American Healthcare REIT (NYSE:AHR - Get Free Report) was upgraded by investment analysts at Colliers Securities from a "hold" rating to a "moderate buy" rating in a research note issued on Sunday, Zacks.com reports.

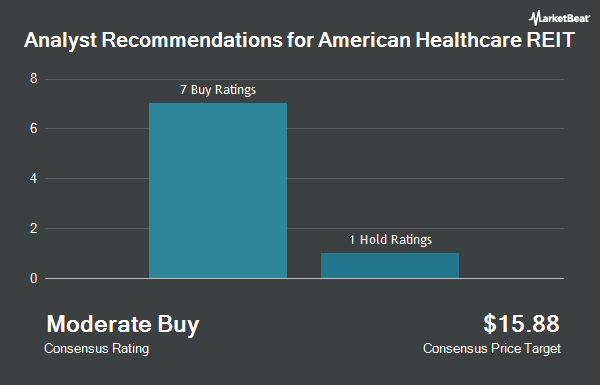

Other analysts also recently issued research reports about the stock. KeyCorp boosted their price objective on shares of American Healthcare REIT from $16.00 to $27.00 and gave the stock an "overweight" rating in a research report on Monday, September 16th. Bank of America boosted their price target on shares of American Healthcare REIT from $27.00 to $31.00 and gave the company a "buy" rating in a research report on Tuesday, September 24th. JMP Securities raised their price objective on American Healthcare REIT from $18.00 to $30.00 and gave the stock a "market outperform" rating in a report on Friday, September 20th. Morgan Stanley boosted their target price on American Healthcare REIT from $17.00 to $22.00 and gave the company an "overweight" rating in a report on Thursday, August 22nd. Finally, Truist Financial raised their price target on American Healthcare REIT from $22.00 to $27.00 and gave the stock a "buy" rating in a research note on Friday, September 20th. One investment analyst has rated the stock with a hold rating and seven have given a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $23.00.

View Our Latest Analysis on AHR

American Healthcare REIT Trading Up 1.0 %

Shares of NYSE:AHR traded up $0.24 during trading hours on Friday, reaching $24.94. The stock had a trading volume of 1,230,259 shares, compared to its average volume of 1,456,117. American Healthcare REIT has a 1 year low of $12.63 and a 1 year high of $26.77. The firm's 50 day moving average is $22.48 and its 200-day moving average is $17.43. The company has a current ratio of 0.29, a quick ratio of 0.29 and a debt-to-equity ratio of 0.60.

American Healthcare REIT (NYSE:AHR - Get Free Report) last released its quarterly earnings data on Monday, August 5th. The company reported $0.01 EPS for the quarter, missing analysts' consensus estimates of $0.29 by ($0.28). The business had revenue of $504.60 million during the quarter, compared to analysts' expectations of $506.55 million. American Healthcare REIT had a negative net margin of 1.99% and a negative return on equity of 2.20%. The company's quarterly revenue was up 7.9% on a year-over-year basis. On average, analysts forecast that American Healthcare REIT will post 1.31 EPS for the current fiscal year.

Institutional Trading of American Healthcare REIT

Hedge funds have recently made changes to their positions in the company. Kiely Wealth Advisory Group Inc. purchased a new stake in American Healthcare REIT during the second quarter worth about $30,000. Amalgamated Bank purchased a new position in American Healthcare REIT in the 2nd quarter valued at approximately $33,000. Commonwealth Equity Services LLC raised its holdings in American Healthcare REIT by 11.8% during the second quarter. Commonwealth Equity Services LLC now owns 23,015 shares of the company's stock worth $336,000 after purchasing an additional 2,429 shares during the last quarter. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors boosted its position in shares of American Healthcare REIT by 9.4% in the 3rd quarter. C2P Capital Advisory Group LLC d.b.a. Prosperity Capital Advisors now owns 29,052 shares of the company's stock worth $758,000 after buying an additional 2,504 shares in the last quarter. Finally, Peak Financial Advisors LLC increased its holdings in American Healthcare REIT by 10.4% during the 2nd quarter. Peak Financial Advisors LLC now owns 31,126 shares of the company's stock valued at $455,000 after acquiring an additional 2,921 shares in the last quarter. Institutional investors and hedge funds own 16.68% of the company's stock.

American Healthcare REIT Company Profile

(

Get Free Report)

Formed by the successful merger of Griffin-American Healthcare REIT III and Griffin-American Healthcare REIT IV, as well as the acquisition of the business and operations of American Healthcare Investors, American Healthcare REIT is one of the larger healthcare-focused real estate investment trusts globally with assets totaling approximately $4.2 billion in gross investment value.

Featured Articles

Before you consider American Healthcare REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Healthcare REIT wasn't on the list.

While American Healthcare REIT currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.