Ceredex Value Advisors LLC bought a new stake in shares of Becton, Dickinson and Company (NYSE:BDX - Free Report) in the third quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The firm bought 214,368 shares of the medical instruments supplier's stock, valued at approximately $51,684,000. Becton, Dickinson and Company makes up about 1.0% of Ceredex Value Advisors LLC's investment portfolio, making the stock its 28th largest position. Ceredex Value Advisors LLC owned 0.07% of Becton, Dickinson and Company as of its most recent SEC filing.

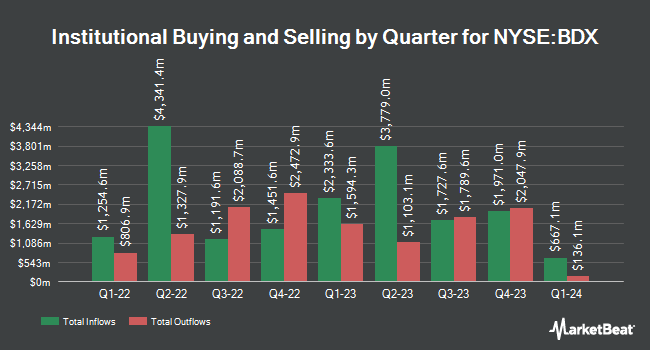

Other large investors have also recently made changes to their positions in the company. Nordea Investment Management AB raised its stake in Becton, Dickinson and Company by 277.3% during the first quarter. Nordea Investment Management AB now owns 1,936,654 shares of the medical instruments supplier's stock valued at $478,295,000 after buying an additional 1,423,353 shares during the last quarter. PineStone Asset Management Inc. increased its holdings in shares of Becton, Dickinson and Company by 141.6% during the second quarter. PineStone Asset Management Inc. now owns 1,345,873 shares of the medical instruments supplier's stock valued at $314,544,000 after acquiring an additional 788,735 shares in the last quarter. M&G Plc purchased a new position in shares of Becton, Dickinson and Company in the 1st quarter worth about $173,692,000. First Eagle Investment Management LLC raised its holdings in Becton, Dickinson and Company by 32.5% in the second quarter. First Eagle Investment Management LLC now owns 2,803,255 shares of the medical instruments supplier's stock worth $655,149,000 after buying an additional 688,296 shares during the last quarter. Finally, Bank of New York Mellon Corp increased its position in shares of Becton, Dickinson and Company by 8.5% during the second quarter. Bank of New York Mellon Corp now owns 4,412,163 shares of the medical instruments supplier's stock valued at $1,031,167,000 after acquiring an additional 346,720 shares in the last quarter. 86.97% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

A number of analysts have recently issued reports on the stock. Stifel Nicolaus raised their price target on shares of Becton, Dickinson and Company from $270.00 to $280.00 and gave the company a "buy" rating in a report on Friday, July 26th. Citigroup raised Becton, Dickinson and Company from a "neutral" rating to a "buy" rating and increased their target price for the company from $255.00 to $275.00 in a report on Tuesday, October 1st. Raymond James cut their price target on Becton, Dickinson and Company from $275.00 to $270.00 and set an "outperform" rating for the company in a research note on Friday, August 2nd. StockNews.com upgraded shares of Becton, Dickinson and Company from a "hold" rating to a "buy" rating in a research note on Thursday, August 8th. Finally, Evercore ISI boosted their target price on shares of Becton, Dickinson and Company from $286.00 to $290.00 and gave the company an "outperform" rating in a research report on Tuesday, October 1st. Nine analysts have rated the stock with a buy rating, According to data from MarketBeat, the stock has an average rating of "Buy" and a consensus price target of $282.63.

Check Out Our Latest Stock Analysis on BDX

Becton, Dickinson and Company Price Performance

Shares of BDX traded up $1.65 during mid-day trading on Friday, reaching $235.24. The stock had a trading volume of 1,278,383 shares, compared to its average volume of 1,371,782. The business has a fifty day moving average of $237.56 and a 200 day moving average of $235.07. The company has a debt-to-equity ratio of 0.70, a quick ratio of 1.36 and a current ratio of 1.85. The firm has a market cap of $67.99 billion, a price-to-earnings ratio of 48.40, a PEG ratio of 1.77 and a beta of 0.42. Becton, Dickinson and Company has a 12 month low of $218.75 and a 12 month high of $259.92.

Becton, Dickinson and Company (NYSE:BDX - Get Free Report) last issued its earnings results on Thursday, August 1st. The medical instruments supplier reported $3.50 earnings per share for the quarter, topping the consensus estimate of $3.31 by $0.19. The company had revenue of $4.99 billion during the quarter, compared to the consensus estimate of $5.08 billion. Becton, Dickinson and Company had a net margin of 7.13% and a return on equity of 14.49%. Becton, Dickinson and Company's quarterly revenue was up 2.3% compared to the same quarter last year. During the same quarter in the prior year, the firm posted $2.96 EPS. Equities analysts predict that Becton, Dickinson and Company will post 13.11 EPS for the current year.

Becton, Dickinson and Company Company Profile

(

Free Report)

Becton, Dickinson and Company develops, manufactures, and sells medical supplies, devices, laboratory equipment, and diagnostic products for healthcare institutions, physicians, life science researchers, clinical laboratories, pharmaceutical industry, and the general public worldwide. The company operates in three segments: BD Medical, BD Life Sciences, and BD Interventional.

Read More

Before you consider Becton, Dickinson and Company, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Becton, Dickinson and Company wasn't on the list.

While Becton, Dickinson and Company currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.