Raymond James & Associates raised its holdings in Axalta Coating Systems Ltd. (NYSE:AXTA - Free Report) by 48.3% during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 168,187 shares of the specialty chemicals company's stock after acquiring an additional 54,746 shares during the period. Raymond James & Associates owned approximately 0.08% of Axalta Coating Systems worth $6,087,000 at the end of the most recent reporting period.

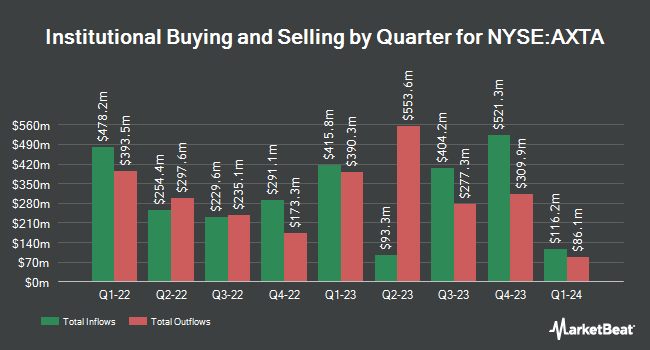

Other large investors have also recently modified their holdings of the company. Millennium Management LLC lifted its stake in Axalta Coating Systems by 89.7% during the second quarter. Millennium Management LLC now owns 2,733,703 shares of the specialty chemicals company's stock worth $93,411,000 after purchasing an additional 1,292,434 shares during the last quarter. Locust Wood Capital Advisers LLC raised its holdings in shares of Axalta Coating Systems by 63.8% during the 1st quarter. Locust Wood Capital Advisers LLC now owns 3,198,290 shares of the specialty chemicals company's stock valued at $109,989,000 after buying an additional 1,245,223 shares in the last quarter. Interval Partners LP lifted its position in Axalta Coating Systems by 716.6% in the 2nd quarter. Interval Partners LP now owns 1,224,961 shares of the specialty chemicals company's stock worth $41,857,000 after buying an additional 1,074,961 shares during the last quarter. Vanguard Group Inc. boosted its stake in Axalta Coating Systems by 2.4% in the first quarter. Vanguard Group Inc. now owns 23,763,601 shares of the specialty chemicals company's stock worth $817,230,000 after buying an additional 554,806 shares in the last quarter. Finally, Victory Capital Management Inc. grew its position in Axalta Coating Systems by 5.6% during the second quarter. Victory Capital Management Inc. now owns 10,403,246 shares of the specialty chemicals company's stock valued at $355,479,000 after acquiring an additional 550,970 shares during the last quarter. Institutional investors own 98.28% of the company's stock.

Axalta Coating Systems Trading Up 0.2 %

Shares of NYSE:AXTA traded up $0.08 on Friday, hitting $38.00. The company had a trading volume of 2,857,784 shares, compared to its average volume of 2,044,568. The firm's 50-day simple moving average is $35.97 and its two-hundred day simple moving average is $35.06. The firm has a market capitalization of $8.33 billion, a price-to-earnings ratio of 25.68, a P/E/G ratio of 0.97 and a beta of 1.44. The company has a quick ratio of 1.70, a current ratio of 2.00 and a debt-to-equity ratio of 1.80. Axalta Coating Systems Ltd. has a 1 year low of $28.69 and a 1 year high of $38.77.

Axalta Coating Systems (NYSE:AXTA - Get Free Report) last issued its quarterly earnings results on Wednesday, October 30th. The specialty chemicals company reported $0.59 earnings per share for the quarter, topping the consensus estimate of $0.51 by $0.08. The company had revenue of $1.32 billion for the quarter, compared to analysts' expectations of $1.32 billion. Axalta Coating Systems had a return on equity of 24.92% and a net margin of 6.22%. The firm's revenue for the quarter was up .8% on a year-over-year basis. During the same period in the prior year, the firm earned $0.45 earnings per share. Equities analysts anticipate that Axalta Coating Systems Ltd. will post 2.06 earnings per share for the current fiscal year.

Analyst Ratings Changes

Several analysts have issued reports on AXTA shares. UBS Group cut their price target on shares of Axalta Coating Systems from $39.00 to $38.00 and set a "neutral" rating for the company in a research report on Tuesday, July 9th. Barclays boosted their price objective on Axalta Coating Systems from $42.00 to $44.00 and gave the company an "overweight" rating in a research report on Friday. Royal Bank of Canada raised their target price on shares of Axalta Coating Systems from $44.00 to $46.00 and gave the stock an "outperform" rating in a report on Friday. JPMorgan Chase & Co. upped their price target on shares of Axalta Coating Systems from $40.00 to $41.00 and gave the company an "overweight" rating in a report on Monday, August 5th. Finally, Robert W. Baird increased their price target on shares of Axalta Coating Systems from $40.00 to $42.00 and gave the company an "outperform" rating in a research report on Friday, August 2nd. Two investment analysts have rated the stock with a hold rating, nine have given a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $41.70.

View Our Latest Report on AXTA

Axalta Coating Systems Profile

(

Free Report)

Axalta Coating Systems Ltd., through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company operates through two segments, Performance Coatings and Mobility Coatings.

Featured Stories

Before you consider Axalta Coating Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axalta Coating Systems wasn't on the list.

While Axalta Coating Systems currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.