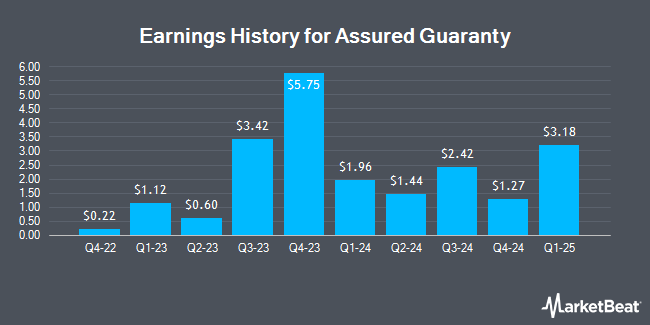

Assured Guaranty (NYSE:AGO - Get Free Report) last issued its quarterly earnings data on Wednesday, August 7th. The financial services provider reported $1.44 EPS for the quarter, topping analysts' consensus estimates of $1.39 by $0.05. Assured Guaranty had a return on equity of 13.19% and a net margin of 61.17%. The company had revenue of $202.00 million for the quarter, compared to analysts' expectations of $193.05 million. During the same quarter in the previous year, the firm posted $0.60 earnings per share. The firm's quarterly revenue was down 43.9% on a year-over-year basis. On average, analysts expect Assured Guaranty to post $6 EPS for the current fiscal year and $7 EPS for the next fiscal year.

Assured Guaranty Stock Down 1.3 %

Shares of AGO stock traded down $1.04 during trading hours on Monday, reaching $81.52. The company had a trading volume of 192,331 shares, compared to its average volume of 383,092. The company has a market capitalization of $4.29 billion, a P/E ratio of 6.63 and a beta of 1.10. The company has a debt-to-equity ratio of 0.30, a quick ratio of 0.96 and a current ratio of 0.96. Assured Guaranty has a twelve month low of $63.66 and a twelve month high of $96.60. The stock's fifty day simple moving average is $81.45 and its 200 day simple moving average is $79.10.

Assured Guaranty Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, September 4th. Shareholders of record on Wednesday, August 21st were given a $0.31 dividend. This represents a $1.24 annualized dividend and a yield of 1.52%. The ex-dividend date was Wednesday, August 21st. Assured Guaranty's dividend payout ratio (DPR) is 10.08%.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on AGO shares. Roth Mkm restated a "buy" rating and issued a $110.00 target price on shares of Assured Guaranty in a research note on Tuesday, July 9th. StockNews.com downgraded Assured Guaranty from a "hold" rating to a "sell" rating in a research note on Friday, October 18th. UBS Group boosted their price target on Assured Guaranty from $84.00 to $87.00 and gave the stock a "neutral" rating in a research note on Thursday, October 17th. Finally, Keefe, Bruyette & Woods upgraded Assured Guaranty from a "market perform" rating to an "outperform" rating and raised their price objective for the company from $87.00 to $92.00 in a research note on Tuesday, July 9th.

View Our Latest Research Report on AGO

Insider Transactions at Assured Guaranty

In other news, Director Yukiko Omura sold 3,599 shares of the stock in a transaction dated Thursday, September 26th. The shares were sold at an average price of $79.73, for a total transaction of $286,948.27. Following the transaction, the director now owns 19,285 shares of the company's stock, valued at approximately $1,537,593.05. This trade represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other news, Director Yukiko Omura sold 3,599 shares of the business's stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $79.73, for a total value of $286,948.27. Following the completion of the sale, the director now directly owns 19,285 shares in the company, valued at approximately $1,537,593.05. The trade was a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, CEO Dominic Frederico sold 31,000 shares of the firm's stock in a transaction on Wednesday, September 4th. The stock was sold at an average price of $80.01, for a total value of $2,480,310.00. Following the transaction, the chief executive officer now owns 1,380,119 shares in the company, valued at $110,423,321.19. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 5.10% of the company's stock.

Assured Guaranty Company Profile

(

Get Free Report)

Assured Guaranty Ltd., together with its subsidiaries, provides credit protection products to public finance, infrastructure, and structured finance markets in the United States and internationally. It operates through two segments: Insurance and Asset Management. The company offers financial guaranty insurance that protects holders of debt instruments and other monetary obligations from defaults in scheduled payments.

Recommended Stories

Before you consider Assured Guaranty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Assured Guaranty wasn't on the list.

While Assured Guaranty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.