Susquehanna Fundamental Investments LLC bought a new position in shares of Apollo Global Management, Inc. (NYSE:APO - Free Report) in the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 166,800 shares of the financial services provider's stock, valued at approximately $19,694,000.

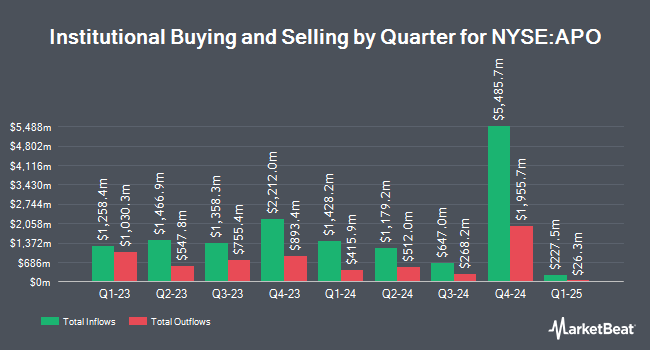

Several other hedge funds and other institutional investors have also modified their holdings of APO. Curated Wealth Partners LLC lifted its position in shares of Apollo Global Management by 200.3% during the 2nd quarter. Curated Wealth Partners LLC now owns 2,362,535 shares of the financial services provider's stock worth $278,945,000 after buying an additional 4,717,661 shares during the period. Capital Research Global Investors increased its holdings in Apollo Global Management by 40.3% during the 1st quarter. Capital Research Global Investors now owns 4,738,565 shares of the financial services provider's stock valued at $532,852,000 after purchasing an additional 1,360,525 shares in the last quarter. Third Point LLC bought a new position in Apollo Global Management in the 4th quarter valued at $83,871,000. Vanguard Group Inc. raised its position in Apollo Global Management by 1.9% in the 4th quarter. Vanguard Group Inc. now owns 41,038,114 shares of the financial services provider's stock valued at $3,824,342,000 after purchasing an additional 750,781 shares during the last quarter. Finally, Jennison Associates LLC raised its position in Apollo Global Management by 199.8% in the 1st quarter. Jennison Associates LLC now owns 925,222 shares of the financial services provider's stock valued at $104,041,000 after purchasing an additional 616,575 shares during the last quarter. Institutional investors own 77.06% of the company's stock.

Apollo Global Management Trading Up 0.2 %

NYSE APO opened at $125.81 on Friday. The stock has a 50-day simple moving average of $113.99 and a 200 day simple moving average of $114.22. The company has a market capitalization of $71.48 billion, a PE ratio of 13.93, a P/E/G ratio of 1.30 and a beta of 1.61. The company has a current ratio of 1.26, a quick ratio of 1.26 and a debt-to-equity ratio of 0.36. Apollo Global Management, Inc. has a 12 month low of $77.11 and a 12 month high of $126.93.

Apollo Global Management (NYSE:APO - Get Free Report) last posted its earnings results on Thursday, August 1st. The financial services provider reported $1.64 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.67 by ($0.03). Apollo Global Management had a net margin of 21.90% and a return on equity of 16.98%. The business had revenue of $6.02 billion during the quarter, compared to analyst estimates of $873.18 million. During the same period in the previous year, the firm posted $1.54 earnings per share. Research analysts forecast that Apollo Global Management, Inc. will post 6.62 EPS for the current year.

Apollo Global Management Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, August 30th. Shareholders of record on Friday, August 16th were paid a $0.4625 dividend. The ex-dividend date was Friday, August 16th. This represents a $1.85 dividend on an annualized basis and a yield of 1.47%. Apollo Global Management's payout ratio is 20.49%.

Wall Street Analysts Forecast Growth

APO has been the subject of several research analyst reports. Redburn Partners initiated coverage on Apollo Global Management in a research report on Tuesday, August 27th. They issued a "buy" rating and a $153.00 price objective for the company. StockNews.com downgraded Apollo Global Management from a "hold" rating to a "sell" rating in a research report on Thursday, August 8th. Wells Fargo & Company began coverage on Apollo Global Management in a research report on Thursday, September 12th. They issued an "overweight" rating and a $132.00 price objective for the company. Wolfe Research began coverage on Apollo Global Management in a research report on Wednesday. They set an "outperform" rating and a $139.00 target price for the company. Finally, Bank of America upgraded Apollo Global Management from a "neutral" rating to a "buy" rating and dropped their target price for the stock from $124.00 to $123.00 in a research report on Tuesday, August 6th. One research analyst has rated the stock with a sell rating, five have given a hold rating and fourteen have given a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $129.65.

View Our Latest Report on Apollo Global Management

Insider Buying and Selling at Apollo Global Management

In other Apollo Global Management news, Director Pauline Richards bought 2,351 shares of the firm's stock in a transaction on Tuesday, August 6th. The stock was purchased at an average cost of $104.92 per share, with a total value of $246,666.92. Following the completion of the purchase, the director now owns 85,854 shares in the company, valued at $9,007,801.68. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Insiders own 8.50% of the company's stock.

About Apollo Global Management

(

Free Report)

Apollo Global Management, Inc is a private equity firm specializing in investments in credit, private equity, infrastructure, secondaries and real estate markets. The firm prefers to invest in private and public markets. The firm's private equity investments include traditional buyouts, recapitalization, distressed buyouts and debt investments in real estate, corporate partner buyouts, distressed asset, corporate carve-outs, middle market, growth, venture capital, turnaround, bridge, corporate restructuring, special situation, acquisition, and industry consolidation transactions.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Apollo Global Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apollo Global Management wasn't on the list.

While Apollo Global Management currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.