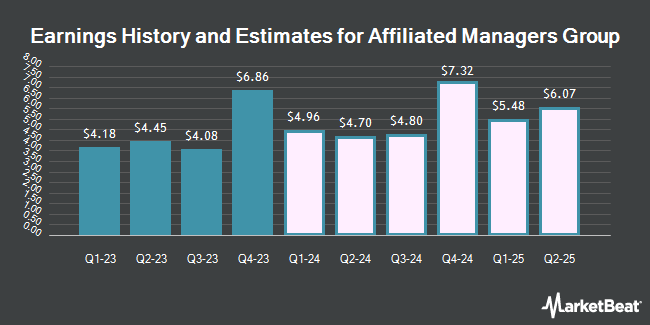

Affiliated Managers Group (NYSE:AMG - Get Free Report) issued an update on its fourth quarter earnings guidance on Monday morning. The company provided EPS guidance of $5.94-6.17 for the period, compared to the consensus EPS estimate of $7.26.

Affiliated Managers Group Price Performance

Shares of AMG stock traded down $16.75 during trading hours on Monday, reaching $177.06. The company had a trading volume of 503,324 shares, compared to its average volume of 240,919. The company has a market cap of $5.28 billion, a price-to-earnings ratio of 10.42, a price-to-earnings-growth ratio of 0.62 and a beta of 1.18. Affiliated Managers Group has a 12 month low of $129.57 and a 12 month high of $199.52. The business has a fifty day simple moving average of $180.27 and a 200-day simple moving average of $168.54.

Wall Street Analyst Weigh In

AMG has been the topic of a number of recent analyst reports. Deutsche Bank Aktiengesellschaft raised their price target on shares of Affiliated Managers Group from $202.00 to $205.00 and gave the company a "buy" rating in a research report on Thursday, August 15th. Barrington Research reaffirmed an "outperform" rating and issued a $210.00 target price on shares of Affiliated Managers Group in a report on Wednesday, October 30th. Bank of America lifted their price target on Affiliated Managers Group from $200.00 to $201.00 and gave the stock a "neutral" rating in a report on Tuesday, July 30th. StockNews.com lowered Affiliated Managers Group from a "buy" rating to a "hold" rating in a research report on Tuesday, July 30th. Finally, TD Cowen lifted their target price on Affiliated Managers Group from $201.00 to $226.00 and gave the stock a "buy" rating in a research note on Tuesday, July 30th. Two equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and a consensus price target of $210.50.

Check Out Our Latest Stock Report on Affiliated Managers Group

Insider Activity at Affiliated Managers Group

In other Affiliated Managers Group news, insider Rizwan M. Jamal sold 8,622 shares of the business's stock in a transaction on Friday, August 16th. The stock was sold at an average price of $172.89, for a total value of $1,490,657.58. Following the sale, the insider now directly owns 128,457 shares in the company, valued at $22,208,930.73. The trade was a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. In related news, CEO Jay C. Horgen sold 9,000 shares of the firm's stock in a transaction that occurred on Monday, August 19th. The shares were sold at an average price of $171.98, for a total value of $1,547,820.00. Following the completion of the transaction, the chief executive officer now directly owns 377,276 shares of the company's stock, valued at approximately $64,883,926.48. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Rizwan M. Jamal sold 8,622 shares of the business's stock in a transaction on Friday, August 16th. The shares were sold at an average price of $172.89, for a total transaction of $1,490,657.58. Following the sale, the insider now directly owns 128,457 shares in the company, valued at $22,208,930.73. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 22,408 shares of company stock worth $3,865,068. Insiders own 1.90% of the company's stock.

Affiliated Managers Group Company Profile

(

Get Free Report)

Affiliated Managers Group, Inc, through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States. It provides advisory or sub-advisory services to mutual funds.

See Also

Before you consider Affiliated Managers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affiliated Managers Group wasn't on the list.

While Affiliated Managers Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.