American Homes 4 Rent (NYSE:AMH - Get Free Report) had its price target decreased by stock analysts at Evercore ISI from $42.00 to $41.00 in a research report issued on Wednesday, Benzinga reports. The firm presently has an "in-line" rating on the real estate investment trust's stock. Evercore ISI's price objective points to a potential upside of 11.66% from the company's current price.

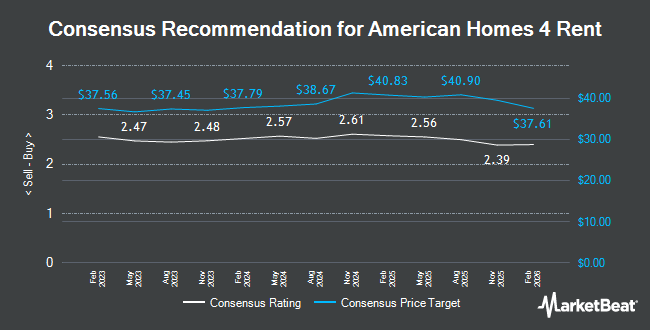

Several other research firms also recently weighed in on AMH. StockNews.com downgraded shares of American Homes 4 Rent from a "hold" rating to a "sell" rating in a research note on Thursday, October 24th. Wells Fargo & Company upgraded American Homes 4 Rent from an "equal weight" rating to an "overweight" rating and lifted their price objective for the stock from $36.00 to $42.00 in a research report on Monday, August 26th. JPMorgan Chase & Co. upped their target price on American Homes 4 Rent from $38.00 to $43.00 and gave the company a "neutral" rating in a report on Monday, September 16th. Scotiabank reiterated an "outperform" rating and set a $42.00 price target on shares of American Homes 4 Rent in a report on Wednesday, August 21st. Finally, Royal Bank of Canada boosted their price target on shares of American Homes 4 Rent from $41.00 to $42.00 and gave the company an "outperform" rating in a research report on Monday, August 5th. One equities research analyst has rated the stock with a sell rating, four have given a hold rating and eleven have issued a buy rating to the company's stock. According to data from MarketBeat, American Homes 4 Rent presently has a consensus rating of "Moderate Buy" and an average target price of $41.60.

Get Our Latest Research Report on AMH

American Homes 4 Rent Price Performance

NYSE AMH traded down $1.08 on Wednesday, hitting $36.72. The company had a trading volume of 4,774,387 shares, compared to its average volume of 2,565,606. The company has a debt-to-equity ratio of 0.65, a current ratio of 1.54 and a quick ratio of 1.54. The company has a market capitalization of $13.45 billion, a PE ratio of 37.45, a PEG ratio of 3.10 and a beta of 0.76. American Homes 4 Rent has a 12-month low of $32.08 and a 12-month high of $41.41. The company's fifty day moving average price is $38.84 and its 200-day moving average price is $37.28.

American Homes 4 Rent (NYSE:AMH - Get Free Report) last released its quarterly earnings results on Tuesday, October 29th. The real estate investment trust reported $0.20 earnings per share for the quarter, missing the consensus estimate of $0.43 by ($0.23). American Homes 4 Rent had a return on equity of 4.89% and a net margin of 21.83%. The company had revenue of $445.06 million for the quarter, compared to analyst estimates of $443.81 million. During the same quarter last year, the company earned $0.41 EPS. The firm's revenue for the quarter was up 5.5% on a year-over-year basis. As a group, analysts predict that American Homes 4 Rent will post 1.76 earnings per share for the current year.

Hedge Funds Weigh In On American Homes 4 Rent

Several institutional investors have recently bought and sold shares of the company. Maryland Capital Advisors Inc. purchased a new position in shares of American Homes 4 Rent in the third quarter valued at approximately $25,000. UMB Bank n.a. boosted its position in American Homes 4 Rent by 331.9% in the 3rd quarter. UMB Bank n.a. now owns 786 shares of the real estate investment trust's stock valued at $30,000 after buying an additional 604 shares during the period. V Square Quantitative Management LLC acquired a new position in shares of American Homes 4 Rent in the second quarter worth $32,000. Wetzel Investment Advisors Inc. acquired a new stake in shares of American Homes 4 Rent in the second quarter valued at $44,000. Finally, Catalyst Capital Advisors LLC purchased a new position in American Homes 4 Rent in the third quarter valued at $53,000. 91.87% of the stock is owned by institutional investors and hedge funds.

American Homes 4 Rent Company Profile

(

Get Free Report)

AMH NYSE: AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

Featured Articles

Before you consider American Homes 4 Rent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Homes 4 Rent wasn't on the list.

While American Homes 4 Rent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.