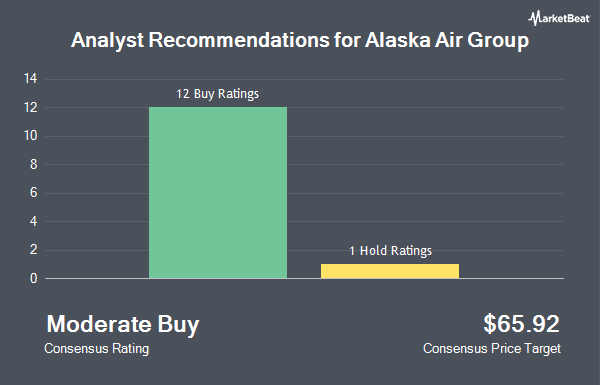

Alaska Air Group, Inc. (NYSE:ALK - Get Free Report) has received an average rating of "Moderate Buy" from the twelve brokerages that are presently covering the company, Marketbeat Ratings reports. Three research analysts have rated the stock with a hold recommendation and nine have given a buy recommendation to the company. The average 1 year price objective among brokers that have issued ratings on the stock in the last year is $53.80.

A number of research analysts recently issued reports on ALK shares. Evercore ISI decreased their target price on shares of Alaska Air Group from $60.00 to $55.00 and set an "outperform" rating for the company in a research report on Thursday, October 3rd. Barclays initiated coverage on Alaska Air Group in a research note on Monday, October 21st. They issued an "overweight" rating and a $55.00 target price on the stock. TD Cowen dropped their target price on Alaska Air Group from $52.00 to $50.00 and set a "buy" rating on the stock in a report on Thursday, October 3rd. Morgan Stanley decreased their price target on Alaska Air Group from $75.00 to $70.00 and set an "overweight" rating for the company in a report on Monday, July 22nd. Finally, Susquehanna raised their price objective on shares of Alaska Air Group from $40.00 to $45.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 9th.

Read Our Latest Analysis on Alaska Air Group

Alaska Air Group Stock Performance

Shares of NYSE ALK traded down $0.07 during mid-day trading on Friday, hitting $45.54. The stock had a trading volume of 1,356,980 shares, compared to its average volume of 2,268,947. The company has a 50 day moving average of $40.93 and a two-hundred day moving average of $40.64. Alaska Air Group has a twelve month low of $30.75 and a twelve month high of $46.87. The company has a debt-to-equity ratio of 0.55, a quick ratio of 0.66 and a current ratio of 0.68. The firm has a market cap of $5.78 billion, a PE ratio of 24.35, a PEG ratio of 0.66 and a beta of 1.60.

Hedge Funds Weigh In On Alaska Air Group

Several large investors have recently made changes to their positions in the stock. Financial Advocates Investment Management lifted its position in shares of Alaska Air Group by 9.3% during the third quarter. Financial Advocates Investment Management now owns 9,735 shares of the transportation company's stock worth $440,000 after purchasing an additional 831 shares in the last quarter. Pinnacle Associates Ltd. lifted its holdings in Alaska Air Group by 33.1% during the 3rd quarter. Pinnacle Associates Ltd. now owns 16,035 shares of the transportation company's stock worth $725,000 after buying an additional 3,985 shares in the last quarter. First Trust Direct Indexing L.P. boosted its position in Alaska Air Group by 4.7% in the 3rd quarter. First Trust Direct Indexing L.P. now owns 5,938 shares of the transportation company's stock valued at $268,000 after buying an additional 267 shares during the period. Mutual Advisors LLC grew its stake in shares of Alaska Air Group by 235.0% in the third quarter. Mutual Advisors LLC now owns 31,733 shares of the transportation company's stock worth $1,447,000 after acquiring an additional 22,261 shares in the last quarter. Finally, Pallas Capital Advisors LLC acquired a new stake in Alaska Air Group in the third quarter valued at approximately $317,000. 81.90% of the stock is currently owned by institutional investors and hedge funds.

Alaska Air Group Company Profile

(

Get Free ReportAlaska Air Group, Inc, through its subsidiaries, operates airlines. It operates through three segments: Mainline, Regional, and Horizon. The company offers scheduled air transportation services on Boeing jet aircraft for passengers and cargo in the United States, and in parts of Canada, Mexico, Costa Rica, Belize, Guatemala, and the Bahamas; and for passengers across a shorter distance network within the United States, Canada, and Mexico.

See Also

Before you consider Alaska Air Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alaska Air Group wasn't on the list.

While Alaska Air Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.