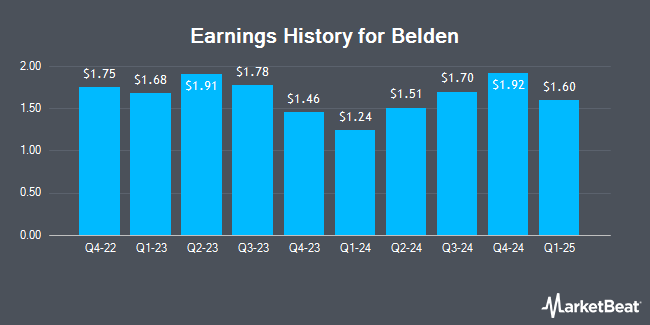

Belden (NYSE:BDC - Get Free Report) released its earnings results on Thursday. The industrial products company reported $1.70 earnings per share for the quarter, topping analysts' consensus estimates of $1.61 by $0.09, Briefing.com reports. Belden had a return on equity of 21.13% and a net margin of 8.51%. The company had revenue of $654.90 million during the quarter, compared to the consensus estimate of $643.63 million. During the same quarter in the previous year, the company posted $1.78 EPS. Belden's quarterly revenue was up 4.5% compared to the same quarter last year. Belden updated its Q4 guidance to $1.62-1.72 EPS and its Q4 2024 guidance to 1.620-1.720 EPS.

Belden Stock Performance

Belden stock opened at $115.24 on Friday. The company has a current ratio of 1.70, a quick ratio of 1.25 and a debt-to-equity ratio of 0.95. The firm has a market cap of $4.70 billion, a P/E ratio of 26.80 and a beta of 1.07. Belden has a 1-year low of $60.54 and a 1-year high of $123.03. The firm has a 50-day moving average of $112.21 and a 200-day moving average of $99.96.

Belden Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, October 8th. Shareholders of record on Thursday, September 12th were given a $0.05 dividend. This represents a $0.20 dividend on an annualized basis and a dividend yield of 0.17%. The ex-dividend date of this dividend was Thursday, September 12th. Belden's payout ratio is 4.65%.

Insider Activity at Belden

In related news, Director Nancy E. Calderon sold 2,500 shares of the company's stock in a transaction that occurred on Monday, August 5th. The stock was sold at an average price of $95.98, for a total transaction of $239,950.00. Following the completion of the transaction, the director now owns 6,954 shares in the company, valued at $667,444.92. This represents a 0.00 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through this hyperlink. In other news, SVP Brian Edward Anderson sold 6,556 shares of the stock in a transaction that occurred on Thursday, August 15th. The stock was sold at an average price of $100.46, for a total value of $658,615.76. Following the completion of the transaction, the senior vice president now owns 32,829 shares of the company's stock, valued at approximately $3,298,001.34. This represents a 0.00 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Nancy E. Calderon sold 2,500 shares of the firm's stock in a transaction that occurred on Monday, August 5th. The shares were sold at an average price of $95.98, for a total value of $239,950.00. Following the completion of the transaction, the director now owns 6,954 shares of the company's stock, valued at approximately $667,444.92. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 10,318 shares of company stock worth $1,020,715 in the last 90 days. Company insiders own 1.59% of the company's stock.

Analysts Set New Price Targets

A number of equities research analysts have recently issued reports on BDC shares. Benchmark upped their price objective on shares of Belden from $120.00 to $130.00 and gave the company a "buy" rating in a research note on Friday. Truist Financial upped their price target on shares of Belden from $124.00 to $136.00 and gave the company a "buy" rating in a research report on Friday. Finally, Vertical Research started coverage on Belden in a report on Tuesday, July 23rd. They issued a "buy" rating and a $110.00 price objective on the stock. Six analysts have rated the stock with a buy rating, Based on data from MarketBeat, Belden presently has an average rating of "Buy" and a consensus price target of $116.40.

View Our Latest Stock Report on Belden

About Belden

(

Get Free Report)

Belden Inc designs, manufactures, and markets a portfolio of signal transmission solutions for mission critical applications in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific. It operates in two segments, Enterprise Solutions and Industrial Automation Solutions. The Enterprise Solutions segment offers copper cable and connectivity solutions, fiber cable and connectivity solutions, interconnect panels, racks and enclosures, and signal extension and matrix switching systems for use in applications, such as local area networks, data centers, access control, 5G, fiber to the home, and building automation.

Featured Articles

Before you consider Belden, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Belden wasn't on the list.

While Belden currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.