Roubaix Capital LLC bought a new position in shares of BARK, Inc. (NYSE:BARK - Free Report) in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm bought 548,764 shares of the company's stock, valued at approximately $894,000. Roubaix Capital LLC owned about 0.32% of BARK at the end of the most recent quarter.

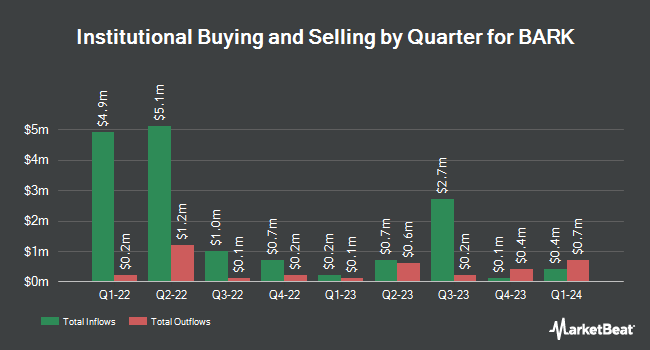

Other large investors have also recently made changes to their positions in the company. Vanguard Group Inc. raised its holdings in shares of BARK by 5.0% in the first quarter. Vanguard Group Inc. now owns 6,207,032 shares of the company's stock valued at $7,697,000 after acquiring an additional 298,343 shares in the last quarter. Renaissance Technologies LLC boosted its stake in shares of BARK by 68.3% during the second quarter. Renaissance Technologies LLC now owns 729,917 shares of the company's stock valued at $1,321,000 after purchasing an additional 296,199 shares in the last quarter. Bank of New York Mellon Corp increased its holdings in shares of BARK by 10.3% in the 2nd quarter. Bank of New York Mellon Corp now owns 407,102 shares of the company's stock valued at $737,000 after acquiring an additional 37,980 shares during the period. Rhumbline Advisers raised its position in shares of BARK by 12.2% in the 2nd quarter. Rhumbline Advisers now owns 148,335 shares of the company's stock worth $268,000 after acquiring an additional 16,185 shares in the last quarter. Finally, ARS Investment Partners LLC bought a new stake in BARK during the second quarter valued at about $205,000. 28.76% of the stock is owned by hedge funds and other institutional investors.

BARK Stock Up 1.8 %

BARK stock traded up $0.03 during trading hours on Thursday, reaching $1.45. The stock had a trading volume of 690,636 shares, compared to its average volume of 731,517. The company has a market cap of $250.78 million, a price-to-earnings ratio of -6.88 and a beta of 1.71. The business's 50 day moving average price is $1.62 and its 200-day moving average price is $1.49. BARK, Inc. has a 52 week low of $0.70 and a 52 week high of $1.91. The company has a debt-to-equity ratio of 0.31, a current ratio of 2.77 and a quick ratio of 1.72.

BARK (NYSE:BARK - Get Free Report) last released its quarterly earnings results on Wednesday, August 7th. The company reported ($0.04) EPS for the quarter, meeting analysts' consensus estimates of ($0.04). BARK had a negative return on equity of 19.27% and a negative net margin of 7.28%. The company had revenue of $116.21 million during the quarter, compared to analysts' expectations of $115.00 million. Sell-side analysts anticipate that BARK, Inc. will post -0.1 EPS for the current year.

BARK Profile

(

Free Report)

BARK Inc, a dog-centric company, provides products, services, and content for dogs. It operates in two segments, Direct to Consumer and Commerce. The company serves dogs through monthly subscription services. It is also involved in the design of playstyle-specific toys, satisfying treats, personal meal plans with supplements, and dog-first experiences designed to foster health and happiness of dogs everywhere.

Featured Stories

Before you consider BARK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BARK wasn't on the list.

While BARK currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.