Associated Banc (NYSE:ASB - Get Free Report) was downgraded by stock analysts at StockNews.com from a "hold" rating to a "sell" rating in a report released on Wednesday.

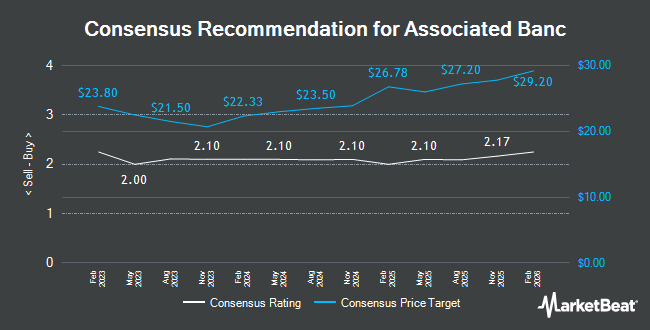

Other equities research analysts have also recently issued research reports about the stock. Piper Sandler raised their price objective on shares of Associated Banc from $23.00 to $24.00 and gave the stock a "neutral" rating in a research note on Friday, July 26th. Jefferies Financial Group lowered their target price on shares of Associated Banc from $24.00 to $22.00 and set a "hold" rating on the stock in a research note on Wednesday, July 3rd. Barclays lifted their price target on Associated Banc from $22.00 to $23.00 and gave the stock an "equal weight" rating in a report on Friday, September 27th. Baird R W lowered shares of Associated Banc from a "strong-buy" rating to a "hold" rating in a report on Wednesday, July 17th. Finally, Royal Bank of Canada boosted their price objective on Associated Banc from $23.00 to $25.00 and gave the stock a "sector perform" rating in a research report on Friday, July 26th. One analyst has rated the stock with a sell rating, nine have issued a hold rating and one has assigned a buy rating to the company. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $23.78.

Check Out Our Latest Analysis on ASB

Associated Banc Stock Performance

Shares of ASB traded up $0.05 on Wednesday, reaching $22.47. The company's stock had a trading volume of 2,197,921 shares, compared to its average volume of 1,327,144. The company has a debt-to-equity ratio of 0.79, a current ratio of 0.89 and a quick ratio of 0.89. The stock has a market capitalization of $3.39 billion, a P/E ratio of 22.70, a PEG ratio of 1.66 and a beta of 0.93. The stock's 50 day simple moving average is $21.73 and its two-hundred day simple moving average is $21.45. Associated Banc has a 12-month low of $15.20 and a 12-month high of $24.21.

Associated Banc (NYSE:ASB - Get Free Report) last announced its quarterly earnings results on Thursday, July 25th. The bank reported $0.52 earnings per share for the quarter, hitting the consensus estimate of $0.52. The company had revenue of $321.75 million for the quarter, compared to analysts' expectations of $330.69 million. Associated Banc had a net margin of 7.93% and a return on equity of 8.14%. Associated Banc's quarterly revenue was down .5% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.56 earnings per share. Research analysts forecast that Associated Banc will post 2.06 earnings per share for the current fiscal year.

Insider Transactions at Associated Banc

In related news, Director Lith Karen Van sold 8,061 shares of Associated Banc stock in a transaction dated Thursday, September 12th. The stock was sold at an average price of $20.48, for a total value of $165,089.28. Following the sale, the director now owns 54,114 shares of the company's stock, valued at approximately $1,108,254.72. The trade was a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. In other Associated Banc news, EVP John A. Utz sold 2,000 shares of the company's stock in a transaction on Thursday, August 29th. The stock was sold at an average price of $22.78, for a total transaction of $45,560.00. Following the completion of the sale, the executive vice president now directly owns 99,637 shares in the company, valued at $2,269,730.86. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Lith Karen Van sold 8,061 shares of the company's stock in a transaction on Thursday, September 12th. The stock was sold at an average price of $20.48, for a total transaction of $165,089.28. Following the transaction, the director now owns 54,114 shares of the company's stock, valued at $1,108,254.72. This trade represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 33,835 shares of company stock worth $757,214 in the last three months. Insiders own 1.45% of the company's stock.

Institutional Trading of Associated Banc

A number of institutional investors have recently bought and sold shares of ASB. LSV Asset Management grew its stake in Associated Banc by 43.3% in the 1st quarter. LSV Asset Management now owns 4,050,813 shares of the bank's stock valued at $87,133,000 after buying an additional 1,224,216 shares in the last quarter. Millennium Management LLC increased its position in shares of Associated Banc by 291.3% in the second quarter. Millennium Management LLC now owns 1,563,274 shares of the bank's stock valued at $33,063,000 after acquiring an additional 1,163,807 shares during the period. M&G Plc purchased a new position in shares of Associated Banc in the first quarter valued at about $8,057,000. Vanguard Group Inc. increased its position in shares of Associated Banc by 1.2% during the fourth quarter. Vanguard Group Inc. now owns 15,639,171 shares of the bank's stock valued at $334,522,000 after buying an additional 184,813 shares during the period. Finally, Point72 Asset Management L.P. increased its position in shares of Associated Banc by 12.0% during the second quarter. Point72 Asset Management L.P. now owns 1,149,355 shares of the bank's stock valued at $24,309,000 after buying an additional 123,271 shares during the period. Institutional investors own 82.98% of the company's stock.

Associated Banc Company Profile

(

Get Free Report)

Associated Banc-Corp, a bank holding company, provides various banking and nonbanking products to individuals and businesses in Wisconsin, Illinois, and Minnesota. The company offers lending solutions, including commercial loans and lines of credit, commercial real estate financing, construction loans, letters of credit, leasing, asset based lending and equipment finance, loan syndications products, residential mortgages, home equity loans and lines of credit, personal and installment loans, auto finance and business loans, and business lines of credit.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Associated Banc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Associated Banc wasn't on the list.

While Associated Banc currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report