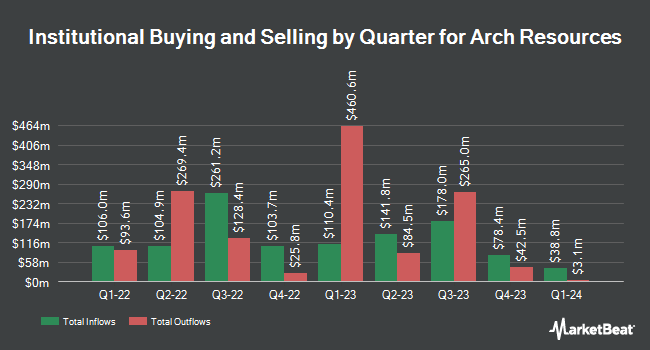

Marshall Wace LLP purchased a new stake in shares of Arch Resources, Inc. (NYSE:ARCH - Free Report) in the 2nd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The fund purchased 13,503 shares of the energy company's stock, valued at approximately $2,056,000. Marshall Wace LLP owned approximately 0.07% of Arch Resources as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds have also made changes to their positions in ARCH. Janney Montgomery Scott LLC boosted its position in Arch Resources by 94.0% during the 1st quarter. Janney Montgomery Scott LLC now owns 13,986 shares of the energy company's stock valued at $2,249,000 after acquiring an additional 6,778 shares in the last quarter. Goldman Sachs Group Inc. grew its stake in Arch Resources by 9.8% in the fourth quarter. Goldman Sachs Group Inc. now owns 182,870 shares of the energy company's stock valued at $30,345,000 after purchasing an additional 16,273 shares during the last quarter. Natixis bought a new position in Arch Resources in the first quarter worth about $2,892,000. Denali Advisors LLC purchased a new stake in shares of Arch Resources during the first quarter valued at about $2,428,000. Finally, Vanguard Group Inc. lifted its position in shares of Arch Resources by 11.9% during the fourth quarter. Vanguard Group Inc. now owns 2,061,209 shares of the energy company's stock valued at $342,037,000 after buying an additional 219,094 shares during the last quarter. 88.14% of the stock is currently owned by hedge funds and other institutional investors.

Arch Resources Price Performance

NYSE ARCH traded up $3.12 during mid-day trading on Friday, hitting $138.18. The stock had a trading volume of 226,940 shares, compared to its average volume of 412,826. Arch Resources, Inc. has a twelve month low of $116.44 and a twelve month high of $187.60. The stock has a market capitalization of $2.50 billion, a price-to-earnings ratio of 8.13 and a beta of 0.60. The firm's 50 day moving average is $130.26 and its 200 day moving average is $149.74. The company has a debt-to-equity ratio of 0.07, a current ratio of 2.54 and a quick ratio of 1.77.

Arch Resources (NYSE:ARCH - Get Free Report) last announced its quarterly earnings data on Thursday, July 25th. The energy company reported $0.81 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.31 by ($0.50). The firm had revenue of $608.75 million during the quarter, compared to analysts' expectations of $562.23 million. Arch Resources had a net margin of 9.24% and a return on equity of 17.91%. The company's revenue for the quarter was down 19.6% compared to the same quarter last year. During the same period in the prior year, the company posted $4.04 EPS. Equities research analysts forecast that Arch Resources, Inc. will post 10.73 earnings per share for the current fiscal year.

Arch Resources Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Friday, September 13th. Shareholders of record on Friday, August 30th were given a $0.25 dividend. This represents a $1.00 dividend on an annualized basis and a yield of 0.72%. The ex-dividend date of this dividend was Friday, August 30th. Arch Resources's payout ratio is 5.88%.

Analysts Set New Price Targets

Several equities analysts recently commented on ARCH shares. Benchmark reaffirmed a "buy" rating and set a $180.00 price target on shares of Arch Resources in a research report on Friday, July 26th. B. Riley dropped their target price on Arch Resources from $198.00 to $188.00 and set a "buy" rating on the stock in a research report on Friday, September 6th. Finally, StockNews.com started coverage on shares of Arch Resources in a research report on Wednesday. They set a "hold" rating for the company. Three research analysts have rated the stock with a hold rating and two have given a buy rating to the stock. Based on data from MarketBeat, Arch Resources has an average rating of "Hold" and an average target price of $175.75.

Read Our Latest Stock Report on ARCH

Arch Resources Company Profile

(

Free Report)

Arch Resources, Inc engages in the production and sale of metallurgical products. It operates in two segments, Metallurgical and Thermal. The company operates active mines. It owned or controlled primarily through long-term leases of coal land in Ohio, Maryland, Virginia, West Virginia, Wyoming, Kentucky, Montana, Pennsylvania, Colorado, and Illinois; and smaller parcels of property in Alabama, Indiana, Washington, Arkansas, California, Utah, and Texas.

Featured Articles

Before you consider Arch Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arch Resources wasn't on the list.

While Arch Resources currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.