Bernzott Capital Advisors grew its holdings in shares of Archrock, Inc. (NYSE:AROC - Free Report) by 15.7% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 336,843 shares of the energy company's stock after purchasing an additional 45,640 shares during the period. Archrock makes up approximately 2.9% of Bernzott Capital Advisors' investment portfolio, making the stock its 18th largest holding. Bernzott Capital Advisors owned 0.22% of Archrock worth $6,818,000 as of its most recent filing with the SEC.

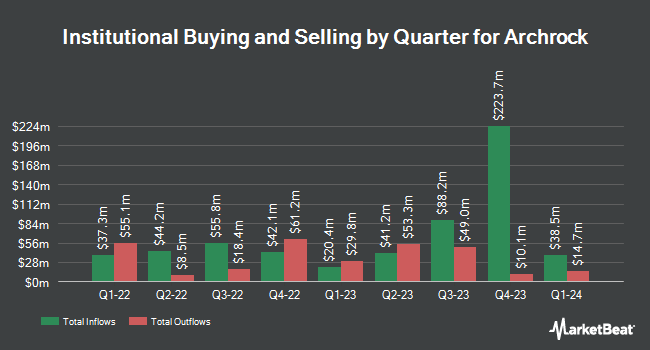

A number of other large investors also recently modified their holdings of AROC. Vanguard Group Inc. grew its holdings in Archrock by 4.9% during the first quarter. Vanguard Group Inc. now owns 18,321,555 shares of the energy company's stock worth $360,385,000 after acquiring an additional 849,750 shares during the period. Earnest Partners LLC grew its holdings in Archrock by 2.6% during the first quarter. Earnest Partners LLC now owns 14,007,955 shares of the energy company's stock worth $275,536,000 after acquiring an additional 351,391 shares during the period. Sei Investments Co. grew its holdings in Archrock by 5.8% during the first quarter. Sei Investments Co. now owns 5,409,863 shares of the energy company's stock worth $106,412,000 after acquiring an additional 295,998 shares during the period. American Century Companies Inc. increased its stake in Archrock by 20.5% in the 2nd quarter. American Century Companies Inc. now owns 3,958,281 shares of the energy company's stock worth $80,036,000 after purchasing an additional 672,663 shares in the last quarter. Finally, Energy Income Partners LLC increased its stake in Archrock by 4.9% in the 1st quarter. Energy Income Partners LLC now owns 2,468,897 shares of the energy company's stock worth $48,563,000 after purchasing an additional 116,298 shares in the last quarter. 95.45% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of equities research analysts have commented on the company. Royal Bank of Canada raised their price objective on Archrock from $22.00 to $26.00 and gave the stock an "outperform" rating in a research report on Wednesday, October 16th. JPMorgan Chase & Co. began coverage on Archrock in a research note on Friday, September 6th. They set an "overweight" rating and a $24.00 target price on the stock. Citigroup began coverage on Archrock in a research note on Friday, September 27th. They issued a "buy" rating and a $24.00 price target for the company. Stifel Nicolaus boosted their price target on Archrock from $23.00 to $25.00 and gave the company a "buy" rating in a research note on Wednesday, July 24th. Finally, Mizuho began coverage on Archrock in a research note on Wednesday, October 2nd. They issued an "outperform" rating and a $24.00 price target for the company. One research analyst has rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, Archrock currently has a consensus rating of "Moderate Buy" and an average price target of $24.50.

Read Our Latest Analysis on AROC

Archrock Price Performance

Shares of AROC stock traded down $0.18 during trading hours on Tuesday, hitting $20.30. 962,965 shares of the company's stock were exchanged, compared to its average volume of 1,434,201. The stock's 50-day moving average is $20.29 and its 200-day moving average is $20.12. The company has a debt-to-equity ratio of 1.80, a current ratio of 1.53 and a quick ratio of 0.94. The stock has a market cap of $3.17 billion, a price-to-earnings ratio of 24.46 and a beta of 1.51. Archrock, Inc. has a 52 week low of $12.41 and a 52 week high of $23.44.

Archrock (NYSE:AROC - Get Free Report) last posted its quarterly earnings results on Tuesday, July 30th. The energy company reported $0.25 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.24 by $0.01. The business had revenue of $270.53 million for the quarter, compared to analysts' expectations of $270.61 million. Archrock had a return on equity of 16.35% and a net margin of 13.20%. As a group, research analysts forecast that Archrock, Inc. will post 1.13 EPS for the current year.

Archrock Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, November 13th. Shareholders of record on Wednesday, November 6th will be paid a $0.175 dividend. This is a positive change from Archrock's previous quarterly dividend of $0.17. The ex-dividend date of this dividend is Wednesday, November 6th. This represents a $0.70 annualized dividend and a yield of 3.45%. Archrock's dividend payout ratio is presently 84.34%.

About Archrock

(

Free Report)

Archrock, Inc, together with its subsidiaries, operates as an energy infrastructure company in the United States. The company operates in two segments, Contract Operations and Aftermarket Services. It engages in the designing, sourcing, owning, installing, operating, servicing, repairing, and maintaining of its owned fleet of natural gas compression equipment to provide natural gas compression services.

Read More

Before you consider Archrock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Archrock wasn't on the list.

While Archrock currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.