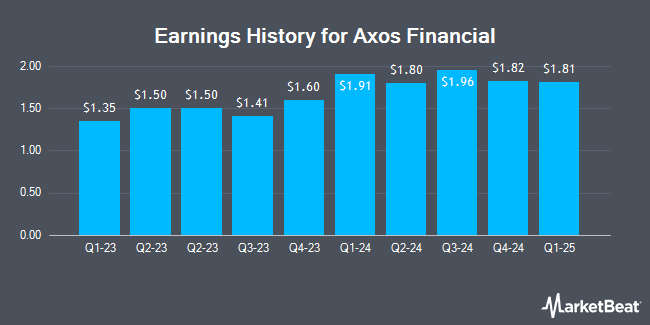

Axos Financial (NYSE:AX - Get Free Report) will be announcing its earnings results after the market closes on Wednesday, October 30th. Analysts expect the company to announce earnings of $1.82 per share for the quarter. Parties interested in registering for the company's conference call can do so using this link.

Axos Financial (NYSE:AX - Get Free Report) last announced its quarterly earnings results on Tuesday, July 30th. The company reported $1.80 EPS for the quarter, meeting analysts' consensus estimates of $1.80. Axos Financial had a return on equity of 18.57% and a net margin of 23.96%. The company had revenue of $484.29 million during the quarter, compared to analyst estimates of $296.02 million. During the same period in the prior year, the company earned $1.50 earnings per share. On average, analysts expect Axos Financial to post $7 EPS for the current fiscal year and $8 EPS for the next fiscal year.

Axos Financial Price Performance

Axos Financial stock traded up $0.03 during midday trading on Wednesday, reaching $65.63. 255,395 shares of the stock traded hands, compared to its average volume of 580,264. The stock's fifty day moving average is $64.57 and its 200-day moving average is $60.74. Axos Financial has a 12 month low of $32.05 and a 12 month high of $79.15. The stock has a market cap of $3.74 billion, a P/E ratio of 8.88 and a beta of 1.39. The company has a quick ratio of 1.08, a current ratio of 1.08 and a debt-to-equity ratio of 0.17.

Wall Street Analysts Forecast Growth

AX has been the subject of a number of research reports. Wedbush dropped their price target on Axos Financial from $80.00 to $75.00 and set a "neutral" rating for the company in a research note on Tuesday, September 24th. Piper Sandler upped their price objective on Axos Financial from $68.00 to $84.00 and gave the company an "overweight" rating in a research report on Wednesday, July 31st. Needham & Company LLC assumed coverage on Axos Financial in a research report on Friday, October 11th. They set a "buy" rating and a $82.00 price objective on the stock. Raymond James upped their price objective on Axos Financial from $67.00 to $81.00 and gave the company an "outperform" rating in a research report on Wednesday, July 31st. Finally, Keefe, Bruyette & Woods downgraded Axos Financial from an "outperform" rating to a "market perform" rating and set a $79.00 price objective on the stock. in a research report on Wednesday, July 31st. Three research analysts have rated the stock with a hold rating and three have given a buy rating to the company. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $80.20.

View Our Latest Research Report on AX

Insider Transactions at Axos Financial

In other Axos Financial news, EVP Andrew J. Micheletti sold 5,197 shares of the firm's stock in a transaction on Monday, September 9th. The stock was sold at an average price of $63.13, for a total transaction of $328,086.61. Following the transaction, the executive vice president now directly owns 424,149 shares in the company, valued at $26,776,526.37. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Company insiders own 4.82% of the company's stock.

About Axos Financial

(

Get Free Report)

Axos Financial, Inc, together with its subsidiaries, provides consumer and business banking products in the United States. It operates through two segments, Banking Business and Securities Business. The company offers deposits products, including consumer and business checking, demand, savings, time deposit, money market, zero balance, and insured cash sweep accounts.

Further Reading

Before you consider Axos Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axos Financial wasn't on the list.

While Axos Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.