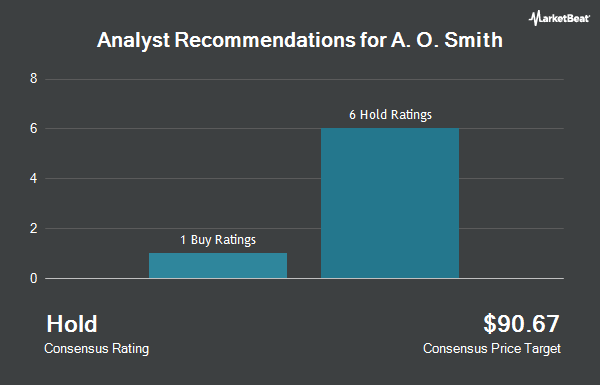

Shares of A. O. Smith Co. (NYSE:AOS - Get Free Report) have been assigned a consensus recommendation of "Hold" from the eight research firms that are currently covering the firm, MarketBeat Ratings reports. Six equities research analysts have rated the stock with a hold rating and two have issued a buy rating on the company. The average 12-month price objective among brokerages that have issued a report on the stock in the last year is $86.71.

A number of brokerages have recently commented on AOS. Stifel Nicolaus dropped their price target on A. O. Smith from $92.00 to $91.00 and set a "buy" rating on the stock in a research report on Wednesday. DA Davidson cut A. O. Smith from a "buy" rating to a "neutral" rating and set a $80.00 price target on the stock. in a research report on Wednesday. UBS Group raised A. O. Smith from a "sell" rating to a "neutral" rating and upped their price target for the company from $75.00 to $80.00 in a research report on Wednesday. Robert W. Baird dropped their price target on A. O. Smith from $82.00 to $81.00 and set a "neutral" rating on the stock in a research report on Wednesday. Finally, StockNews.com lowered A. O. Smith from a "buy" rating to a "hold" rating in a research note on Saturday.

Read Our Latest Research Report on AOS

A. O. Smith Stock Performance

AOS stock traded down $0.47 during midday trading on Friday, hitting $76.87. The company's stock had a trading volume of 822,041 shares, compared to its average volume of 964,321. The stock's 50-day moving average price is $82.48 and its 200 day moving average price is $83.34. The company has a quick ratio of 1.07, a current ratio of 1.67 and a debt-to-equity ratio of 0.06. A. O. Smith has a 1 year low of $65.20 and a 1 year high of $92.44. The stock has a market cap of $11.27 billion, a price-to-earnings ratio of 19.91, a PEG ratio of 2.30 and a beta of 1.15.

A. O. Smith (NYSE:AOS - Get Free Report) last issued its quarterly earnings results on Tuesday, October 22nd. The industrial products company reported $0.82 EPS for the quarter, meeting analysts' consensus estimates of $0.82. A. O. Smith had a return on equity of 30.09% and a net margin of 14.41%. The firm had revenue of $957.80 million for the quarter, compared to analysts' expectations of $960.36 million. During the same quarter in the prior year, the firm earned $0.90 EPS. On average, equities analysts forecast that A. O. Smith will post 3.78 EPS for the current year.

A. O. Smith Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, November 15th. Investors of record on Thursday, October 31st will be paid a dividend of $0.34 per share. This represents a $1.36 dividend on an annualized basis and a dividend yield of 1.77%. This is a positive change from A. O. Smith's previous quarterly dividend of $0.32. The ex-dividend date is Thursday, October 31st. A. O. Smith's payout ratio is presently 35.23%.

Insiders Place Their Bets

In other A. O. Smith news, SVP Samuel M. Carver sold 14,705 shares of the company's stock in a transaction dated Wednesday, August 7th. The stock was sold at an average price of $81.00, for a total value of $1,191,105.00. Following the transaction, the senior vice president now directly owns 2,399 shares in the company, valued at $194,319. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. Corporate insiders own 2.70% of the company's stock.

Hedge Funds Weigh In On A. O. Smith

A number of institutional investors have recently added to or reduced their stakes in the business. First Trust Direct Indexing L.P. bought a new position in A. O. Smith in the 3rd quarter worth about $256,000. Trajan Wealth LLC increased its stake in A. O. Smith by 7.8% in the 3rd quarter. Trajan Wealth LLC now owns 3,073 shares of the industrial products company's stock worth $276,000 after acquiring an additional 222 shares during the last quarter. Valmark Advisers Inc. bought a new position in A. O. Smith in the 3rd quarter worth about $226,000. State of Alaska Department of Revenue increased its position in shares of A. O. Smith by 4.6% during the 3rd quarter. State of Alaska Department of Revenue now owns 13,936 shares of the industrial products company's stock valued at $1,251,000 after purchasing an additional 610 shares during the last quarter. Finally, GHP Investment Advisors Inc. increased its position in shares of A. O. Smith by 7.4% during the 3rd quarter. GHP Investment Advisors Inc. now owns 31,406 shares of the industrial products company's stock valued at $2,821,000 after purchasing an additional 2,166 shares during the last quarter. 76.10% of the stock is currently owned by institutional investors.

About A. O. Smith

(

Get Free ReportA. O. Smith Corporation manufactures and markets residential and commercial gas and electric water heaters, boilers, heat pumps, tanks, and water treatment products in North America, China, Europe, and India. The company offers water heaters for residences, restaurants, hotels, office buildings, laundries, car washes, and small businesses; boilers for hospitals, schools, hotels, and other large commercial buildings, as well as homes, apartments, and condominiums; and water treatment products comprising point-of-entry water softeners, well water solutions, and whole-home water filtration products, and point-of-use carbon and reverse osmosis products for residences, restaurants, hotels, and offices.

Further Reading

Before you consider A. O. Smith, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A. O. Smith wasn't on the list.

While A. O. Smith currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.