AptarGroup (NYSE:ATR - Get Free Report) had its price objective boosted by equities researchers at Robert W. Baird from $170.00 to $185.00 in a report issued on Monday, Benzinga reports. The firm currently has an "outperform" rating on the industrial products company's stock. Robert W. Baird's target price indicates a potential upside of 9.37% from the stock's current price.

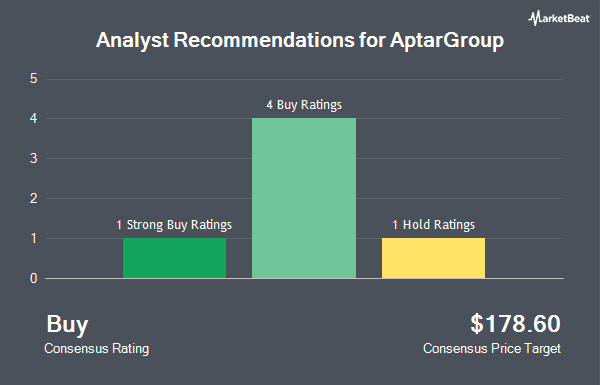

ATR has been the subject of several other reports. Jefferies Financial Group upgraded AptarGroup from a "hold" rating to a "buy" rating and upped their price objective for the stock from $155.00 to $215.00 in a research report on Monday, October 14th. Wells Fargo & Company upped their target price on AptarGroup from $168.00 to $185.00 and gave the stock an "overweight" rating in a report on Tuesday, October 15th. Finally, Dbs Bank raised AptarGroup from a "hold" rating to a "strong-buy" rating in a report on Wednesday, October 16th. Four equities research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, AptarGroup presently has a consensus rating of "Buy" and an average price target of $195.00.

Check Out Our Latest Report on AptarGroup

AptarGroup Price Performance

Shares of ATR stock traded up $0.24 on Monday, hitting $169.15. 349,962 shares of the company's stock were exchanged, compared to its average volume of 292,918. The company has a debt-to-equity ratio of 0.28, a current ratio of 1.36 and a quick ratio of 0.95. AptarGroup has a 12 month low of $120.85 and a 12 month high of $171.41. The stock has a market cap of $11.21 billion, a P/E ratio of 36.61, a price-to-earnings-growth ratio of 3.29 and a beta of 0.58. The company has a 50 day moving average of $156.93 and a 200 day moving average of $149.04.

AptarGroup (NYSE:ATR - Get Free Report) last announced its quarterly earnings data on Thursday, July 25th. The industrial products company reported $1.37 earnings per share for the quarter, topping the consensus estimate of $1.36 by $0.01. AptarGroup had a return on equity of 15.13% and a net margin of 9.00%. The business had revenue of $910.10 million during the quarter, compared to the consensus estimate of $930.15 million. During the same period in the prior year, the company earned $1.23 EPS. AptarGroup's revenue for the quarter was up 1.6% on a year-over-year basis. On average, equities research analysts predict that AptarGroup will post 5.36 EPS for the current year.

AptarGroup announced that its Board of Directors has authorized a stock repurchase plan on Thursday, October 10th that authorizes the company to repurchase $500.00 million in shares. This repurchase authorization authorizes the industrial products company to buy up to 4.7% of its shares through open market purchases. Shares repurchase plans are typically an indication that the company's management believes its stock is undervalued.

Insider Activity

In other news, insider Gael Touya sold 3,300 shares of the stock in a transaction dated Monday, September 9th. The stock was sold at an average price of $151.62, for a total value of $500,346.00. Following the completion of the sale, the insider now owns 32,165 shares of the company's stock, valued at approximately $4,876,857.30. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. In related news, CFO Robert Kuhn sold 200 shares of the firm's stock in a transaction that occurred on Thursday, August 22nd. The stock was sold at an average price of $150.18, for a total transaction of $30,036.00. Following the completion of the sale, the chief financial officer now owns 65,552 shares of the company's stock, valued at $9,844,599.36. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Also, insider Gael Touya sold 3,300 shares of the firm's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $151.62, for a total value of $500,346.00. Following the sale, the insider now directly owns 32,165 shares of the company's stock, valued at $4,876,857.30. This represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders sold 17,457 shares of company stock valued at $2,592,110. Company insiders own 1.00% of the company's stock.

Institutional Investors Weigh In On AptarGroup

Several large investors have recently added to or reduced their stakes in the business. Ballentine Partners LLC boosted its holdings in AptarGroup by 2.3% in the third quarter. Ballentine Partners LLC now owns 3,315 shares of the industrial products company's stock worth $531,000 after acquiring an additional 76 shares in the last quarter. Fifth Third Bancorp boosted its holdings in AptarGroup by 3.6% in the second quarter. Fifth Third Bancorp now owns 2,361 shares of the industrial products company's stock worth $332,000 after acquiring an additional 82 shares in the last quarter. Argent Trust Co boosted its holdings in AptarGroup by 6.1% in the second quarter. Argent Trust Co now owns 1,685 shares of the industrial products company's stock worth $237,000 after acquiring an additional 97 shares in the last quarter. Adirondack Trust Co. boosted its holdings in AptarGroup by 25.0% in the second quarter. Adirondack Trust Co. now owns 500 shares of the industrial products company's stock worth $70,000 after acquiring an additional 100 shares in the last quarter. Finally, Fulton Bank N.A. boosted its holdings in AptarGroup by 6.0% in the third quarter. Fulton Bank N.A. now owns 2,058 shares of the industrial products company's stock worth $330,000 after acquiring an additional 117 shares in the last quarter. Institutional investors and hedge funds own 88.52% of the company's stock.

AptarGroup Company Profile

(

Get Free Report)

AptarGroup, Inc designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets. The company operates through Aptar Pharma, Aptar Beauty, and Aptar Closures segments.

Further Reading

Before you consider AptarGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AptarGroup wasn't on the list.

While AptarGroup currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.