Antero Resources (NYSE:AR - Get Free Report) had its price target decreased by equities research analysts at UBS Group from $33.00 to $31.00 in a report issued on Monday, Benzinga reports. The brokerage currently has a "neutral" rating on the oil and natural gas company's stock. UBS Group's target price points to a potential upside of 16.67% from the stock's current price.

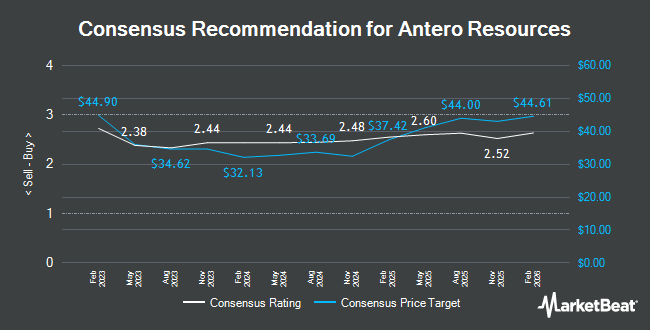

Several other analysts also recently weighed in on the stock. Wells Fargo & Company decreased their price target on shares of Antero Resources from $25.00 to $24.00 and set an "underweight" rating for the company in a research note on Friday, October 18th. Citigroup started coverage on shares of Antero Resources in a research report on Tuesday, September 17th. They set a "neutral" rating and a $29.00 target price on the stock. Roth Mkm assumed coverage on Antero Resources in a research report on Tuesday, August 27th. They issued a "buy" rating and a $32.00 target price on the stock. Scotiabank upgraded Antero Resources from a "sector perform" rating to a "sector outperform" rating and lifted their price objective for the company from $40.00 to $44.00 in a research note on Tuesday, August 20th. Finally, JPMorgan Chase & Co. dropped their price target on shares of Antero Resources from $37.00 to $30.00 and set an "overweight" rating on the stock in a research report on Thursday, September 12th. Two investment analysts have rated the stock with a sell rating, seven have issued a hold rating, nine have given a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $32.83.

Get Our Latest Research Report on AR

Antero Resources Price Performance

AR stock traded up $1.03 during midday trading on Monday, hitting $26.57. The company's stock had a trading volume of 3,710,168 shares, compared to its average volume of 4,111,314. The firm has a market capitalization of $8.27 billion, a price-to-earnings ratio of 189.79 and a beta of 3.36. The company has a 50 day moving average of $27.37 and a two-hundred day moving average of $30.20. The company has a quick ratio of 0.29, a current ratio of 0.28 and a debt-to-equity ratio of 0.23. Antero Resources has a 12 month low of $20.10 and a 12 month high of $36.28.

Institutional Investors Weigh In On Antero Resources

Hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Kailix Advisors LLC acquired a new stake in shares of Antero Resources in the third quarter worth $17,327,000. Capital Performance Advisors LLP acquired a new position in shares of Antero Resources in the 3rd quarter valued at about $45,000. Confluence Investment Management LLC lifted its position in shares of Antero Resources by 7.8% in the third quarter. Confluence Investment Management LLC now owns 19,939 shares of the oil and natural gas company's stock worth $571,000 after purchasing an additional 1,440 shares in the last quarter. Mariner Investment Group LLC acquired a new stake in shares of Antero Resources during the third quarter worth approximately $430,000. Finally, VELA Investment Management LLC grew its position in Antero Resources by 135.6% during the third quarter. VELA Investment Management LLC now owns 73,816 shares of the oil and natural gas company's stock valued at $2,115,000 after purchasing an additional 42,488 shares in the last quarter. Institutional investors own 83.04% of the company's stock.

About Antero Resources

(

Get Free Report)

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Development; Marketing; and Equity Method Investment in Antero Midstream.

Featured Stories

Before you consider Antero Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Antero Resources wasn't on the list.

While Antero Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.