China Universal Asset Management Co. Ltd. decreased its holdings in KE Holdings Inc. (NYSE:BEKE - Free Report) by 17.4% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor owned 109,000 shares of the company's stock after selling 23,000 shares during the period. China Universal Asset Management Co. Ltd.'s holdings in KE were worth $2,170,000 at the end of the most recent reporting period.

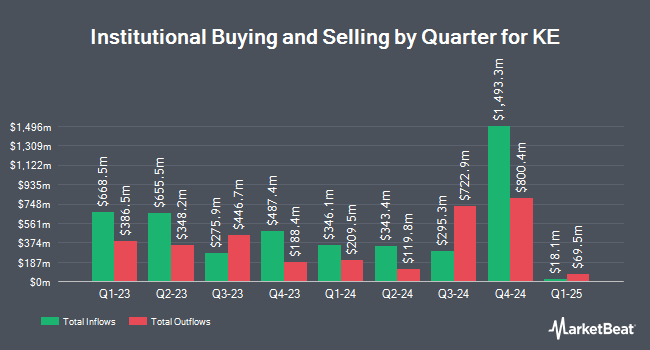

Several other institutional investors have also recently made changes to their positions in BEKE. abrdn plc raised its position in KE by 24.5% in the 3rd quarter. abrdn plc now owns 591,835 shares of the company's stock worth $11,869,000 after purchasing an additional 116,367 shares during the period. Assenagon Asset Management S.A. increased its position in shares of KE by 1,155.7% in the third quarter. Assenagon Asset Management S.A. now owns 2,353,268 shares of the company's stock valued at $46,854,000 after acquiring an additional 2,165,863 shares during the period. Allspring Global Investments Holdings LLC raised its stake in shares of KE by 2.2% during the third quarter. Allspring Global Investments Holdings LLC now owns 58,758 shares of the company's stock valued at $1,170,000 after acquiring an additional 1,271 shares during the last quarter. Blue Trust Inc. grew its stake in shares of KE by 352.9% in the third quarter. Blue Trust Inc. now owns 14,886 shares of the company's stock worth $296,000 after purchasing an additional 11,599 shares during the last quarter. Finally, Sumitomo Mitsui DS Asset Management Company Ltd boosted its holdings in KE by 25.5% in the third quarter. Sumitomo Mitsui DS Asset Management Company Ltd now owns 250,234 shares of the company's stock valued at $4,982,000 after acquiring an additional 50,900 shares in the last quarter. Hedge funds and other institutional investors own 39.34% of the company's stock.

KE Stock Performance

KE stock traded up $0.08 during mid-day trading on Tuesday, hitting $22.16. The company's stock had a trading volume of 10,887,709 shares, compared to its average volume of 9,468,211. The stock has a market cap of $27.09 billion, a PE ratio of 53.83, a P/E/G ratio of 4.76 and a beta of -0.71. The company has a 50 day moving average of $17.94 and a 200-day moving average of $16.26. KE Holdings Inc. has a one year low of $12.44 and a one year high of $26.05.

KE (NYSE:BEKE - Get Free Report) last announced its quarterly earnings results on Monday, August 12th. The company reported $2.28 EPS for the quarter, beating the consensus estimate of $0.22 by $2.06. KE had a return on equity of 6.74% and a net margin of 5.32%. The firm had revenue of $23.37 billion for the quarter, compared to analyst estimates of $21.51 billion. During the same quarter last year, the firm posted $0.17 earnings per share. The business's revenue for the quarter was up 19.9% on a year-over-year basis. On average, equities research analysts forecast that KE Holdings Inc. will post 0.68 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several equities analysts have commented on BEKE shares. Citigroup started coverage on KE in a research report on Tuesday, September 10th. They set a "buy" rating and a $23.80 price objective for the company. Bank of America raised their price objective on KE from $21.00 to $24.00 and gave the company a "neutral" rating in a research report on Wednesday, October 9th. One equities research analyst has rated the stock with a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $24.90.

Check Out Our Latest Stock Analysis on KE

KE Company Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

See Also

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.