Deroy & Devereaux Private Investment Counsel Inc. bought a new stake in Brunswick Co. (NYSE:BC - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 189,775 shares of the company's stock, valued at approximately $15,907,000. Deroy & Devereaux Private Investment Counsel Inc. owned 0.28% of Brunswick as of its most recent SEC filing.

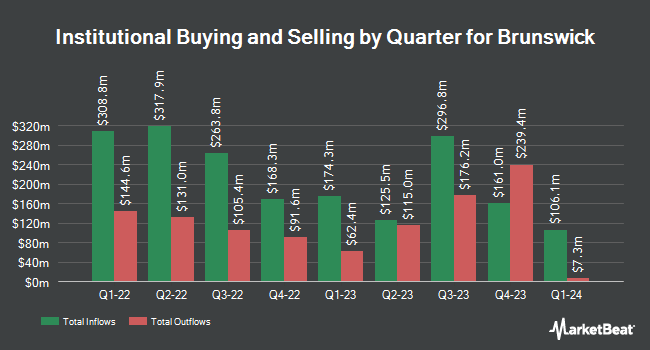

A number of other institutional investors have also bought and sold shares of BC. US Bancorp DE raised its holdings in shares of Brunswick by 3.0% during the third quarter. US Bancorp DE now owns 8,214 shares of the company's stock valued at $689,000 after purchasing an additional 241 shares during the period. Trajan Wealth LLC acquired a new position in Brunswick during the 3rd quarter worth approximately $254,000. Hunter Associates Investment Management LLC boosted its holdings in Brunswick by 13.4% in the third quarter. Hunter Associates Investment Management LLC now owns 17,680 shares of the company's stock worth $1,482,000 after acquiring an additional 2,084 shares in the last quarter. Nisa Investment Advisors LLC increased its holdings in shares of Brunswick by 0.5% during the third quarter. Nisa Investment Advisors LLC now owns 26,731 shares of the company's stock valued at $2,241,000 after acquiring an additional 145 shares in the last quarter. Finally, State of Alaska Department of Revenue raised its position in shares of Brunswick by 3.5% during the third quarter. State of Alaska Department of Revenue now owns 7,691 shares of the company's stock worth $644,000 after purchasing an additional 260 shares during the period. Institutional investors own 99.34% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on the stock. Benchmark reaffirmed a "buy" rating and issued a $100.00 price objective on shares of Brunswick in a research note on Friday, October 25th. Roth Mkm reissued a "buy" rating and set a $94.00 price objective on shares of Brunswick in a report on Thursday, July 25th. Jefferies Financial Group restated a "hold" rating and issued a $70.00 target price (down previously from $115.00) on shares of Brunswick in a report on Friday, July 26th. Northcoast Research upgraded Brunswick from a "neutral" rating to a "buy" rating and set a $100.00 price target for the company in a report on Monday, July 29th. Finally, Stifel Nicolaus dropped their price objective on Brunswick from $97.00 to $95.00 and set a "buy" rating on the stock in a research note on Friday, July 12th. Six research analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus target price of $89.23.

View Our Latest Stock Analysis on BC

Brunswick Stock Performance

Shares of NYSE:BC traded up $1.13 during mid-day trading on Friday, reaching $80.87. The company had a trading volume of 582,733 shares, compared to its average volume of 713,793. The company's 50-day moving average price is $80.70 and its 200-day moving average price is $78.92. Brunswick Co. has a one year low of $69.05 and a one year high of $99.68. The firm has a market cap of $5.36 billion, a price-to-earnings ratio of 20.12 and a beta of 1.51. The company has a current ratio of 1.97, a quick ratio of 0.74 and a debt-to-equity ratio of 1.17.

Brunswick Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, December 13th. Investors of record on Wednesday, November 20th will be issued a $0.42 dividend. This represents a $1.68 annualized dividend and a yield of 2.08%. The ex-dividend date is Wednesday, November 20th. Brunswick's dividend payout ratio (DPR) is currently 41.79%.

Insider Buying and Selling at Brunswick

In related news, Director Joseph W. Mcclanathan sold 4,745 shares of the firm's stock in a transaction that occurred on Friday, October 25th. The shares were sold at an average price of $80.14, for a total value of $380,264.30. Following the completion of the transaction, the director now directly owns 19,218 shares of the company's stock, valued at approximately $1,540,130.52. This trade represents a 0.00 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. In other news, Director Nancy E. Cooper sold 366 shares of the firm's stock in a transaction that occurred on Friday, November 1st. The shares were sold at an average price of $80.19, for a total value of $29,349.54. Following the completion of the transaction, the director now directly owns 24,557 shares in the company, valued at approximately $1,969,225.83. This trade represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Joseph W. Mcclanathan sold 4,745 shares of the company's stock in a transaction that occurred on Friday, October 25th. The stock was sold at an average price of $80.14, for a total transaction of $380,264.30. Following the sale, the director now directly owns 19,218 shares in the company, valued at $1,540,130.52. This trade represents a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders own 0.81% of the company's stock.

Brunswick Company Profile

(

Free Report)

Brunswick Corporation designs, manufactures, and markets recreation products in the United States, Europe, the Asia-Pacific, Canada, and internationally. It operates through four segments: Propulsion, Engine P&A, Navico Group, and Boat. The Propulsion segment provides outboard, sterndrive, inboard engines, propulsion-related controls, rigging, and propellers for boat builders through marine retail dealers under the Mercury, Mercury MerCruiser, Mariner, Mercury Racing, Mercury Diesel, Avator, and Fliteboard brands.

Further Reading

Before you consider Brunswick, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brunswick wasn't on the list.

While Brunswick currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.