AMN Healthcare Services (NYSE:AMN - Free Report) had its price target cut by JMP Securities from $66.00 to $57.00 in a research note issued to investors on Tuesday, Benzinga reports. They currently have a market outperform rating on the stock.

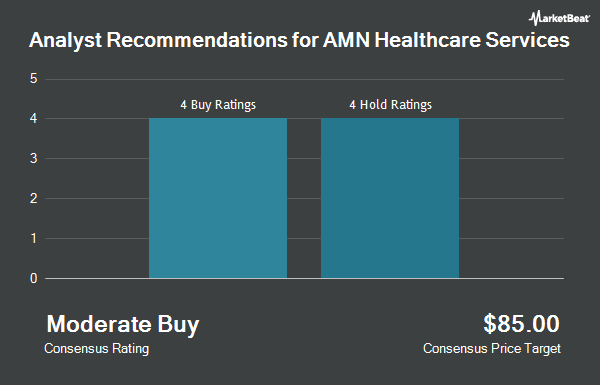

Several other brokerages have also recently weighed in on AMN. Truist Financial dropped their price objective on AMN Healthcare Services from $70.00 to $50.00 and set a "buy" rating for the company in a report on Monday. BMO Capital Markets boosted their price objective on AMN Healthcare Services from $60.00 to $71.00 and gave the stock an "outperform" rating in a report on Monday, August 12th. StockNews.com cut AMN Healthcare Services from a "hold" rating to a "sell" rating in a report on Wednesday, July 31st. Bank of America cut AMN Healthcare Services from a "neutral" rating to an "underperform" rating and dropped their price objective for the stock from $65.00 to $48.00 in a report on Monday, October 7th. Finally, Benchmark reissued a "hold" rating on shares of AMN Healthcare Services in a report on Wednesday, October 2nd. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat.com, the company has an average rating of "Hold" and an average target price of $60.17.

Check Out Our Latest Report on AMN

AMN Healthcare Services Price Performance

Shares of AMN Healthcare Services stock traded up $0.06 during trading on Tuesday, reaching $39.65. The company's stock had a trading volume of 670,965 shares, compared to its average volume of 803,523. The stock has a 50-day moving average price of $45.89 and a two-hundred day moving average price of $52.80. The company has a current ratio of 1.23, a quick ratio of 1.23 and a debt-to-equity ratio of 1.36. AMN Healthcare Services has a one year low of $36.50 and a one year high of $80.22. The stock has a market capitalization of $1.51 billion, a P/E ratio of 10.51 and a beta of 0.11.

AMN Healthcare Services (NYSE:AMN - Get Free Report) last released its quarterly earnings results on Thursday, August 8th. The company reported $0.98 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.76 by $0.22. AMN Healthcare Services had a return on equity of 23.68% and a net margin of 3.07%. The business had revenue of $740.69 million during the quarter, compared to analysts' expectations of $740.43 million. During the same period in the previous year, the business posted $2.38 earnings per share. The firm's revenue for the quarter was down 25.3% compared to the same quarter last year. As a group, sell-side analysts anticipate that AMN Healthcare Services will post 3.21 EPS for the current fiscal year.

Hedge Funds Weigh In On AMN Healthcare Services

Several institutional investors and hedge funds have recently modified their holdings of AMN. Mather Group LLC. acquired a new position in shares of AMN Healthcare Services in the 2nd quarter valued at approximately $31,000. Nisa Investment Advisors LLC boosted its position in AMN Healthcare Services by 41.4% during the 2nd quarter. Nisa Investment Advisors LLC now owns 748 shares of the company's stock worth $38,000 after acquiring an additional 219 shares during the last quarter. Geneos Wealth Management Inc. acquired a new position in AMN Healthcare Services during the 1st quarter worth approximately $58,000. GAMMA Investing LLC boosted its position in AMN Healthcare Services by 232.4% during the 2nd quarter. GAMMA Investing LLC now owns 1,160 shares of the company's stock worth $59,000 after acquiring an additional 811 shares during the last quarter. Finally, Innealta Capital LLC acquired a new position in AMN Healthcare Services during the 2nd quarter worth approximately $65,000. 99.23% of the stock is currently owned by institutional investors and hedge funds.

AMN Healthcare Services Company Profile

(

Get Free Report)

AMN Healthcare Services, Inc provides healthcare workforce solutions and staffing services to healthcare facilities in the United States. It operates through three segments: Nurse and Allied Solutions, Physician and Leadership Solutions, and Technology and Workforce Solutions. The Nurse and Allied Solutions segment offers travel nurse staffing, labor disruption staffing, local staffing, international nurse and allied permanent placement, and allied staffing solutions.

Featured Stories

Before you consider AMN Healthcare Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AMN Healthcare Services wasn't on the list.

While AMN Healthcare Services currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.