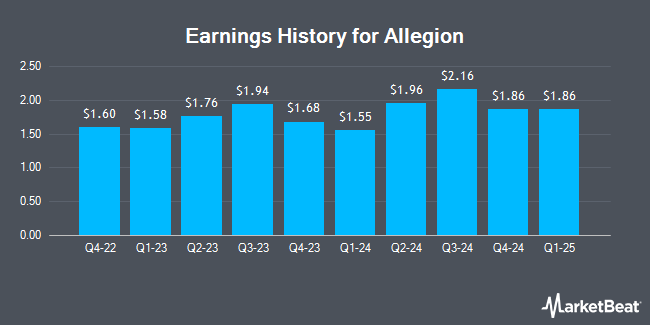

Allegion (NYSE:ALLE - Get Free Report) is set to announce its earnings results before the market opens on Thursday, October 24th. Analysts expect the company to announce earnings of $1.93 per share for the quarter. Allegion has set its FY 2024 guidance at 7.150-7.300 EPS and its FY24 guidance at $7.15-7.30 EPS.Investors interested in registering for the company's conference call can do so using this link.

Allegion (NYSE:ALLE - Get Free Report) last posted its earnings results on Wednesday, July 24th. The scientific and technical instruments company reported $1.96 EPS for the quarter, beating the consensus estimate of $1.84 by $0.12. The company had revenue of $965.60 million during the quarter, compared to analyst estimates of $953.63 million. Allegion had a return on equity of 47.21% and a net margin of 15.08%. The business's revenue was up 5.8% compared to the same quarter last year. During the same period in the prior year, the company earned $1.76 earnings per share. On average, analysts expect Allegion to post $7 EPS for the current fiscal year and $8 EPS for the next fiscal year.

Allegion Stock Performance

ALLE traded up $1.58 during trading on Thursday, reaching $152.51. 780,002 shares of the company were exchanged, compared to its average volume of 698,816. Allegion has a 52 week low of $95.94 and a 52 week high of $152.94. The company has a current ratio of 1.66, a quick ratio of 1.23 and a debt-to-equity ratio of 1.40. The firm has a 50 day moving average of $139.64 and a 200 day moving average of $129.30. The stock has a market cap of $13.34 billion, a P/E ratio of 24.88, a PEG ratio of 4.50 and a beta of 1.12.

Allegion Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Friday, September 20th were issued a dividend of $0.48 per share. The ex-dividend date of this dividend was Friday, September 20th. This represents a $1.92 dividend on an annualized basis and a dividend yield of 1.26%. Allegion's dividend payout ratio (DPR) is presently 31.32%.

Analyst Ratings Changes

ALLE has been the subject of several research analyst reports. Barclays upped their price objective on shares of Allegion from $117.00 to $135.00 and gave the stock an "underweight" rating in a report on Wednesday, October 2nd. Mizuho increased their price objective on shares of Allegion from $135.00 to $150.00 and gave the company a "neutral" rating in a report on Thursday. Wells Fargo & Company boosted their target price on Allegion from $137.00 to $152.00 and gave the stock an "equal weight" rating in a report on Monday, October 7th. Finally, StockNews.com upgraded Allegion from a "hold" rating to a "buy" rating in a research report on Saturday, July 27th. One research analyst has rated the stock with a sell rating, four have assigned a hold rating and one has assigned a buy rating to the stock. According to MarketBeat, the company has a consensus rating of "Hold" and an average target price of $133.80.

Get Our Latest Analysis on Allegion

Allegion Company Profile

(

Get Free Report)

Allegion plc manufactures and sells mechanical and electronic security products and solutions worldwide. The company offers door controls and systems and exit devices; locks, locksets, portable locks, and key systems and services; electronic security products and access control systems; time, attendance, and workforce productivity systems; doors, accessories, and other.

Featured Articles

Before you consider Allegion, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Allegion wasn't on the list.

While Allegion currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.