UG Investment Advisers Ltd. acquired a new position in KE Holdings Inc. (NYSE:BEKE - Free Report) in the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm acquired 680,757 shares of the company's stock, valued at approximately $13,554,000. KE makes up approximately 5.1% of UG Investment Advisers Ltd.'s holdings, making the stock its 6th largest position. UG Investment Advisers Ltd. owned approximately 0.06% of KE as of its most recent filing with the Securities and Exchange Commission.

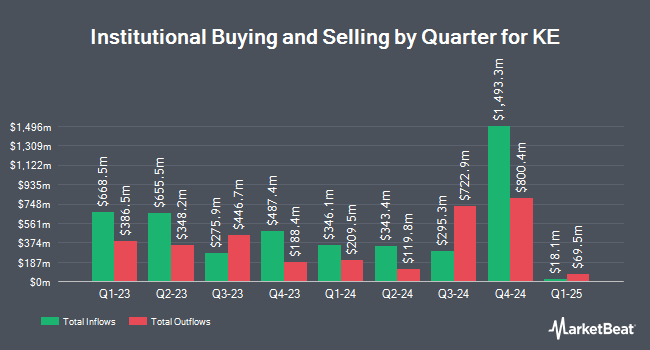

A number of other institutional investors and hedge funds have also made changes to their positions in the business. Price T Rowe Associates Inc. MD grew its position in shares of KE by 14.1% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 38,363,638 shares of the company's stock worth $526,734,000 after buying an additional 4,736,152 shares during the last quarter. Capital World Investors boosted its holdings in shares of KE by 5.8% in the 1st quarter. Capital World Investors now owns 14,666,625 shares of the company's stock valued at $201,373,000 after acquiring an additional 804,773 shares during the last quarter. M&G Plc acquired a new position in shares of KE in the 1st quarter valued at $135,880,000. Turiya Advisors Asia Ltd lifted its stake in shares of KE by 56.2% in the 2nd quarter. Turiya Advisors Asia Ltd now owns 5,070,206 shares of the company's stock valued at $71,743,000 after purchasing an additional 1,824,206 shares during the period. Finally, RWC Asset Advisors US LLC acquired a new position in shares of KE in the 2nd quarter valued at $70,807,000. 39.34% of the stock is owned by hedge funds and other institutional investors.

KE Stock Performance

Shares of BEKE traded up $0.16 during mid-day trading on Friday, hitting $22.09. 8,327,015 shares of the company's stock were exchanged, compared to its average volume of 9,450,684. The company has a market cap of $27.01 billion, a price-to-earnings ratio of 46.02, a P/E/G ratio of 4.87 and a beta of -0.73. KE Holdings Inc. has a fifty-two week low of $12.44 and a fifty-two week high of $26.05. The stock's 50-day moving average is $18.52 and its 200-day moving average is $16.46.

KE (NYSE:BEKE - Get Free Report) last issued its quarterly earnings results on Monday, August 12th. The company reported $2.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.22 by $2.06. The business had revenue of $23.37 billion for the quarter, compared to analysts' expectations of $21.51 billion. KE had a net margin of 5.32% and a return on equity of 6.74%. The business's quarterly revenue was up 19.9% on a year-over-year basis. During the same quarter in the prior year, the company earned $0.17 earnings per share. As a group, equities research analysts anticipate that KE Holdings Inc. will post 0.68 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of equities research analysts have recently commented on BEKE shares. Citigroup started coverage on shares of KE in a research report on Tuesday, September 10th. They issued a "buy" rating and a $23.80 target price for the company. Bank of America upgraded shares of KE from a "neutral" rating to a "buy" rating and increased their target price for the company from $24.00 to $28.00 in a research report on Wednesday. Four investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the stock currently has a consensus rating of "Buy" and an average price target of $25.90.

Read Our Latest Stock Analysis on BEKE

KE Profile

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

See Also

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.