B&G Foods (NYSE:BGS - Get Free Report) is scheduled to release its earnings data after the market closes on Tuesday, November 5th. Analysts expect B&G Foods to post earnings of $0.20 per share for the quarter. B&G Foods has set its FY24 guidance at $0.70-$0.90 EPS and its FY 2024 guidance at 0.700-0.900 EPS.Persons that are interested in participating in the company's earnings conference call can do so using this link.

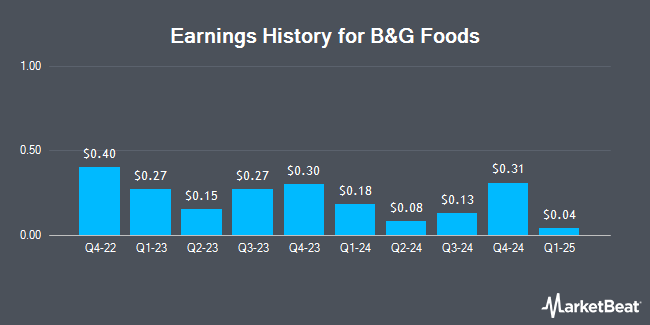

B&G Foods (NYSE:BGS - Get Free Report) last issued its quarterly earnings results on Tuesday, August 6th. The company reported $0.08 EPS for the quarter, hitting analysts' consensus estimates of $0.08. B&G Foods had a positive return on equity of 8.07% and a negative net margin of 5.82%. The company had revenue of $444.60 million during the quarter, compared to analysts' expectations of $435.83 million. During the same quarter in the previous year, the firm posted $0.15 EPS. The firm's revenue was down 5.3% compared to the same quarter last year. On average, analysts expect B&G Foods to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

B&G Foods Stock Performance

Shares of NYSE:BGS traded up $0.23 during trading on Tuesday, hitting $8.81. The stock had a trading volume of 1,401,331 shares, compared to its average volume of 1,009,520. The company has a quick ratio of 0.48, a current ratio of 1.63 and a debt-to-equity ratio of 2.33. B&G Foods has a 12-month low of $7.62 and a 12-month high of $11.97. The stock has a market capitalization of $696.44 million, a price-to-earnings ratio of -6.09 and a beta of 0.60. The stock has a 50-day simple moving average of $8.58 and a two-hundred day simple moving average of $8.91.

Analyst Upgrades and Downgrades

A number of research analysts recently issued reports on BGS shares. Evercore ISI upgraded shares of B&G Foods to a "hold" rating in a research report on Wednesday, August 7th. Piper Sandler lowered their target price on B&G Foods from $9.00 to $8.00 and set a "neutral" rating on the stock in a research note on Thursday, July 11th. Barclays reduced their price target on B&G Foods from $10.00 to $8.00 and set an "equal weight" rating for the company in a research report on Friday, July 19th. StockNews.com upgraded B&G Foods from a "sell" rating to a "hold" rating in a research report on Thursday, September 26th. Finally, Royal Bank of Canada reaffirmed a "sector perform" rating and set a $10.00 target price on shares of B&G Foods in a report on Wednesday, August 7th. Five analysts have rated the stock with a hold rating, According to MarketBeat, the stock has an average rating of "Hold" and an average target price of $8.67.

View Our Latest Stock Report on B&G Foods

Insider Activity at B&G Foods

In other B&G Foods news, EVP Jordan E. Greenberg sold 8,000 shares of the company's stock in a transaction on Tuesday, September 3rd. The shares were sold at an average price of $8.33, for a total transaction of $66,640.00. Following the completion of the transaction, the executive vice president now directly owns 66,095 shares in the company, valued at approximately $550,571.35. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this hyperlink. 3.20% of the stock is owned by corporate insiders.

B&G Foods Company Profile

(

Get Free Report)

B&G Foods, Inc manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods, and household products in the United States, Canada, and Puerto Rico. The company's products include frozen and canned vegetables, vegetables, canola and other cooking oils, vegetable shortening, cooking sprays, oatmeal and other hot cereals, fruit spreads, canned meats and beans, bagel chips, spices, seasonings, hot sauces, wine vinegar, maple syrups, molasses, salad dressings, pizza crusts, Mexican-style sauces, dry soups, taco shells and kits, salsas, pickles, peppers, tomato-based products, crackers, baking powder and soda, corn starch, nut clusters, and other specialty products.

See Also

Before you consider B&G Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B&G Foods wasn't on the list.

While B&G Foods currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.