Northcape Capital Pty Ltd decreased its stake in American Tower Co. (NYSE:AMT - Free Report) by 32.2% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 10,326 shares of the real estate investment trust's stock after selling 4,906 shares during the quarter. American Tower comprises 0.4% of Northcape Capital Pty Ltd's portfolio, making the stock its 16th biggest holding. Northcape Capital Pty Ltd's holdings in American Tower were worth $2,401,000 as of its most recent filing with the SEC.

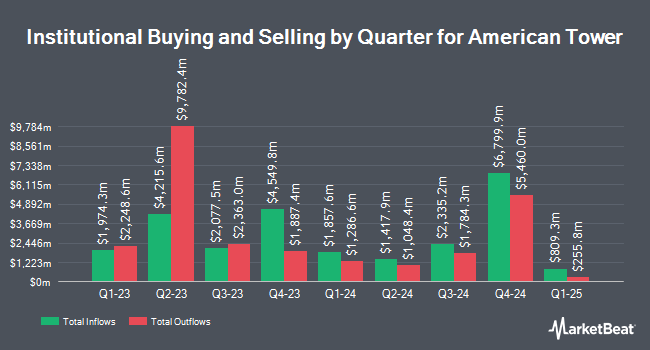

Several other hedge funds also recently bought and sold shares of AMT. Wellington Management Group LLP grew its holdings in shares of American Tower by 21.9% during the fourth quarter. Wellington Management Group LLP now owns 15,823,622 shares of the real estate investment trust's stock valued at $3,416,004,000 after buying an additional 2,839,570 shares during the last quarter. Principal Financial Group Inc. lifted its stake in American Tower by 36.2% in the 1st quarter. Principal Financial Group Inc. now owns 8,794,776 shares of the real estate investment trust's stock valued at $1,737,760,000 after buying an additional 2,336,501 shares in the last quarter. Ameriprise Financial Inc. grew its holdings in shares of American Tower by 41.8% during the second quarter. Ameriprise Financial Inc. now owns 6,395,906 shares of the real estate investment trust's stock worth $1,243,333,000 after buying an additional 1,885,421 shares in the last quarter. Vanguard Group Inc. lifted its position in American Tower by 1.6% during the first quarter. Vanguard Group Inc. now owns 61,991,053 shares of the real estate investment trust's stock worth $12,248,812,000 after buying an additional 965,938 shares in the last quarter. Finally, M&G Plc acquired a new stake in shares of American Tower during the 1st quarter worth about $164,300,000. Institutional investors own 92.69% of the company's stock.

Insider Transactions at American Tower

In other American Tower news, CAO Robert Joseph Meyer, Jr. sold 2,181 shares of the firm's stock in a transaction on Friday, August 2nd. The stock was sold at an average price of $232.93, for a total value of $508,020.33. Following the sale, the chief accounting officer now owns 31,873 shares of the company's stock, valued at approximately $7,424,177.89. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. In related news, CEO Steven O. Vondran sold 21,537 shares of the stock in a transaction on Friday, August 2nd. The shares were sold at an average price of $230.00, for a total transaction of $4,953,510.00. Following the transaction, the chief executive officer now directly owns 61,843 shares of the company's stock, valued at $14,223,890. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, CAO Robert Joseph Meyer, Jr. sold 2,181 shares of the company's stock in a transaction that occurred on Friday, August 2nd. The stock was sold at an average price of $232.93, for a total value of $508,020.33. Following the transaction, the chief accounting officer now directly owns 31,873 shares in the company, valued at $7,424,177.89. The trade was a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 33,723 shares of company stock worth $7,795,397 over the last quarter. Company insiders own 0.18% of the company's stock.

Wall Street Analyst Weigh In

AMT has been the subject of several research reports. Scotiabank lifted their target price on American Tower from $223.00 to $248.00 and gave the company a "sector outperform" rating in a research report on Wednesday, July 31st. BMO Capital Markets raised their price objective on shares of American Tower from $246.00 to $260.00 and gave the stock an "outperform" rating in a research report on Friday, September 13th. Barclays upped their price target on American Tower from $223.00 to $255.00 and gave the stock an "overweight" rating in a research note on Thursday. Mizuho increased their price objective on American Tower from $205.00 to $221.00 and gave the stock a "neutral" rating in a research report on Thursday, September 12th. Finally, Deutsche Bank Aktiengesellschaft upped their price target on American Tower from $212.00 to $235.00 and gave the stock a "buy" rating in a report on Wednesday, August 14th. Three equities research analysts have rated the stock with a hold rating, eleven have issued a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average price target of $235.21.

Get Our Latest Stock Report on American Tower

American Tower Stock Performance

NYSE AMT traded up $1.37 during trading on Friday, hitting $219.27. The company's stock had a trading volume of 1,614,001 shares, compared to its average volume of 2,099,325. American Tower Co. has a 52 week low of $157.25 and a 52 week high of $243.56. The firm has a market cap of $102.42 billion, a P/E ratio of 41.22, a price-to-earnings-growth ratio of 1.00 and a beta of 0.83. The firm has a 50 day moving average price of $228.56 and a 200 day moving average price of $205.45. The company has a quick ratio of 0.81, a current ratio of 0.81 and a debt-to-equity ratio of 3.42.

American Tower (NYSE:AMT - Get Free Report) last announced its quarterly earnings data on Tuesday, July 30th. The real estate investment trust reported $1.92 earnings per share for the quarter, missing the consensus estimate of $2.44 by ($0.52). The firm had revenue of $2.90 billion for the quarter, compared to the consensus estimate of $2.82 billion. American Tower had a return on equity of 23.06% and a net margin of 21.95%. The business's revenue for the quarter was up 4.7% compared to the same quarter last year. During the same period in the prior year, the firm posted $2.46 earnings per share. Equities research analysts forecast that American Tower Co. will post 10.13 earnings per share for the current fiscal year.

American Tower Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, October 25th. Shareholders of record on Wednesday, October 9th will be issued a dividend of $1.62 per share. This represents a $6.48 annualized dividend and a yield of 2.96%. The ex-dividend date is Wednesday, October 9th. American Tower's dividend payout ratio is 121.80%.

American Tower Profile

(

Free Report)

American Tower, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of over 224,000 communications sites and a highly interconnected footprint of U.S. data center facilities.

See Also

Before you consider American Tower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Tower wasn't on the list.

While American Tower currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report