Brunswick (NYSE:BC - Get Free Report) issued an update on its FY24 earnings guidance on Thursday morning. The company provided EPS guidance of ~$4.50 for the period, compared to the consensus EPS estimate of $5.23. The company issued revenue guidance of $5.1-5.2 billion, compared to the consensus revenue estimate of $5.30 billion. Brunswick also updated its FY 2024 guidance to 4.500-4.500 EPS.

Analysts Set New Price Targets

A number of equities research analysts recently commented on the stock. B. Riley lowered their price objective on shares of Brunswick from $108.00 to $97.00 and set a "buy" rating on the stock in a research note on Wednesday, July 10th. Roth Mkm restated a "buy" rating and set a $94.00 target price on shares of Brunswick in a report on Thursday, July 25th. Jefferies Financial Group reaffirmed a "hold" rating and set a $70.00 target price (down from $115.00) on shares of Brunswick in a research report on Friday, July 26th. Benchmark reiterated a "buy" rating and issued a $100.00 target price on shares of Brunswick in a research report on Friday, July 26th. Finally, Truist Financial lowered their price objective on Brunswick from $95.00 to $90.00 and set a "buy" rating for the company in a research note on Monday, July 8th. Six equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the company. According to data from MarketBeat, the company has an average rating of "Moderate Buy" and a consensus price target of $89.23.

Read Our Latest Research Report on BC

Brunswick Stock Up 3.9 %

Shares of NYSE:BC traded up $2.97 during midday trading on Thursday, reaching $79.99. The company had a trading volume of 1,080,802 shares, compared to its average volume of 716,431. Brunswick has a 1-year low of $66.47 and a 1-year high of $99.68. The stock has a market cap of $5.40 billion, a PE ratio of 14.87 and a beta of 1.51. The company has a quick ratio of 0.75, a current ratio of 1.70 and a debt-to-equity ratio of 1.18. The business's 50 day moving average price is $80.20 and its 200 day moving average price is $79.27.

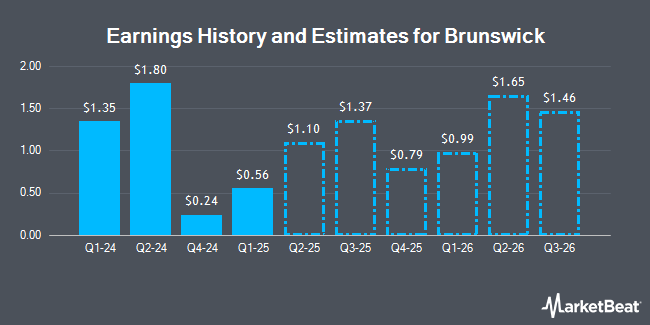

Brunswick (NYSE:BC - Get Free Report) last issued its quarterly earnings data on Thursday, July 25th. The company reported $1.80 EPS for the quarter, missing analysts' consensus estimates of $1.90 by ($0.10). The firm had revenue of $1.44 billion during the quarter, compared to analyst estimates of $1.55 billion. Brunswick had a net margin of 5.92% and a return on equity of 23.46%. The business's quarterly revenue was down 15.2% compared to the same quarter last year. During the same period in the prior year, the company earned $2.35 earnings per share. Research analysts forecast that Brunswick will post 5.26 EPS for the current fiscal year.

Brunswick Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 13th. Shareholders of record on Wednesday, November 20th will be paid a dividend of $0.42 per share. This represents a $1.68 annualized dividend and a yield of 2.10%. The ex-dividend date of this dividend is Wednesday, November 20th. Brunswick's payout ratio is presently 31.23%.

Insider Buying and Selling

In other Brunswick news, Director Nancy E. Cooper sold 358 shares of the company's stock in a transaction dated Thursday, August 1st. The stock was sold at an average price of $81.34, for a total value of $29,119.72. Following the sale, the director now owns 23,877 shares in the company, valued at approximately $1,942,155.18. The trade was a 0.00 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through this link. 0.81% of the stock is owned by corporate insiders.

About Brunswick

(

Get Free Report)

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

See Also

Before you consider Brunswick, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brunswick wasn't on the list.

While Brunswick currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.