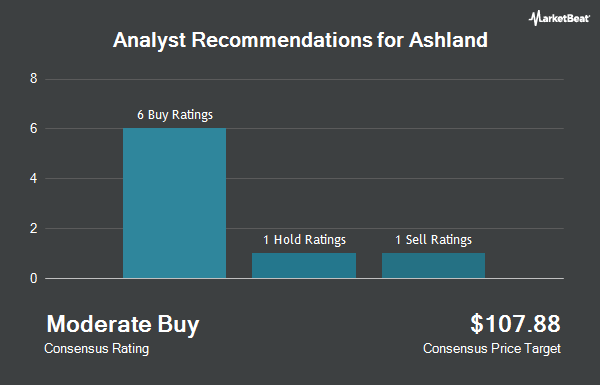

Shares of Ashland Inc. (NYSE:ASH - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the eight research firms that are currently covering the stock, Marketbeat Ratings reports. Two investment analysts have rated the stock with a hold rating and six have issued a buy rating on the company. The average 12 month target price among brokers that have issued a report on the stock in the last year is $103.50.

A number of equities research analysts recently weighed in on ASH shares. BMO Capital Markets dropped their price target on Ashland from $105.00 to $92.00 and set a "market perform" rating for the company in a report on Friday, August 9th. UBS Group lowered their target price on Ashland from $116.00 to $107.00 and set a "buy" rating for the company in a research note on Thursday, August 15th. StockNews.com cut Ashland from a "buy" rating to a "hold" rating in a research note on Friday, September 13th. Wells Fargo & Company lowered their target price on Ashland from $112.00 to $100.00 and set an "overweight" rating for the company in a research note on Thursday, August 8th. Finally, JPMorgan Chase & Co. raised Ashland from an "underweight" rating to a "neutral" rating and lowered their target price for the company from $90.00 to $89.00 in a research note on Thursday, August 8th.

Get Our Latest Research Report on Ashland

Ashland Stock Performance

Shares of ASH stock traded up $0.25 during mid-day trading on Friday, reaching $84.82. The stock had a trading volume of 307,632 shares, compared to its average volume of 414,458. Ashland has a one year low of $70.82 and a one year high of $102.50. The company has a quick ratio of 1.84, a current ratio of 2.98 and a debt-to-equity ratio of 0.45. The firm's 50 day simple moving average is $86.49 and its 200 day simple moving average is $91.95. The firm has a market cap of $4.14 billion, a PE ratio of 28.75, a P/E/G ratio of 1.16 and a beta of 0.88.

Ashland (NYSE:ASH - Get Free Report) last issued its earnings results on Tuesday, August 6th. The basic materials company reported $1.49 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.45 by $0.04. Ashland had a return on equity of 5.98% and a net margin of 7.01%. The business had revenue of $544.00 million during the quarter, compared to analysts' expectations of $577.08 million. During the same period in the prior year, the firm posted $1.23 EPS. Ashland's quarterly revenue was down .4% compared to the same quarter last year. On average, analysts forecast that Ashland will post 4.49 EPS for the current year.

Ashland Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Sunday, September 15th. Stockholders of record on Sunday, September 1st were issued a $0.405 dividend. The ex-dividend date was Friday, August 30th. This represents a $1.62 dividend on an annualized basis and a dividend yield of 1.91%. Ashland's dividend payout ratio (DPR) is 54.92%.

Institutional Trading of Ashland

A number of institutional investors have recently modified their holdings of the company. Massachusetts Financial Services Co. MA increased its position in shares of Ashland by 9.4% in the second quarter. Massachusetts Financial Services Co. MA now owns 2,314,387 shares of the basic materials company's stock valued at $218,686,000 after acquiring an additional 198,913 shares during the last quarter. AQR Capital Management LLC increased its position in shares of Ashland by 616.6% in the second quarter. AQR Capital Management LLC now owns 189,175 shares of the basic materials company's stock valued at $17,875,000 after acquiring an additional 162,776 shares during the last quarter. Hantz Financial Services Inc. acquired a new stake in shares of Ashland in the second quarter valued at about $14,346,000. Clearbridge Investments LLC increased its position in shares of Ashland by 9.0% in the first quarter. Clearbridge Investments LLC now owns 1,806,137 shares of the basic materials company's stock valued at $175,864,000 after acquiring an additional 149,483 shares during the last quarter. Finally, American Century Companies Inc. increased its position in shares of Ashland by 407.2% in the second quarter. American Century Companies Inc. now owns 139,718 shares of the basic materials company's stock valued at $13,202,000 after acquiring an additional 112,169 shares during the last quarter. 93.95% of the stock is currently owned by institutional investors.

Ashland Company Profile

(

Get Free ReportAshland Inc provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally. It operates through Life Sciences, Personal Care, Specialty Additives, and Intermediates segments. The Life Sciences segment offers pharmaceutical solutions, including controlled release polymers, disintegrants, tablet coatings, thickeners, solubilizers, and tablet binders; nutrition solutions, such as thickeners, stabilizers, emulsifiers, and additives; and nutraceutical solutions comprising products for weight management, joint comfort, stomach and intestinal health, sports nutrition, and general wellness, as well as custom formulation, toll processing, and particle engineering solutions.

Read More

Before you consider Ashland, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ashland wasn't on the list.

While Ashland currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.