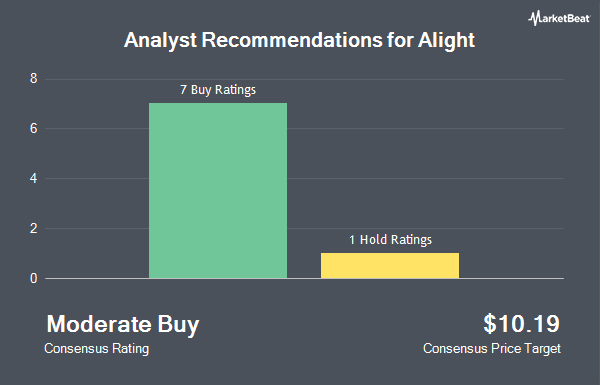

Shares of Alight, Inc. (NYSE:ALIT - Get Free Report) have been assigned an average rating of "Moderate Buy" from the ten brokerages that are covering the company, MarketBeat Ratings reports. One investment analyst has rated the stock with a hold rating and nine have issued a buy rating on the company. The average 1-year price objective among brokers that have updated their coverage on the stock in the last year is $10.75.

A number of research analysts have recently issued reports on the company. Citigroup reduced their price objective on Alight from $12.00 to $11.00 and set a "buy" rating on the stock in a research note on Thursday, August 29th. KeyCorp lowered their target price on Alight from $11.00 to $10.00 and set an "overweight" rating for the company in a research report on Thursday, July 11th. Wedbush dropped their target price on shares of Alight from $12.00 to $10.00 and set an "outperform" rating on the stock in a research note on Thursday, August 8th. JPMorgan Chase & Co. lowered shares of Alight from an "overweight" rating to a "neutral" rating and set a $8.00 price target for the company. in a research report on Tuesday, August 20th. Finally, Needham & Company LLC reiterated a "buy" rating and issued a $9.00 price objective on shares of Alight in a research note on Monday, September 30th.

Get Our Latest Research Report on ALIT

Alight Stock Down 0.4 %

Shares of NYSE:ALIT traded down $0.03 during midday trading on Thursday, reaching $7.09. 1,448,205 shares of the company were exchanged, compared to its average volume of 5,692,801. Alight has a fifty-two week low of $6.15 and a fifty-two week high of $10.38. The stock has a fifty day simple moving average of $7.22 and a two-hundred day simple moving average of $7.62. The firm has a market cap of $3.87 billion, a PE ratio of -16.18 and a beta of 0.86. The company has a quick ratio of 1.37, a current ratio of 1.37 and a debt-to-equity ratio of 0.55.

Alight (NYSE:ALIT - Get Free Report) last issued its earnings results on Tuesday, August 6th. The company reported $0.09 earnings per share for the quarter, beating analysts' consensus estimates of $0.08 by $0.01. Alight had a positive return on equity of 5.42% and a negative net margin of 6.58%. The firm had revenue of $787.00 million for the quarter, compared to the consensus estimate of $791.22 million. As a group, sell-side analysts forecast that Alight will post 0.42 earnings per share for the current year.

Institutional Trading of Alight

A number of institutional investors and hedge funds have recently made changes to their positions in ALIT. Ingalls & Snyder LLC lifted its holdings in Alight by 20.9% in the second quarter. Ingalls & Snyder LLC now owns 12,919 shares of the company's stock valued at $95,000 after buying an additional 2,235 shares during the period. Amalgamated Bank lifted its position in shares of Alight by 16.2% during the 2nd quarter. Amalgamated Bank now owns 16,434 shares of the company's stock valued at $121,000 after buying an additional 2,289 shares during the last quarter. Saxon Interests Inc. grew its stake in Alight by 15.4% in the 1st quarter. Saxon Interests Inc. now owns 19,668 shares of the company's stock valued at $194,000 after buying an additional 2,632 shares in the last quarter. Nisa Investment Advisors LLC grew its stake in Alight by 65.3% during the second quarter. Nisa Investment Advisors LLC now owns 7,498 shares of the company's stock valued at $55,000 after acquiring an additional 2,961 shares in the last quarter. Finally, Pekin Hardy Strauss Inc. raised its holdings in shares of Alight by 7.4% in the 2nd quarter. Pekin Hardy Strauss Inc. now owns 57,750 shares of the company's stock valued at $426,000 after acquiring an additional 4,000 shares in the last quarter. Institutional investors own 96.74% of the company's stock.

Alight Company Profile

(

Get Free ReportAlight, Inc provides cloud-based integrated digital human capital and business solutions worldwide. The company operates through two segments, Employer Solutions and Professional Services. The Employer Solutions segment offers employee wellbeing, integrated benefits administration, healthcare navigation, financial wellbeing, leave of absence management, retiree healthcare and payroll; and operates AI-led capabilities software.

Further Reading

Before you consider Alight, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alight wasn't on the list.

While Alight currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.