Tectonic Advisors LLC boosted its position in shares of American Homes 4 Rent (NYSE:AMH - Free Report) by 28.3% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 171,697 shares of the real estate investment trust's stock after buying an additional 37,915 shares during the period. Tectonic Advisors LLC's holdings in American Homes 4 Rent were worth $6,591,000 at the end of the most recent quarter.

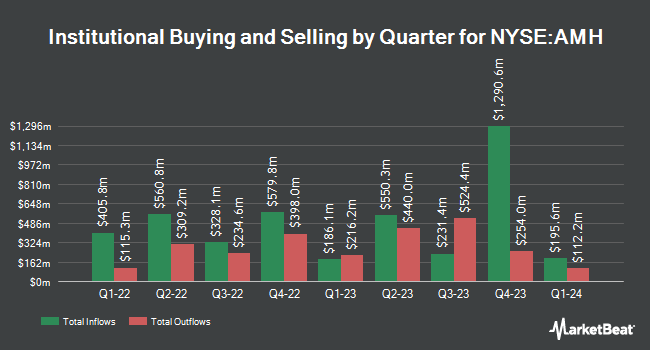

Several other large investors also recently bought and sold shares of the company. Vanguard Group Inc. boosted its holdings in shares of American Homes 4 Rent by 2.5% during the 1st quarter. Vanguard Group Inc. now owns 45,673,416 shares of the real estate investment trust's stock worth $1,679,868,000 after purchasing an additional 1,094,714 shares during the last quarter. Price T Rowe Associates Inc. MD boosted its holdings in shares of American Homes 4 Rent by 6.1% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 8,830,756 shares of the real estate investment trust's stock worth $324,798,000 after purchasing an additional 507,307 shares during the last quarter. Dimensional Fund Advisors LP boosted its holdings in shares of American Homes 4 Rent by 7.3% during the 2nd quarter. Dimensional Fund Advisors LP now owns 4,935,560 shares of the real estate investment trust's stock worth $183,403,000 after purchasing an additional 334,358 shares during the last quarter. Massachusetts Financial Services Co. MA boosted its holdings in shares of American Homes 4 Rent by 1.0% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 3,951,840 shares of the real estate investment trust's stock worth $146,850,000 after purchasing an additional 37,757 shares during the last quarter. Finally, Burgundy Asset Management Ltd. boosted its holdings in shares of American Homes 4 Rent by 1.5% during the 2nd quarter. Burgundy Asset Management Ltd. now owns 3,691,640 shares of the real estate investment trust's stock worth $137,181,000 after purchasing an additional 53,648 shares during the last quarter. 91.87% of the stock is currently owned by hedge funds and other institutional investors.

American Homes 4 Rent Trading Down 0.9 %

NYSE AMH traded down $0.33 on Friday, reaching $38.29. The stock had a trading volume of 2,210,270 shares, compared to its average volume of 2,555,104. The firm has a market capitalization of $14.03 billion, a price-to-earnings ratio of 39.07, a P/E/G ratio of 3.10 and a beta of 0.76. The company has a quick ratio of 1.54, a current ratio of 1.54 and a debt-to-equity ratio of 0.65. American Homes 4 Rent has a 12-month low of $31.36 and a 12-month high of $41.41. The stock has a fifty day moving average price of $38.87 and a two-hundred day moving average price of $37.24.

American Homes 4 Rent (NYSE:AMH - Get Free Report) last announced its earnings results on Thursday, August 1st. The real estate investment trust reported $0.25 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.43 by ($0.18). American Homes 4 Rent had a net margin of 21.83% and a return on equity of 4.89%. The firm had revenue of $423.50 million during the quarter, compared to analysts' expectations of $422.46 million. During the same period in the previous year, the firm earned $0.41 EPS. The firm's revenue for the quarter was up 7.1% compared to the same quarter last year. As a group, sell-side analysts forecast that American Homes 4 Rent will post 1.76 EPS for the current fiscal year.

American Homes 4 Rent Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Stockholders of record on Friday, September 13th were given a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a dividend yield of 2.72%. The ex-dividend date was Friday, September 13th. American Homes 4 Rent's dividend payout ratio is currently 106.12%.

Analyst Ratings Changes

AMH has been the topic of several recent research reports. Royal Bank of Canada boosted their target price on American Homes 4 Rent from $41.00 to $42.00 and gave the stock an "outperform" rating in a report on Monday, August 5th. Scotiabank restated an "outperform" rating and set a $42.00 target price on shares of American Homes 4 Rent in a report on Wednesday, August 21st. The Goldman Sachs Group began coverage on American Homes 4 Rent in a report on Wednesday, September 4th. They issued a "buy" rating and a $48.00 price objective on the stock. UBS Group upped their price objective on American Homes 4 Rent from $37.00 to $40.00 and gave the company a "neutral" rating in a report on Friday, August 16th. Finally, StockNews.com cut American Homes 4 Rent from a "hold" rating to a "sell" rating in a report on Thursday. One research analyst has rated the stock with a sell rating, four have given a hold rating and eleven have issued a buy rating to the company. Based on data from MarketBeat.com, American Homes 4 Rent presently has a consensus rating of "Moderate Buy" and an average target price of $41.67.

Read Our Latest Report on American Homes 4 Rent

American Homes 4 Rent Company Profile

(

Free Report)

AMH NYSE: AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

Read More

Before you consider American Homes 4 Rent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Homes 4 Rent wasn't on the list.

While American Homes 4 Rent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.