Assenagon Asset Management S.A. lifted its position in BILL Holdings, Inc. (NYSE:BILL - Free Report) by 297.7% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 380,640 shares of the company's stock after purchasing an additional 284,935 shares during the quarter. Assenagon Asset Management S.A. owned about 0.36% of BILL worth $20,083,000 at the end of the most recent quarter.

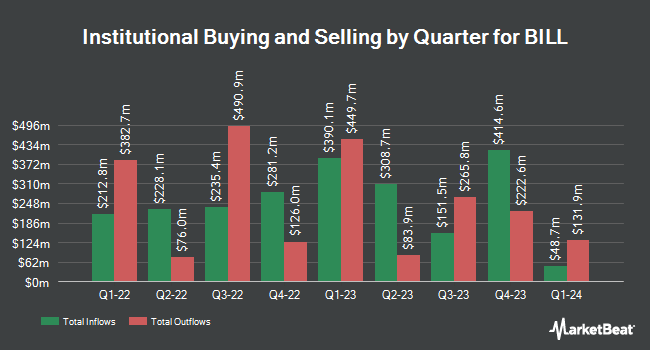

Several other institutional investors have also recently made changes to their positions in BILL. DekaBank Deutsche Girozentrale lifted its position in BILL by 4.0% during the first quarter. DekaBank Deutsche Girozentrale now owns 6,749 shares of the company's stock valued at $449,000 after purchasing an additional 257 shares during the last quarter. Advisors Asset Management Inc. lifted its holdings in shares of BILL by 75.0% during the 1st quarter. Advisors Asset Management Inc. now owns 658 shares of the company's stock worth $45,000 after acquiring an additional 282 shares during the last quarter. Institute for Wealth Management LLC. grew its position in BILL by 4.4% in the second quarter. Institute for Wealth Management LLC. now owns 7,670 shares of the company's stock worth $404,000 after acquiring an additional 322 shares in the last quarter. UniSuper Management Pty Ltd raised its position in BILL by 100.0% during the first quarter. UniSuper Management Pty Ltd now owns 1,400 shares of the company's stock valued at $96,000 after purchasing an additional 700 shares in the last quarter. Finally, American Century Companies Inc. lifted its stake in BILL by 0.4% during the second quarter. American Century Companies Inc. now owns 171,273 shares of the company's stock worth $9,012,000 after purchasing an additional 709 shares during the last quarter. Institutional investors own 97.99% of the company's stock.

Insider Activity

In other BILL news, CEO Rene A. Lacerte bought 42,248 shares of the firm's stock in a transaction on Monday, August 26th. The stock was acquired at an average price of $49.60 per share, with a total value of $2,095,500.80. Following the completion of the purchase, the chief executive officer now owns 184,249 shares of the company's stock, valued at approximately $9,138,750.40. This trade represents a 0.00 % increase in their ownership of the stock. The acquisition was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. In related news, CEO Rene A. Lacerte purchased 42,248 shares of the stock in a transaction dated Monday, August 26th. The stock was purchased at an average price of $49.60 per share, with a total value of $2,095,500.80. Following the transaction, the chief executive officer now directly owns 184,249 shares in the company, valued at $9,138,750.40. This trade represents a 0.00 % increase in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Alison Wagonfeld sold 519 shares of the company's stock in a transaction dated Monday, October 21st. The stock was sold at an average price of $57.50, for a total transaction of $29,842.50. Following the completion of the transaction, the director now owns 1,038 shares in the company, valued at approximately $59,685. The trade was a 0.00 % decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have acquired 68,372 shares of company stock worth $3,404,826 and have sold 3,808 shares worth $209,866. Company insiders own 3.80% of the company's stock.

Wall Street Analyst Weigh In

BILL has been the subject of several research reports. Needham & Company LLC reaffirmed a "buy" rating and issued a $100.00 target price on shares of BILL in a research note on Friday, August 23rd. Canaccord Genuity Group restated a "buy" rating and set a $100.00 price target on shares of BILL in a research report on Friday, August 23rd. Evercore ISI decreased their price objective on BILL from $70.00 to $60.00 and set an "in-line" rating on the stock in a report on Friday, August 23rd. BMO Capital Markets lowered their target price on BILL from $75.00 to $57.00 and set a "market perform" rating for the company in a research note on Monday, August 26th. Finally, Keefe, Bruyette & Woods decreased their price target on BILL from $60.00 to $55.00 and set a "market perform" rating on the stock in a research note on Friday, August 23rd. One analyst has rated the stock with a sell rating, nine have issued a hold rating and ten have assigned a buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average target price of $70.71.

Check Out Our Latest Research Report on BILL

BILL Trading Down 0.6 %

Shares of NYSE BILL traded down $0.33 during midday trading on Friday, hitting $54.77. 668,282 shares of the company traded hands, compared to its average volume of 1,903,119. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.55 and a current ratio of 1.55. BILL Holdings, Inc. has a 12-month low of $43.11 and a 12-month high of $93.48. The stock has a 50-day moving average price of $53.51 and a 200 day moving average price of $53.61. The firm has a market cap of $5.81 billion, a P/E ratio of -69.33 and a beta of 1.61.

BILL (NYSE:BILL - Get Free Report) last announced its earnings results on Thursday, August 22nd. The company reported $0.57 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.46 by $0.11. The firm had revenue of $343.67 million during the quarter, compared to analyst estimates of $328.27 million. BILL had a positive return on equity of 1.13% and a negative net margin of 2.24%. The business's revenue was up 16.1% compared to the same quarter last year. During the same quarter in the prior year, the company earned $0.10 EPS. As a group, analysts expect that BILL Holdings, Inc. will post -0.58 earnings per share for the current year.

About BILL

(

Free Report)

BILL Holdings, Inc provides financial automation software for small and midsize businesses worldwide. The company provides software-as-a-service, cloud-based payments, and spend management products, which allow users to automate accounts payable and accounts receivable transactions, as well as enable users to connect with their suppliers and/or customers to do business, eliminate expense reports, manage cash flows, and improve office efficiency.

Recommended Stories

Before you consider BILL, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BILL wasn't on the list.

While BILL currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.