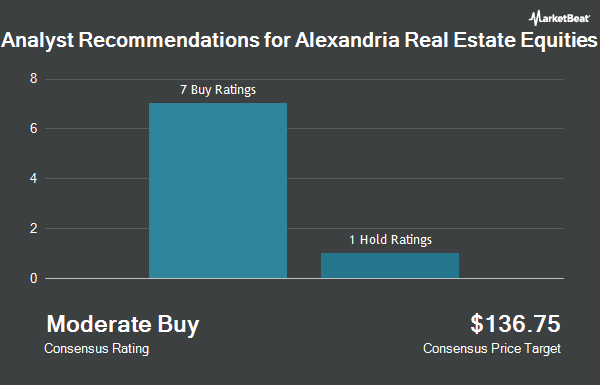

Shares of Alexandria Real Estate Equities, Inc. (NYSE:ARE - Get Free Report) have received a consensus rating of "Hold" from the ten ratings firms that are presently covering the firm, Marketbeat Ratings reports. Seven analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $131.22.

A number of equities analysts have commented on the stock. Evercore ISI cut their price objective on shares of Alexandria Real Estate Equities from $129.00 to $124.00 and set an "in-line" rating for the company in a research report on Wednesday, October 23rd. Wedbush cut their price objective on Alexandria Real Estate Equities from $130.00 to $120.00 and set a "neutral" rating for the company in a research report on Wednesday, October 23rd. Bank of America downgraded shares of Alexandria Real Estate Equities from a "buy" rating to a "neutral" rating and lowered their price target for the stock from $151.00 to $126.00 in a report on Monday, July 29th. BMO Capital Markets upgraded Alexandria Real Estate Equities to a "hold" rating in a research note on Wednesday, September 25th. Finally, JMP Securities reaffirmed a "market outperform" rating and set a $140.00 price target on shares of Alexandria Real Estate Equities in a research note on Tuesday, July 23rd.

Get Our Latest Stock Analysis on ARE

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the business. First Trust Direct Indexing L.P. raised its holdings in Alexandria Real Estate Equities by 20.7% during the 1st quarter. First Trust Direct Indexing L.P. now owns 3,131 shares of the real estate investment trust's stock worth $404,000 after purchasing an additional 537 shares during the last quarter. Mirae Asset Global Investments Co. Ltd. increased its position in shares of Alexandria Real Estate Equities by 4.3% during the 1st quarter. Mirae Asset Global Investments Co. Ltd. now owns 30,180 shares of the real estate investment trust's stock worth $3,737,000 after purchasing an additional 1,245 shares during the last quarter. Tokio Marine Asset Management Co. Ltd. raised its position in Alexandria Real Estate Equities by 13.5% during the first quarter. Tokio Marine Asset Management Co. Ltd. now owns 5,358 shares of the real estate investment trust's stock worth $691,000 after acquiring an additional 637 shares in the last quarter. Nordea Investment Management AB lifted its stake in Alexandria Real Estate Equities by 4.7% in the 1st quarter. Nordea Investment Management AB now owns 11,495 shares of the real estate investment trust's stock valued at $1,485,000 after purchasing an additional 516 shares during the last quarter. Finally, Mutual of America Capital Management LLC lifted its position in shares of Alexandria Real Estate Equities by 2.4% in the first quarter. Mutual of America Capital Management LLC now owns 44,228 shares of the real estate investment trust's stock valued at $5,701,000 after buying an additional 1,032 shares during the last quarter. Institutional investors own 96.54% of the company's stock.

Alexandria Real Estate Equities Trading Up 0.8 %

Shares of ARE stock traded up $0.85 on Tuesday, hitting $113.84. The stock had a trading volume of 790,432 shares, compared to its average volume of 988,901. The company's 50 day moving average price is $118.35 and its 200-day moving average price is $118.26. The company has a debt-to-equity ratio of 0.56, a current ratio of 0.20 and a quick ratio of 0.20. Alexandria Real Estate Equities has a 1 year low of $93.17 and a 1 year high of $135.45. The firm has a market capitalization of $19.89 billion, a P/E ratio of 69.41, a P/E/G ratio of 4.15 and a beta of 1.16.

Alexandria Real Estate Equities (NYSE:ARE - Get Free Report) last announced its quarterly earnings data on Monday, October 21st. The real estate investment trust reported $0.96 EPS for the quarter, missing analysts' consensus estimates of $2.38 by ($1.42). Alexandria Real Estate Equities had a net margin of 9.62% and a return on equity of 1.31%. The firm had revenue of $791.60 million during the quarter, compared to analysts' expectations of $766.97 million. During the same period in the prior year, the company posted $2.26 earnings per share. The company's revenue for the quarter was up 10.9% on a year-over-year basis. Analysts anticipate that Alexandria Real Estate Equities will post 9.48 earnings per share for the current year.

Alexandria Real Estate Equities Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Tuesday, October 15th. Shareholders of record on Monday, September 30th were given a dividend of $1.30 per share. This represents a $5.20 dividend on an annualized basis and a yield of 4.57%. The ex-dividend date of this dividend was Monday, September 30th. Alexandria Real Estate Equities's dividend payout ratio is 317.07%.

Alexandria Real Estate Equities Company Profile

(

Get Free ReportAlexandria Real Estate Equities, Inc NYSE: ARE, an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche since our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative life science, agtech, and advanced technology mega campuses in AAA innovation cluster locations, including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and Research Triangle.

Featured Stories

Before you consider Alexandria Real Estate Equities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alexandria Real Estate Equities wasn't on the list.

While Alexandria Real Estate Equities currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.