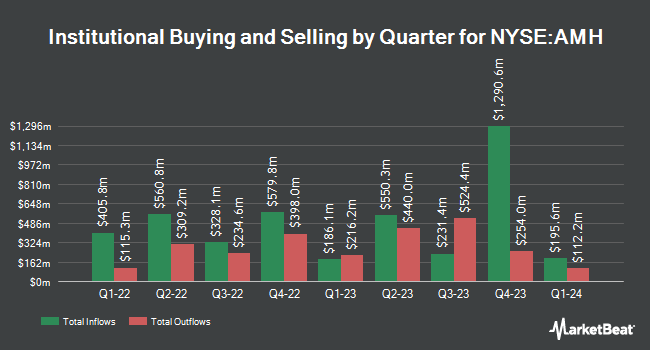

Asset Management One Co. Ltd. trimmed its position in shares of American Homes 4 Rent (NYSE:AMH - Free Report) by 5.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 659,169 shares of the real estate investment trust's stock after selling 37,057 shares during the period. Asset Management One Co. Ltd. owned about 0.18% of American Homes 4 Rent worth $25,305,000 as of its most recent SEC filing.

Other institutional investors also recently modified their holdings of the company. Maryland Capital Advisors Inc. bought a new position in shares of American Homes 4 Rent in the 3rd quarter worth about $25,000. UMB Bank n.a. boosted its stake in shares of American Homes 4 Rent by 331.9% in the third quarter. UMB Bank n.a. now owns 786 shares of the real estate investment trust's stock worth $30,000 after acquiring an additional 604 shares during the period. V Square Quantitative Management LLC purchased a new position in American Homes 4 Rent during the second quarter valued at $32,000. Wetzel Investment Advisors Inc. purchased a new position in American Homes 4 Rent during the 2nd quarter valued at approximately $44,000. Finally, Opal Wealth Advisors LLC bought a new stake in shares of American Homes 4 Rent in the 2nd quarter worth about $54,000. 91.87% of the stock is currently owned by hedge funds and other institutional investors.

American Homes 4 Rent Trading Up 0.6 %

AMH stock traded up $0.21 during mid-day trading on Tuesday, hitting $35.41. 1,943,642 shares of the company were exchanged, compared to its average volume of 2,575,479. The business has a fifty day simple moving average of $38.61 and a 200-day simple moving average of $37.30. The firm has a market capitalization of $12.98 billion, a P/E ratio of 36.67, a PEG ratio of 2.90 and a beta of 0.77. American Homes 4 Rent has a 12-month low of $33.75 and a 12-month high of $41.41. The company has a quick ratio of 0.58, a current ratio of 0.58 and a debt-to-equity ratio of 0.59.

American Homes 4 Rent (NYSE:AMH - Get Free Report) last posted its earnings results on Tuesday, October 29th. The real estate investment trust reported $0.20 earnings per share for the quarter, missing the consensus estimate of $0.43 by ($0.23). American Homes 4 Rent had a net margin of 21.51% and a return on equity of 4.76%. The company had revenue of $445.06 million during the quarter, compared to analyst estimates of $443.81 million. During the same quarter last year, the business posted $0.41 EPS. The firm's revenue for the quarter was up 5.5% on a year-over-year basis. On average, equities research analysts predict that American Homes 4 Rent will post 1.77 earnings per share for the current fiscal year.

American Homes 4 Rent Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Friday, September 13th were issued a dividend of $0.26 per share. This represents a $1.04 dividend on an annualized basis and a yield of 2.94%. The ex-dividend date of this dividend was Friday, September 13th. American Homes 4 Rent's dividend payout ratio (DPR) is 108.33%.

Analyst Ratings Changes

Several equities research analysts have recently weighed in on the company. Royal Bank of Canada increased their price target on American Homes 4 Rent from $41.00 to $42.00 and gave the stock an "outperform" rating in a report on Monday, August 5th. StockNews.com cut American Homes 4 Rent from a "hold" rating to a "sell" rating in a research note on Thursday, October 24th. The Goldman Sachs Group began coverage on American Homes 4 Rent in a research report on Wednesday, September 4th. They issued a "buy" rating and a $48.00 target price on the stock. Mizuho raised their price objective on shares of American Homes 4 Rent from $39.00 to $40.00 and gave the stock an "outperform" rating in a research note on Thursday, October 10th. Finally, Evercore ISI cut their price target on shares of American Homes 4 Rent from $42.00 to $41.00 and set an "in-line" rating for the company in a report on Wednesday, October 30th. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and eleven have given a buy rating to the company's stock. Based on data from MarketBeat.com, American Homes 4 Rent has an average rating of "Moderate Buy" and an average target price of $41.60.

Get Our Latest Stock Analysis on American Homes 4 Rent

American Homes 4 Rent Company Profile

(

Free Report)

AMH NYSE: AMH is a leading large-scale integrated owner, operator and developer of single-family rental homes. We're an internally managed Maryland real estate investment trust (REIT) focused on acquiring, developing, renovating, leasing and managing homes as rental properties. Our goal is to simplify the experience of leasing a home and deliver peace of mind to households across the country.

See Also

Before you consider American Homes 4 Rent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Homes 4 Rent wasn't on the list.

While American Homes 4 Rent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.