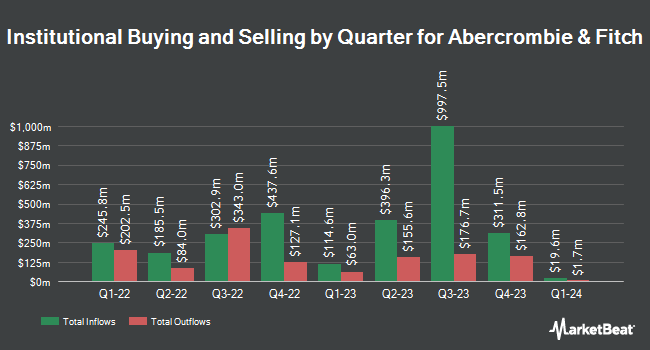

Cavalier Investments LLC bought a new position in shares of Abercrombie & Fitch Co. (NYSE:ANF - Free Report) during the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission. The firm bought 10,423 shares of the apparel retailer's stock, valued at approximately $1,458,000.

A number of other institutional investors have also recently added to or reduced their stakes in the business. Matrix Trust Co bought a new position in shares of Abercrombie & Fitch during the second quarter worth about $35,000. Quarry LP raised its holdings in Abercrombie & Fitch by 156.0% during the 2nd quarter. Quarry LP now owns 279 shares of the apparel retailer's stock worth $50,000 after purchasing an additional 170 shares during the last quarter. CWM LLC lifted its position in shares of Abercrombie & Fitch by 242.6% in the 2nd quarter. CWM LLC now owns 531 shares of the apparel retailer's stock worth $94,000 after purchasing an additional 376 shares during the period. GAMMA Investing LLC boosted its stake in shares of Abercrombie & Fitch by 39.2% in the 3rd quarter. GAMMA Investing LLC now owns 788 shares of the apparel retailer's stock valued at $110,000 after purchasing an additional 222 shares during the last quarter. Finally, Northwestern Mutual Wealth Management Co. increased its position in shares of Abercrombie & Fitch by 8,914.3% during the second quarter. Northwestern Mutual Wealth Management Co. now owns 631 shares of the apparel retailer's stock worth $112,000 after buying an additional 624 shares during the period.

Insider Buying and Selling

In related news, Director Helen Mccluskey sold 3,500 shares of the firm's stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $139.38, for a total transaction of $487,830.00. Following the transaction, the director now directly owns 37,470 shares of the company's stock, valued at $5,222,568.60. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In other news, CFO Scott D. Lipesky sold 9,000 shares of Abercrombie & Fitch stock in a transaction on Friday, August 30th. The stock was sold at an average price of $146.80, for a total transaction of $1,321,200.00. Following the sale, the chief financial officer now directly owns 106,455 shares in the company, valued at $15,627,594. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Helen Mccluskey sold 3,500 shares of the stock in a transaction dated Thursday, September 5th. The shares were sold at an average price of $139.38, for a total transaction of $487,830.00. Following the transaction, the director now owns 37,470 shares of the company's stock, valued at approximately $5,222,568.60. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 31,541 shares of company stock worth $4,310,256. 3.77% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on ANF. UBS Group cut their price target on shares of Abercrombie & Fitch from $193.00 to $165.00 and set a "neutral" rating on the stock in a research report on Thursday, August 29th. Argus downgraded shares of Abercrombie & Fitch from a "buy" rating to a "hold" rating in a research report on Thursday, July 11th. Morgan Stanley lowered their price objective on shares of Abercrombie & Fitch from $155.00 to $147.00 and set an "equal weight" rating for the company in a research note on Thursday, August 29th. JPMorgan Chase & Co. increased their target price on shares of Abercrombie & Fitch from $194.00 to $195.00 and gave the stock an "overweight" rating in a research note on Friday, October 4th. Finally, Jefferies Financial Group lifted their price target on shares of Abercrombie & Fitch from $215.00 to $220.00 and gave the company a "buy" rating in a research note on Wednesday, September 4th. Three equities research analysts have rated the stock with a hold rating and five have given a buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and an average price target of $176.71.

View Our Latest Research Report on ANF

Abercrombie & Fitch Price Performance

Shares of NYSE:ANF traded down $3.61 during midday trading on Monday, hitting $137.92. 1,520,481 shares of the company's stock were exchanged, compared to its average volume of 1,701,637. Abercrombie & Fitch Co. has a 12 month low of $57.78 and a 12 month high of $196.99. The company has a market cap of $7.05 billion, a PE ratio of 17.25 and a beta of 1.49. The stock has a 50 day moving average price of $146.16 and a 200-day moving average price of $150.39.

Abercrombie & Fitch (NYSE:ANF - Get Free Report) last issued its quarterly earnings data on Wednesday, August 28th. The apparel retailer reported $2.50 EPS for the quarter, topping analysts' consensus estimates of $2.14 by $0.36. Abercrombie & Fitch had a return on equity of 47.35% and a net margin of 10.76%. The firm had revenue of $1.13 billion during the quarter, compared to analyst estimates of $1.09 billion. On average, analysts anticipate that Abercrombie & Fitch Co. will post 10.26 EPS for the current fiscal year.

Abercrombie & Fitch Profile

(

Free Report)

Abercrombie & Fitch Co, through its subsidiaries, operates as an omnichannel retailer in the United States, Europe, the Middle East, Asia, the Asia-Pacific, Canada, and internationally. The company offers an assortment of apparel, personal care products, and accessories for men, women, and kids under the Abercrombie & Fitch, abercrombie kids, Hollister, and Gilly Hicks brands.

Featured Articles

Before you consider Abercrombie & Fitch, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abercrombie & Fitch wasn't on the list.

While Abercrombie & Fitch currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.