Lecap Asset Management Ltd. acquired a new stake in Bunge Global SA (NYSE:BG - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor acquired 13,472 shares of the basic materials company's stock, valued at approximately $1,302,000.

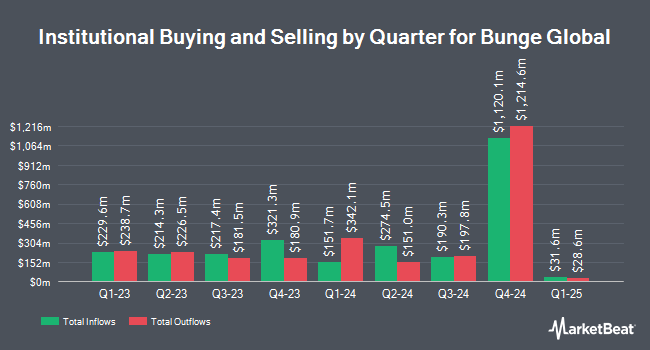

Several other institutional investors have also bought and sold shares of BG. Everence Capital Management Inc. purchased a new stake in Bunge Global during the third quarter valued at about $325,000. Blue Trust Inc. increased its stake in shares of Bunge Global by 121.5% in the third quarter. Blue Trust Inc. now owns 658 shares of the basic materials company's stock worth $70,000 after purchasing an additional 361 shares in the last quarter. Aaron Wealth Advisors LLC bought a new stake in shares of Bunge Global in the third quarter valued at approximately $280,000. V Square Quantitative Management LLC lifted its stake in shares of Bunge Global by 3.7% during the 3rd quarter. V Square Quantitative Management LLC now owns 4,367 shares of the basic materials company's stock valued at $422,000 after buying an additional 156 shares in the last quarter. Finally, Ellsworth Advisors LLC boosted its holdings in Bunge Global by 21.0% in the 3rd quarter. Ellsworth Advisors LLC now owns 12,891 shares of the basic materials company's stock worth $1,246,000 after buying an additional 2,241 shares during the period. Hedge funds and other institutional investors own 86.23% of the company's stock.

Wall Street Analysts Forecast Growth

Separately, Citigroup lowered shares of Bunge Global from a "buy" rating to a "neutral" rating and cut their price objective for the company from $125.00 to $114.00 in a research report on Thursday, August 1st. Four investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $118.00.

Check Out Our Latest Stock Report on BG

Bunge Global Price Performance

Shares of Bunge Global stock traded up $1.23 during trading on Thursday, hitting $90.22. 1,222,757 shares of the stock traded hands, compared to its average volume of 1,492,961. The stock has a market cap of $12.77 billion, a price-to-earnings ratio of 7.26 and a beta of 0.64. The company has a quick ratio of 0.97, a current ratio of 2.03 and a debt-to-equity ratio of 0.37. Bunge Global SA has a 52 week low of $86.10 and a 52 week high of $114.92. The firm's fifty day moving average is $96.97 and its 200-day moving average is $102.56.

Bunge Global (NYSE:BG - Get Free Report) last posted its quarterly earnings results on Wednesday, July 31st. The basic materials company reported $1.73 EPS for the quarter, missing the consensus estimate of $1.79 by ($0.06). Bunge Global had a return on equity of 14.84% and a net margin of 2.33%. The business had revenue of $13.24 billion for the quarter, compared to analysts' expectations of $14.30 billion. During the same period last year, the business posted $3.72 earnings per share. The company's revenue was down 12.0% compared to the same quarter last year. Research analysts expect that Bunge Global SA will post 9.3 EPS for the current fiscal year.

Bunge Global Profile

(

Free Report)

Bunge Global SA operates as an agribusiness and food company worldwide. It operates through four segments: Agribusiness, Refined and Specialty Oils, Milling, and Sugar and Bioenergy. The Agribusiness segment purchases, stores, transports, processes, and sells agricultural commodities and commodity products, including oilseeds primarily soybeans, rapeseed, canola, and sunflower seeds, as well as grains comprising wheat and corn; and processes oilseeds into vegetable oils and protein meals.

Read More

Before you consider Bunge Global, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bunge Global wasn't on the list.

While Bunge Global currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.