Pinnacle Associates Ltd. decreased its stake in Bloom Energy Co. (NYSE:BE - Free Report) by 33.4% in the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 578,979 shares of the company's stock after selling 290,607 shares during the quarter. Pinnacle Associates Ltd. owned approximately 0.26% of Bloom Energy worth $6,114,000 at the end of the most recent quarter.

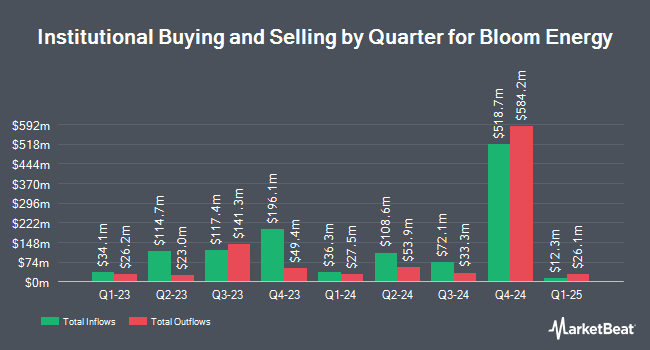

A number of other institutional investors also recently modified their holdings of BE. Vanguard Group Inc. increased its holdings in Bloom Energy by 0.8% in the first quarter. Vanguard Group Inc. now owns 19,685,235 shares of the company's stock worth $221,262,000 after buying an additional 156,434 shares during the last quarter. Electron Capital Partners LLC grew its position in Bloom Energy by 131.5% in the second quarter. Electron Capital Partners LLC now owns 3,152,944 shares of the company's stock worth $38,592,000 after acquiring an additional 1,790,733 shares in the last quarter. DigitalBridge Group Inc. increased its stake in shares of Bloom Energy by 66.3% during the 2nd quarter. DigitalBridge Group Inc. now owns 1,160,389 shares of the company's stock worth $14,203,000 after purchasing an additional 462,581 shares during the last quarter. Van ECK Associates Corp lifted its stake in shares of Bloom Energy by 19.2% in the 1st quarter. Van ECK Associates Corp now owns 1,012,547 shares of the company's stock valued at $11,381,000 after purchasing an additional 162,968 shares during the last quarter. Finally, DekaBank Deutsche Girozentrale boosted its holdings in Bloom Energy by 64.6% in the second quarter. DekaBank Deutsche Girozentrale now owns 830,405 shares of the company's stock worth $11,017,000 after purchasing an additional 325,814 shares in the last quarter. Institutional investors and hedge funds own 77.04% of the company's stock.

Bloom Energy Stock Performance

BE traded down $0.51 during trading on Thursday, reaching $9.59. 4,525,278 shares of the company's stock were exchanged, compared to its average volume of 5,807,597. The company has a market capitalization of $2.18 billion, a P/E ratio of -7.41 and a beta of 2.69. The company has a quick ratio of 3.33, a current ratio of 4.65 and a debt-to-equity ratio of 3.43. The business has a 50 day moving average price of $10.53 and a 200 day moving average price of $12.06. Bloom Energy Co. has a fifty-two week low of $8.41 and a fifty-two week high of $18.14.

Bloom Energy (NYSE:BE - Get Free Report) last posted its earnings results on Thursday, August 8th. The company reported ($0.06) earnings per share for the quarter, meeting analysts' consensus estimates of ($0.06). The business had revenue of $335.80 million for the quarter, compared to analysts' expectations of $307.73 million. Bloom Energy had a negative net margin of 21.37% and a negative return on equity of 11.90%. The firm's revenue for the quarter was up 11.5% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($0.32) earnings per share. As a group, analysts predict that Bloom Energy Co. will post -0.25 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on BE. Susquehanna reduced their price target on Bloom Energy from $16.00 to $13.00 and set a "positive" rating for the company in a research report on Wednesday, October 16th. Truist Financial lowered their price target on Bloom Energy from $13.00 to $12.00 and set a "hold" rating on the stock in a report on Wednesday, October 16th. Jefferies Financial Group cut shares of Bloom Energy from a "buy" rating to a "hold" rating and reduced their price objective for the stock from $15.00 to $11.00 in a research note on Friday, September 6th. JPMorgan Chase & Co. raised their target price on shares of Bloom Energy from $12.00 to $14.00 and gave the company a "neutral" rating in a research note on Tuesday, July 16th. Finally, Piper Sandler reiterated a "neutral" rating and issued a $10.00 target price (down previously from $11.00) on shares of Bloom Energy in a report on Tuesday. One research analyst has rated the stock with a sell rating, nine have assigned a hold rating and nine have issued a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus target price of $15.39.

View Our Latest Stock Report on Bloom Energy

About Bloom Energy

(

Free Report)

Bloom Energy Corporation designs, manufactures, sells, and installs solid-oxide fuel cell systems for on-site power generation in the United States and internationally. The company offers Bloom Energy Server, a solid oxide technology that converts fuel, such as natural gas, biogas, hydrogen, or a blend of these fuels into electricity through an electrochemical process without combustion.

Further Reading

Before you consider Bloom Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bloom Energy wasn't on the list.

While Bloom Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.